The Hikkake Pattern is a specialized candlestick pattern designed to capitalize on market indecision and false breakouts. Derived from the Japanese word for “to trick” or “to trap,” this price pattern is highly valued by technical traders.

It is particularly effective for signaling sharp, high-probability trend reversals following a failed short-term move. Mastering the Hikkake allows experienced traders to identify and exploit the very momentum generated by those who were caught in the trap, often leading to optimal entry points.

This guide goes beyond simple definitions, providing you with the exact strategies for entry, stop-loss placement, and trade confirmation needed to accurately trade the Hikkake.

Key Takeaways

- The Hikkake Pattern (Japanese for “trap” or “snare”) is a multi-candlestick setup developed by Daniel L. Chesler, CMT.

- Its primary function is to identify a false breakout that immediately reverses, trapping unsuspecting traders.

- The setup signals an imminent, high-momentum reversal.

- The pattern requires strict adherence to candle sequence rules and confirmation to be traded effectively.

- It is a powerful tool for short-term traders looking to fade failed continuation moves.

1. What Is a Hikkake Pattern?

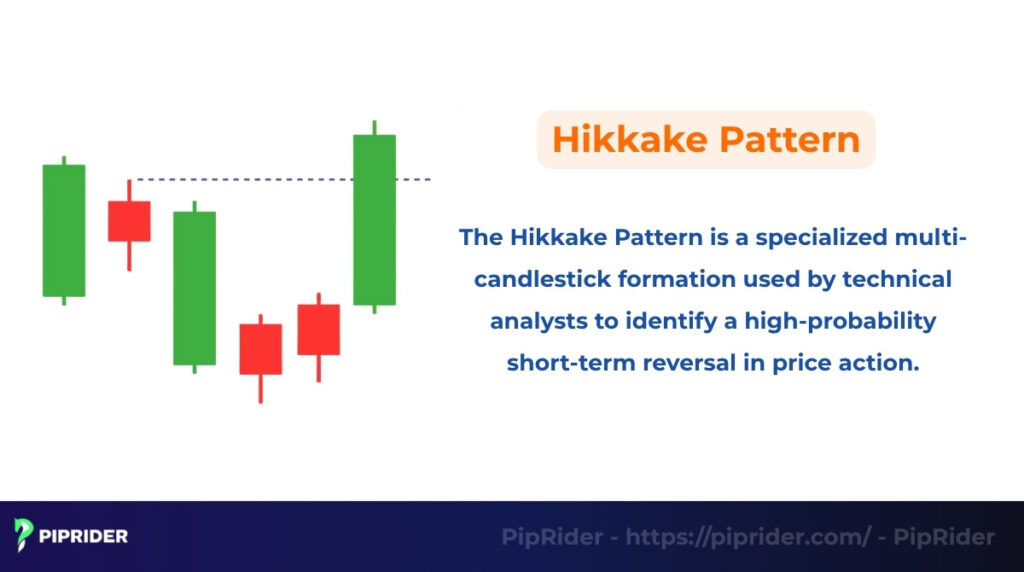

The Hikkake Pattern is a specialized multi-candlestick formation used by technical analysts to identify a high-probability short-term reversal in price action. It is one of the more subtle patterns, specifically designed to capitalize on misleading market moves.

