Ever see a strong market trend and feel like you’ve missed the boat, only to watch it pause for a moment before continuing its powerful move? That pause is often a flag pattern. In technical analysis, the flag is a classic continuation pattern that provides a high-probability opportunity to join a trend that’s already in motion. This guide will teach you how to identify it, understand its structure, and execute an effective flag pattern trading strategy.

Key Takeaways

- A flag pattern is a bullish or bearish continuation signal that appears after a strong bearish price move.

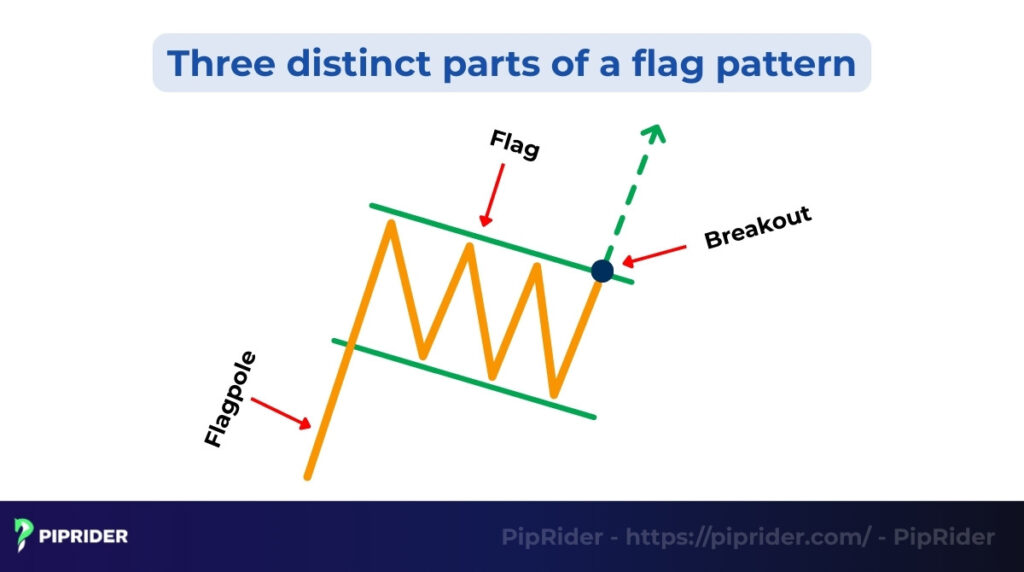

- It is composed of two parts: the “flagpole” (the initial strong move) and the “flag” (a brief, counter-trend consolidation).

- The primary trading strategy is to enter on a breakout from the “flag” in the direction of the original trend.

- Confirmation from volume is crucial: high on the flagpole and breakout, but low during the flag’s formation.

1. What Is a Flag Pattern in Trading?

A flag pattern is a technical price pattern that indicates a continuation of a previous trend. It is named for its distinct shape, which resembles a flag on a flagpole (Investopedia, 2025).

The flag belongs to the group of continuation patterns. This means it signals a brief pause or consolidation in the market, after which the original trend is expected to resume. It is not a reversal signal.

For a new trader, its basic meaning is simple: it represents a “breather” in the market. After a strong price move, the market consolidates briefly as some traders take profits. The flag formation signals that the primary trend is still strong and is likely to continue after this short pause, offering a potential breakout opportunity.

2. How Does Flag Pattern Trading Work?

The flag tells a clear story about market dynamics. Understanding the structure and psychology behind it is key to trade effectively.

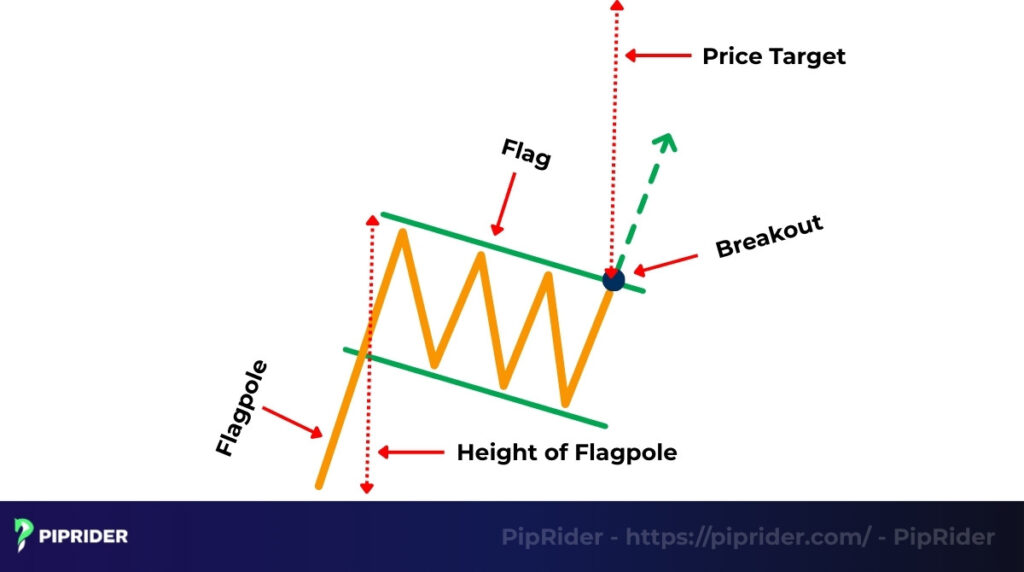

- The Flagpole: A sharp, strong, and near-vertical price move on high trading activity. This forms the initial, powerful trend.

- The Flag: A brief period of consolidation that slopes against the main trend, forming a small, rectangular ‘flag’. Volume should decrease during this phase.

- The Breakout: The price breaks out of the flag’s consolidation in the direction of the original trend, ideally on another surge in volume.

Flag patterns are a hallmark of a strong, healthy trend. They appear because the market is so one-sided that the opposing side lacks the strength to create a deep pullback or reversal. The flag is simply the market “catching its breath” before the next powerful move in the same direction.

3. Key Characteristics of Flag Patterns

To distinguish a valid flag pattern from random market noise, traders look for a specific set of characteristics. These features help confirm the pattern’s reliability.

3.1. Shape and Proportions

The flagpole should be a sharp, strong price move. The flag itself should be a tight, rectangular consolidation that slopes against the main trend (e.g., a downward slope in an uptrend).

A key rule is that the flag should not retrace more than 50% of the flagpole (Investopedia, 2025); a retracement deeper than this often invalidates the pattern.

3.2. The Classic Volume Behavior

Volume provides critical confirmation. A valid flag pattern typically has this signature:

- High Vol on the Flagpole: The initial strong move should occur on high, above-average volume.

- Low Vol on the Flag: Volume should decrease significantly as the flag forms.

- High Vol on the Breakout: The breakout from the flag should occur on another strong surge in volume.

Within this low-volume consolidation, look for weak candlestick formations. A thrusting pattern appearing here, where price tries but fails to penetrate deeply into the previous session’s range, confirms that the counter-trend move lacks true conviction.

3.3. A Quick Identification Checklist for Beginners

Here is a simple checklist to help you spot a high-probability flag pattern:

- Is there a sharp, strong flagpole?

- Is the flag a tight consolidation that slopes against the main trend?

- Does the flag retrace less than 50% of the flagpole?

- Does the volume signature match (high-low-high)?

- Is the overall market context supportive of the trend continuing?

4. Types of Flag Pattern Trading Setups

The flag pattern appears in two primary forms: bullish and bearish, along with some common variations. Understanding these setups is key to applying the strategy correctly.