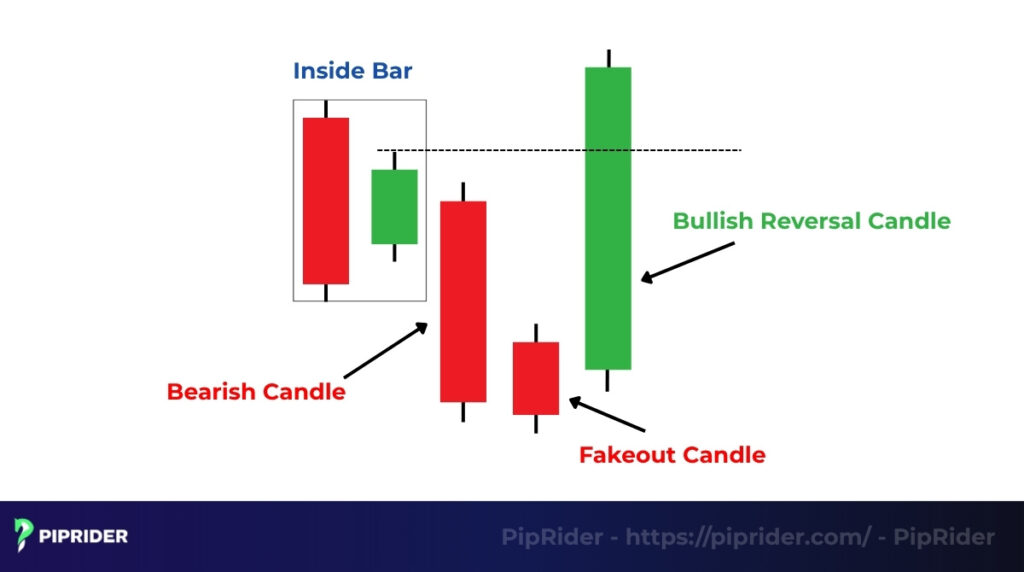

The Hikkake starts with a period of low volatility, where a candle forms inside the range of the preceding candle (known as an inside bar or Harami pattern). It occurs when the price attempts to break out of this narrow consolidation range but fails immediately, reversing quickly back into the opposite direction.

While primarily known for reversals, advanced traders also use it as one of the most effective continuation candlestick patterns. When this trap forms during a pullback in a strong trend, it signals that the counter-trend move has failed and the primary trend is resuming.

This candlestick pattern essentially signals that the dominant market move is about to resume, trapping those traders who mistakenly entered on the initial, failed breakout. The pattern was developed by technical analyst Daniel L. Chesler, CMT.

The name “Hikkake” is the Japanese word for “to trap” or “to snare,” accurately reflecting its market mechanism (Chen, 2024). The initial, fleeting move acts as a false breakout, luring aggressive traders into the wrong direction. When the price reverses, the resulting mass liquidation of their stop loss orders injects powerful, directional momentum, accelerating the price movement and confirming the trap.

2. Hikkake Pattern Formation

The Hikkake formation is a three-stage sequence of candles that identifies a failed attempt to exit a consolidation range, setting up a sharp reversal.

- Inside Bar Setup (Consolidation): The pattern begins with an inside bar (Candle 2) fully contained within the high and low of the previous candle (Candle 1). This establishes a zone of low market volatility and market indecision.

- False Breakout: Candle 3 attempts a temporary breakout by closing outside the range of the Candle 2, successfully luring short-term traders into positions.

- Confirmation/Reversal: Candle 4 (the confirmation candle) quickly snaps back and closes definitively in the opposite direction of the false breakout. This action confirms the trap, generating the strong momentum needed for a new, sustained trend.

Read more:

Top 21 Trading Patterns Every Trader Should Master in 2025

Pin Bar in Trading: How to Identify, Interpret and Trade It

Alligator Indicator: Best forex trading guide

3. Types of Hikkake Pattern

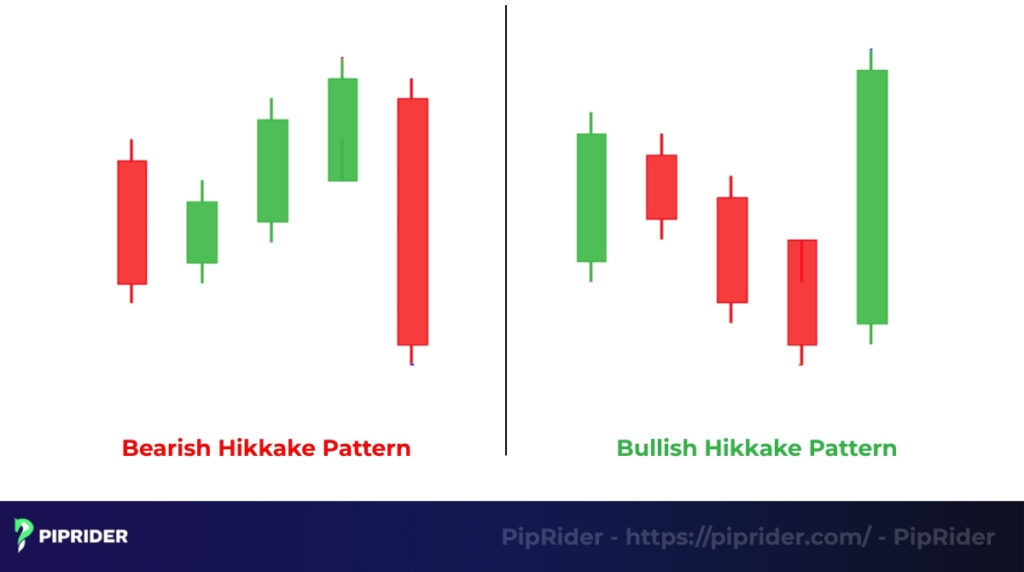

The Hikkake Pattern is a versatile signal, identifying false breakouts in either direction (Finance Strategists, n.d.). It appears in two distinct forms: the Bullish Hikkake and the Bearish Hikkake. Recognizing the key differences and precise candle requirements between these two is vital for accurate trading.

3.1. Bullish Hikkake Pattern

The Bullish Hikkake signals a probable price increase after the market executes a false downward breakout. This sequence confirms that selling pressure has failed, setting up a buying opportunity (Definedge Securities, n.d.).

Key Features (Candle-by-Candle Description):

- Candles 1 & 2 (Inside Bar Setup): Establish consolidation. Candle 2’s high and low are contained within Candle 1’s range.

- Candle 3 (False Breakout): The price opens near the previous close but breaks below the low of Candle 2, creating the illusion of a downturn. This attracts sellers.

- Candle 4 (Confirmation): This candle opens and reverses the action. It snaps back above the high of Candle 2 and closes strongly. The definitive close above the inside bar’s high confirms that the initial downward move was a trap and signals a high-momentum reversal upward.

3.2. Bearish Hikkake Pattern

The Bearish Hikkake signals a probable price decline following a false upward breakout. This sequence confirms that buying pressure has failed, setting up a selling opportunity (Definedge Securities, n.d.).

Key Features (Candle-by-Candle Description):

- Candles 1 & 2 (Inside Bar Setup): Establish consolidation. Candle 2’s high and low are contained within Candle 1’s range.

- Candle 3 (False Breakout): The price opens near the previous close but breaks above the high of Candle 2, creating the illusion of a continued rally. This attracts buyers.

- Candle 4 (Confirmation): This candle opens and reverses the action. It snaps back below the low of Candle 2 and closes strongly. The definitive close below the inside bar’s low confirms that the initial upward move was a trap and signals a high-momentum reversal downward.

3.2. Key Differences

The primary distinction between the two types lies in the direction of the false breakout and the subsequent confirmation move:

| Feature | Bullish Hikkake | Bearish Hikkake |

| False Breakout Direction | Downward (Candle 3 breaks low) | Upward (Candle 3 breaks high) |

| Confirmation Entry Point | Price moves above Candle 2 high | Price moves below Candle 2 low |

| Trading Signal | Buy (Long) | Sell (Short) |

Read more:

Thrusting Candlestick Pattern: Definition, Types & Strategies

4. How to Identify a Hikkake Pattern

Accurate identification of the Hikkake Pattern relies on rigid adherence to a four-candle sequence and an understanding of the psychological trap being set.

4.1. Candle Sequence Rules

To confirm a valid Hikkake setup, observe the following rules precisely:

- The Base (Candles 1 & 2): Traders must first identify a clear setup, where Candle 2’s entire price action (high and low) is contained within the range of Candle 1. This is the non-negotiable prerequisite for consolidation.

- The Trap (Candle 3): Candle 3 must successfully break out of the inside bar’s range and close outside that range. This is the false signal that lures breakout traders.

- The Signal (Candle 4): This is the confirmation. Candle 4 must close decisively in the direction opposite to Candle 3’s breakout, effectively negating the previous move.

- Bullish Hikkake: Candle 4 closes above the high of Candle 2.

- Bearish Hikkake: Candle 4 closes below the low of Candle 2.

4.2. Position of Breakouts and Reversals

The spatial relationship between the candles is crucial for defining risk and entry:

- False Extreme: The highest high or lowest low reached by Candle 3 (the false breakout) is the pivotal point. This extreme confirms the momentary failure of the initial move and serves as the required level for the subsequent stop-loss placement.

- Negation Point: The confirmation (Candle 4) must break the opposite side of the Inside Bar setup (Candle 2). This decisive reversal confirms the strength needed to reverse the market direction.