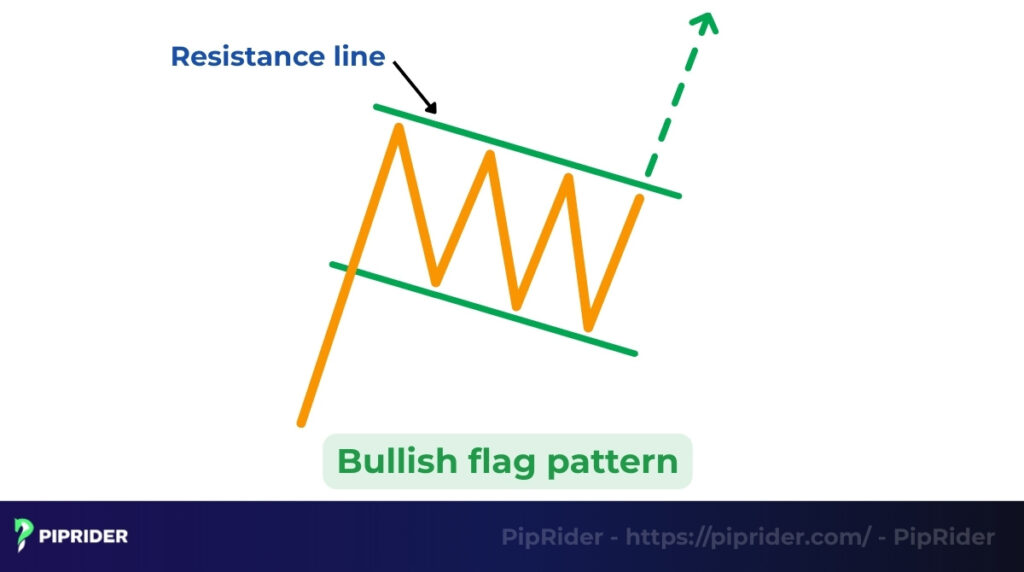

4.1. The Bull Flag

A bull flag is a bullish continuation pattern that forms during a strong uptrend. It is composed of a sharp upward move followed by a brief, downward-sloping consolidation. A breakout above the flag’s resistance is a signal to enter a long (buy) trade.

Example: Imagine a stock rallies sharply from $50 to $60 (the flagpole). It then consolidates by drifting down to $57 in a tight, rectangular channel (the flag). A trader would look for a breakout where the price closes decisively above the top of the flag’s channel to enter a long position.

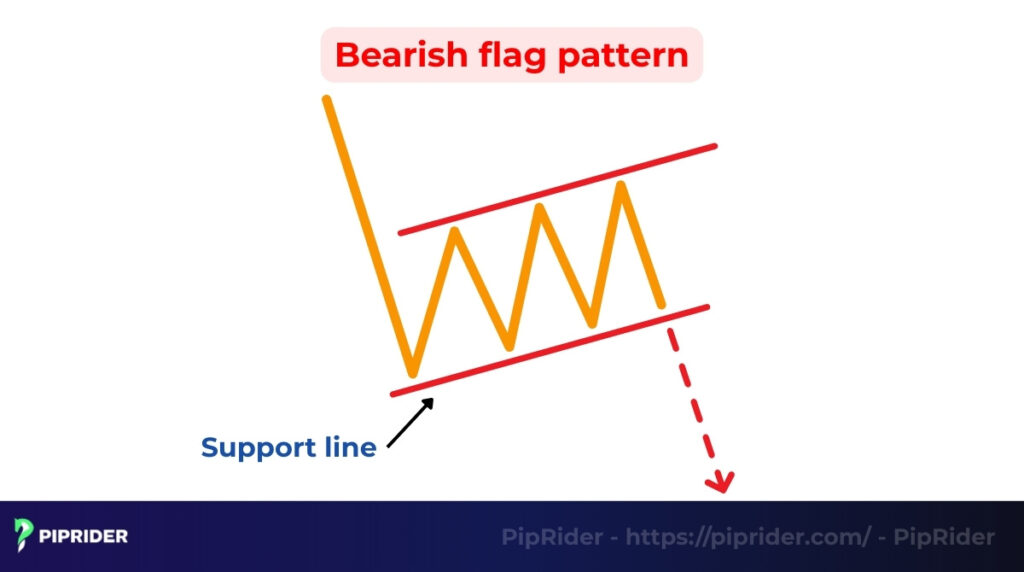

4.2. The Bear Flag

What is a bearish flag pattern and how does it work? A bear flag, a classic example of bearish flag patterns, is a bearish continuation pattern that forms during a strong downtrend. It is composed of a sharp downward move followed by a brief, upward-sloping consolidation. A breakout below the flag’s support signals an entry for a short (sell) trade.

Example: If the EUR/USD currency pair drops sharply from 1.0800 to 1.0700 (the flagpole) and then consolidates in a brief, upward-sloping channel to 1.0740 (the bear flag), a trader would look for a breakout where the price closes decisively below the bottom of the flag’s channel to enter a short position, confirming the bearish sentiment.

4.3. Common Variations

While the classic flag is a rectangle, traders will often see variations in a flag stock chart. The consolidation might be a perfect horizontal channel (often called a “high, tight flag”) or it might be slightly deformed. The key is that the consolidation is brief and shallow relative to the flagpole. A trader should not confuse a flag with a longer, more complex trading range, which is another type of trading pattern.

5. How to Identify Flag Patterns on Charts

Identifying a flag pattern accurately involves more than just seeing the general shape. A professional trader follows a systematic process to validate the pattern, mark its boundaries, and distinguish real breakouts from false ones.

5.1. Drawing Trendlines and Parallel Channels

The “flag” portion of the pattern is defined by two parallel trendlines that create a channel. In a bull flag scenario, a trader should draw a trendline connecting the lower highs of the consolidation with a parallel line connecting its lower lows, forming a downward-sloping channel. For a bear flag, this channel will slope upwards. These lines are critical as they define the exact breakout point and the boundaries of the consolidation.

5.2. Real Breakouts vs. False Breakouts

Distinguishing a real breakout from a false one is a critical skill.

- A real breakout is a sign of conviction; it should be a strong, full-bodied candle that closes decisively outside the flag’s channel, accompanied by a significant increase in market participation. This shows that the dominant market players are back in control, whether for a bullish or bearish move.

- A false breakout, in contrast, represents a lack of conviction. The price might briefly poke outside the channel, often on low volume, but will quickly be pushed back inside by the opposing force, frequently leaving a long wick. This is a common trap for impatient traders.

Sometimes, this trap evolves into a specific setup known as the hikkake candlestick pattern. If you spot this deceptive move forming at the flag’s boundary, it’s often a warning that the initial breakout was a liquidity grab before the real move occurs.

5.3. Step-by-Step Identification on a Chart

Here is a more detailed, 4-step process for identifying a high-probability setup:

- Identify the Flagpole: First, a trader must identify a sharp, near-vertical price move. This move should be significantly stronger and faster than the preceding price action.

- Draw the Flag’s Channel: Next, identify the brief, orderly consolidation that slopes against the main trend. Use your drawing tools to connect the highs and lows with two parallel trendlines.

- Analyze the Volume: Observe the trading activity during the flag’s formation. It should be noticeably lower than the volume during the flagpole. A decrease in trading action confirms that the consolidation is a healthy pause, not a reversal.

- Wait for the Confirmed: Finally, wait for a strong candle to break and close outside the flag’s channel on a surge of high volume. This is the confirmation that the original trend is resuming.

To objectively verify this explosive momentum, some traders overlay the GMMA indicator. A wide, uniform expansion between the short-term and long-term moving average groups visually confirms the powerful nature of the flagpole.

6. Why the Flag Pattern Is Important

The flag pattern is a crucial tool in technical analysis because it provides a high-probability signal of trend continuation. It represents a healthy, temporary pause in a strong trend, which shows that the market is simply “catching its breath” rather than reversing. For a trader, this is invaluable, as it helps them distinguish between a minor pullback (an opportunity) and a major trend change (a threat), allowing them to stay on the right side of the market’s momentum.

Validating this momentum context is crucial. Tools like the alligator indicator can help ensure you are trading in an active trend phase (when the Alligator is ‘eating’) rather than getting caught in a trendless chop.

Beyond just a directional signal, the pattern’s real importance lies in providing a complete and objective framework for a trade. Its structure gives a trader everything they need to execute a disciplined trade:

- A clear entry triggers at the breakout of the flag.

- A logical and defensible stop-loss location on the opposite side of the flag.

- A data-driven profit target calculated from the height of the flagpole.

This removes guesswork and emotion, turning a potential setup into a systematic and manageable trade plan.

7. Practical Strategies for Flag Pattern Trading

Executing a flag pattern trade involves more than just identifying the setup. Professional traders use specific strategies for entry, exit, and trade management to maximize their edge.