4.3. Market Psychology Behind the Pattern

The Hikkake price pattern is inherently powerful because its momentum is self-fulfilling, driven by the failure of others:

- Luring the Crowd: Candle 3 attracts aggressive, short-term traders expecting a simple continuation of the breakout direction. These traders immediately place their protective stop-loss orders just beyond the extreme of Candle 3.

- Fueling the Reversal: When Candle 4 rapidly reverses, it triggers the stop-loss orders of this newly trapped crowd. This mass liquidation (forced buying/selling) creates an immediate, sharp surge of volume and momentum, accelerating the price action in the confirmed direction. The pattern, therefore, capitalizes on liquidation momentum.

This specific psychology makes it highly effective when spotting ‘traps’ within larger formations. For instance, a Hikkake appearing at the rim of a cup and handle chart pattern often marks the final shakeout of weak hands before the major breakout occurs.

Read more:

How To Trade Bearish Shooting Star Candlestick Pattern?

Gartley Patterns: A Trader’s Guide to Harmonic Chart Signals

5. Real-World Example: Bullish Hikkake

Consider a practical trading scenario on the XAU/USD (Gold) pair, where the price is in a downtrend and approaching a critical support level.

- The Base (C1 & C2): Price forms an Inside Bar (C2 contained within C1) after a sell-off, indicating a temporary halt in bearish momentum.

- The Trap (C3): Candle 3 breaks and closes below the low of C2. This is the false breakout action, luring new sellers (shorts) into the market.

- The Signal (C4): Candle 4 immediately reverses, closing strongly above the high of C2. This reversal traps all the newly entered short traders. Their stop loss orders are triggered, creating strong upward momentum to initiate the new uptrend.

- Trade Execution: A Long (buy) order is executed when the price surpasses the high of C4. The Stop Loss order is strategically placed just below the lowest point of Candle 3 (the false breakout extreme) for optimal risk control.

6. How to Trade the Hikkake Pattern

Successful trading of the Hikkake Pattern demands disciplined execution, strict adherence to confirmation rules, and precise risk management. The pattern’s structure inherently allows for very tight stop-loss placement.

Context is equally critical. Integrating this setup into flag pattern trading strategies can be powerful. If a Hikkake forms at the boundary of a flag channel, it often provides the precise trigger needed to catch the continuation move.

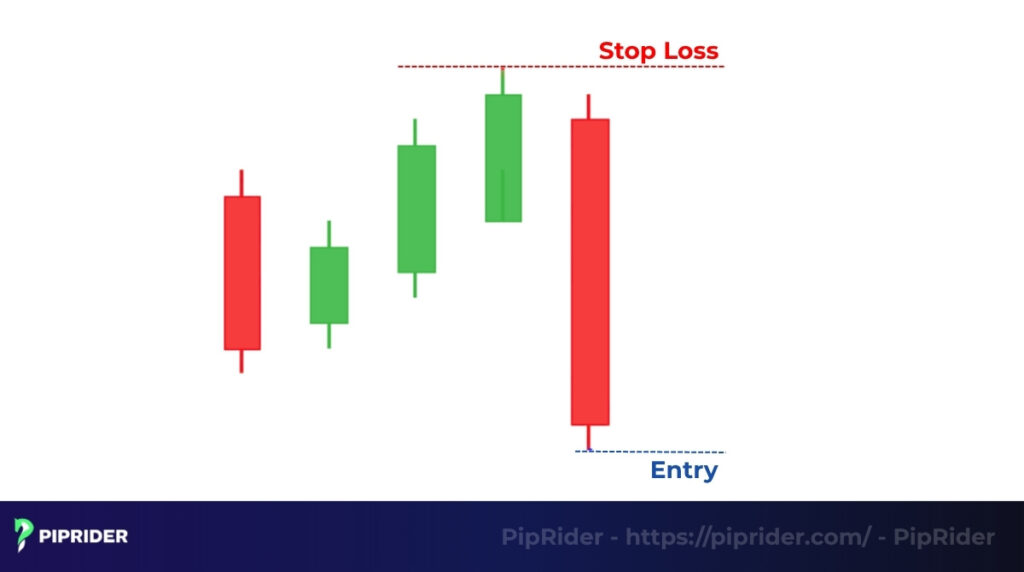

6.1. Entry Strategy

The primary rule is to avoid the trap: Never enter a trade during the false breakout (Candle 3).