7.1. The Breakout Entry Strategy

The standard and most reliable entry method is to wait for a breakout. A trader places a stop-entry order just outside the flag’s channel (a buy-stop above a bull flag, a sell-stop below a bear flag). This ensures the trade is only triggered after the price confirms its intention to continue the trend.

7.2. Stop Loss and Take Profit Placement

A complete trade plan requires clear exit points for both a losing and a winning scenario. The flag’s structure provides logical, non-emotional levels for both.

- Stop Loss Placement: This is set on the opposite side of the pattern. For a bullish flag, the stop goes just below its lowest channel point. For a bearish flag, it goes just above its highest point. This defines a clear invalidation level.

- Take Profit: The profit target is typically calculated by measuring the height of the flagpole and projecting that same distance from the breakout point. This is known as the “measured move” technique.

7.3. Advanced Trade Management

For larger moves, traders can use advanced management techniques:

- Trailing Stop: Instead of a fixed target, a trailing stop can be used to lock in profits as the price moves in your favor, allowing you to capture a larger portion of the trend.

- Partial Exits: A trader can sell a portion of their position at the first profit target (e.g., a 1:1 extension of the flagpole) and let the rest run, creating a risk-free trade.

8. Indicators to Support Flag Pattern Trading

While the flag pattern is a powerful price action signal, its reliability increases significantly when confirmed by other technical indicators. This alignment of signals is known as “confluence” and creates high-probability trading opportunities.

- Volume: This is the most critical indicator for a flag. Volume should be high during the flagpole, decrease during the flag’s consolidation, and surge again when the trend resumes.

- RSI & MACD: These momentum indicators can confirm the trend’s health. During the flag’s consolidation, the RSI should ideally stay above 40 in an uptrend (or below 60 in a downtrend). A strong reading on the MACD also confirms the underlying momentum.

- Moving Averages: A moving average (like the 20 or 50 EMA) can act as a dynamic support or resistance level. A bull flag that forms and holds above a rising moving average is a very high-probability setup.

9. Risks and Common Mistakes

While the flag pattern is a high-probability setup, traders can still make costly errors. Being aware of these common mistakes is key to consistent trading.

- The biggest risk is a false breakout, where the price moves out of the flag only to quickly reverse. To avoid this, always wait for a strong candle to close outside the pattern on a significant increase in volume.

- A common error is confusing a flag (a rectangle) with a pennant (a triangle) or a wedge. Misidentifying the pattern can lead to incorrect profit targets.

- Impatience is a major pitfall. A trader must wait for the confirmed breakout and never enter while the price is still inside the flag’s channel. Equally important, every trade must have a pre-defined stop loss.

10. Best Timeframes and Markets for Flag Pattern

The flag pattern is a versatile tool, but its reliability can vary depending on the timeframe and market you are trading. Here’s a breakdown of where it works best.

10.1. Choosing the Right Timeframe

While flags can appear on any chart, higher timeframes are generally more reliable as they filter out market noise.

- Daily & 4-Hour Charts: This is the “sweet spot” for swing traders. Flags on these timeframes are very reliable and often lead to significant, multi-day moves.

- 1-Hour Chart: Good for day traders. Patterns are more frequent, but traders need to be more cautious of false signals.

- 15-Minute Chart & Below: Primarily used by scalpers. Flags on these timeframes are very common but have a much lower reliability rate and are prone to false breakouts.

10.2. Applying the Flag in Different Markets

The psychology behind the flag pattern is universal, making it effective across all major markets. This is particularly true in strong bullish and bearish trends, which are most common in liquid markets.

- Forex: The candlestick flag pattern is extremely effective, especially on major pairs like EUR/USD and GBP/USD, due to the market’s strong trending nature.

- Stocks: It is a classic pattern for trading a stock flag, particularly for high-volume stocks that are in a strong, established trend.

- Crypto: The pattern works well, but traders must be extremely cautious due to the high volatility. The “flagpole” can be massive, and breakouts can be very aggressive.