- Confirmation Entry: Initiate position only when the price breaks the high (for Bullish Hikkake) or low (for Bearish Hikkake) of the Confirmation Candle (Candle 4). This action confirms that the reversal is executing with momentum.

- Execution: Traders often use a pending buy-stop or sell-stop order placed slightly beyond the C4 boundary to ensure their entry is triggered by directional momentum.

6.2. Stop-Loss Placement

Define risk tightly by using the immediate point of failure, the false breakout extreme.

- The Anchor: The stop-loss must be placed slightly beyond the extreme high/low point of Candle 3.

- Bullish Hikkake: Place the stop-loss marginally below the low of Candle 3.

- Bearish Hikkake: Place the stop-loss marginally above the high of Candle 3.

- Rationale: This placement ensures that if the price reverses back to the level of the failed breakout, the trading premise is invalidated, allowing for the fastest possible exit with minimal loss.

6.3. Take-Profit Targets

Targets should be set to achieve a favorable risk-to-reward ratio while respecting structural price obstacles.

- Primary Target: Identify the nearest significant support or resistance level on the chart.

- Minimum R:R Goal: Always seek a minimum 1:2 Risk-to-Reward (R:R) ratio. For instance, if the stop-loss risk is 30 pips, the target should be a minimum of 60 pips.

6.4. Risk/Reward Advantage

The Hikkake offers an excellent structural advantage: because the stop-loss is placed tightly at the extreme of the false move (C3), the initial risk is minimal, thereby maximizing the potential return on capital risk.

Read more:

GMMA Trading Indicator: How to identify strong trends for Hikkake setups

7. Pros and Cons of the Hikkake Pattern

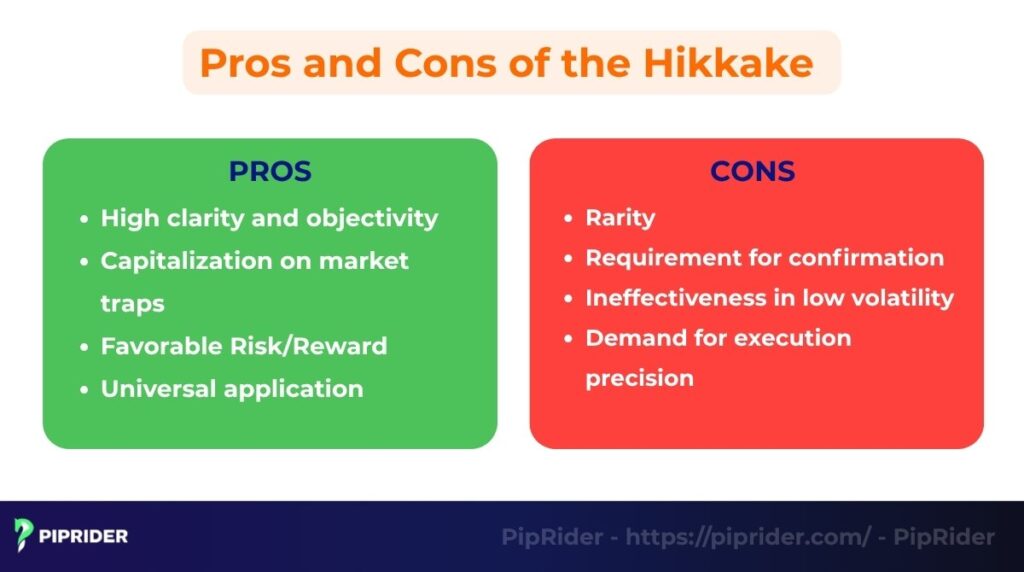

While the Hikkake is a high-conviction pattern, successful application requires awareness of both its structural strengths and practical limitations in various market conditions.

7.1. Strengths (Pros)

The Hikkake Pattern offers several advantages that appeal to experienced technical investors:

- High clarity and objectivity: The rules for identification and execution are clear and objective (C1, C2, C3, C4 sequence), minimizing subjective interpretation.

- Capitalizes on traps: Its primary strength is reliably signaling failed market moves, allowing traders to capitalize on false breakouts that generate strong reversal momentum.