11. Real-Life Examples

Let’s look at two real-world examples: one successful trade and one failed trade. Analyzing both is crucial for a complete understanding.

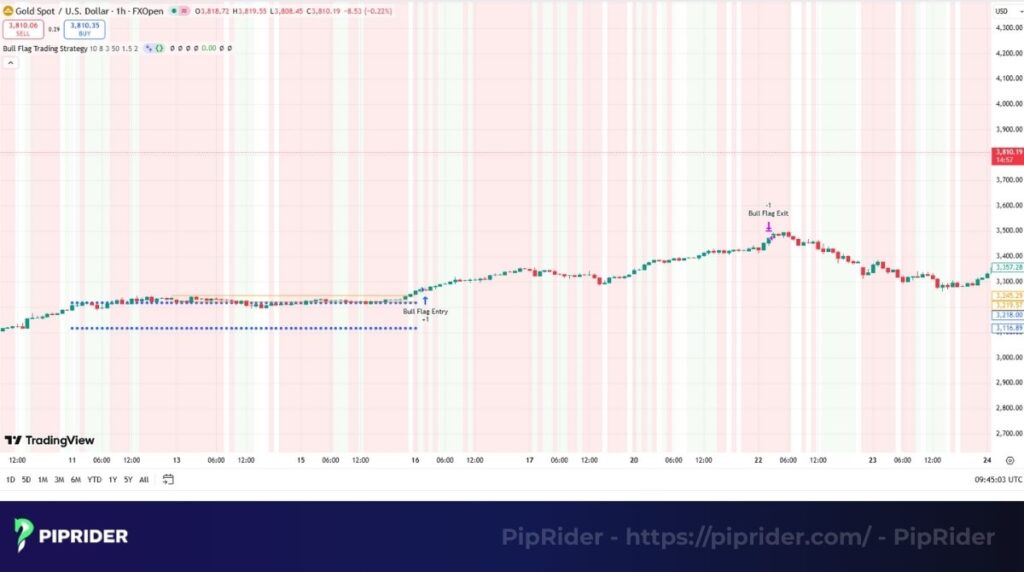

11.1. Case Study: A Successful Bull Flag Trade

On the 4-hour chart of the S&P 500 (SPX500), the index made a strong upward move. It then formed a clear, downward-sloping bull flag on low volume.

- The Trade: An entry was placed on a breakout above the flag’s resistance, confirmed by a surge in volume. A stop-loss was then positioned below its low, and a profit target was calculated from the flagpole’s height.

- The Outcome: The price continued its strong uptrend and hit the profit target for a successful trade.

11.2. Case Study: A Failed Trade and the Lesson

On the 1-hour chart of Gold (XAU/USD), a bear flag appeared to form during a downtrend.

- The Trade: A trader entered a short position on the initial breakout below the flag’s support. However, it occurred on very low volume.

- The Outcome: The price immediately reversed back into the flag and then broke out to the upside, hitting the stop-loss. This is a classic false move.

The Lesson: The key lesson here is the importance of volume confirmation. A breakout without a significant increase in volume is a low-probability signal and should often be avoided.

12. Frequently asked questions about the flag pattern

13. Conclusion: Your 5-Step Checklist for Success

In conclusion, mastering Flag Pattern Trading is about recognizing a powerful and reliable continuation signal. To put all of our insights into action, here is a final 5-step checklist for identifying and trading a high-probability flag setup with confidence.

The 5-Step Flag Pattern Trading Checklist

- Identify the Flagpole: Look for a sharp, strong, and high-volume price move that establishes the trend.

- Confirm the Flag: Ensure the consolidation is a shallow, orderly channel that slopes against the main trend on low trading activity.

- Wait for the Breakout: Wait for a strong candle to close outside the flag’s channel, confirmed by a surge in volume.

- Plan Your Trade: Define your entry, place your stop-loss on the opposite side of the flag, and calculate your profit target by measuring the flagpole.

- Execute with Discipline: Follow your plan without exception. Do not enter early or trade without a stop-loss.

Before risking real capital, it is crucial that you practice identifying and trading this pattern on a demo account. To continue building your trading system, we encourage you to explore more in-depth guides in our Trading Strategies category on Piprider.