- Favorable Risk/Reward: Since the stop-loss is placed tightly just beyond the extreme of the false breakout (C3), the pattern inherently offers low relative risk and favorable Risk-to-Reward (R:R) ratios.

- Universal application: It is effective across all markets (forex, stocks, crypto) and various timeframes.

7.2. Weaknesses (Cons)

Investors must be aware of the pattern’s inherent limitations to mitigate risks:

- Rarity: The strict four-candle sequence and reversal requirement mean the pattern is not common. This demands significant patience and prevents constant trading.

- Requires confirmation: The Hikkake can generate noise; therefore, it must be confirmed by additional tools (e.g., volume, RSI, or MACD) to filter out false signals.

- Ineffective in low volatility: The pattern loses effectiveness when the market is caught in an extremely tight, choppy, flat range, where signals may lack the necessary momentum. This is due to low market volatility.

- Demands precision: Successful execution relies entirely on precise stop-loss placement and disciplined entry only after Candle 4’s close or break.

8. Modified Hikkake Pattern

The Modified Hikkake Pattern is an enhanced version of the classic setup, to significantly increase signal accuracy and help traders filter out false signals.

The modification adds a specific, stricter requirement to the candle immediately following the Inside Bar setup (Candle 3/False Breakout):

- Standard Rule: Only requires the False Breakout candle (C3) to exit the range.

- Modified Rule: Requires that the False Breakout candle itself must close with a lower high (for a Bearish setup) or a higher low (for a Bullish setup). This imposes a tighter structural prerequisite, confirming momentum is truly struggling before the reversal.

Investors often prefer the Modified Hikkake for its enhanced reliability. By imposing this tighter structural requirement, the pattern is less likely to generate false signals, leading to more informed and higher-probability trading decisions. It is especially useful for conservative traders operating in noisy markets where extra confirmation is valued.

9. Hikkake Pattern vs. Similar Patterns

The Hikkake Pattern is a highly specific, multi-candle trap setup built on an Inside Bar base and a subsequent failure of a false breakout. Recognizing its unique mechanism prevents it from being confused with other similar reversal signals.

| Pattern | Core Definition/Mechanism | Primary Function | Distinguishing Conditions |

| Bullish Hikkake | Multi-candle setup exploiting a false low breakout move from an Inside Bar. | Reversal UP (Buy Signal) | False breakout occurs down below the C2 low; Confirmation (C4) must close above the C2 high. |

| Bearish Hikkake | Multi-candle setup exploiting a false high breakout from an Inside Bar. | Reversal DOWN (Sell Signal) | False breakout occurs up above the C2 high; Confirmation (C4) must close below the C2 low. |

| Inside Bar Breakout | A trade taken immediately when price breaks the Inside Bar range (C3). | Trend Continuation | The strategy trades the breakout (C3) hoping for continuation, not waiting for the failure and reversal. |

| Engulfing Pattern | A two-candle price pattern where the second candle’s body fully covers the first candle’s body. | Direct Reversal | Lacks the multi-candle C3 False Breakout, the critical trap mechanism that fuels the reversal momentum. |

| Generic False Breakout | Price briefly passes a key structural level (S/R) and fails. | Reversal (Broad/Subjective) | Lacks the rigid Inside Bar base (C1 & C2) to objectively define the consolidation base and risk placement. |

10. 3 Tips to Improve Hikkake Accuracy

To significantly increase the reliability of the Hikkake signal and avoid false traps, integrate the pattern with broader technical analysis tools and proper timeframe selection.

- Confirm with momentum and volume: Always seek above-average volume on the Confirmation Candle (C4). Use momentum indicators like RSI or MACD to confirm that the reversal is supported by underlying market strength, ensuring the signal isn’t generated purely by thin-market stop-loss hunting.

- Contextualize with trend: Only take a Hikkake signal if the reversal aligns with the direction of the higher timeframe (e.g., Hikkake on H1 confirming a move in the H4 trend direction). Avoid trading reversals that conflict with major market directions.

- Prioritize higher timeframes: Signals on H4 (4-Hour) and D1 (Daily) timeframes are generally more reliable than those on lower timeframes (M15, M30). Higher timeframes naturally filter out market noise (minor false breakouts) and provide a clearer picture of the reversal’s commitment.

11. Common Mistakes to Avoid

Even experienced traders make errors when applying the Hikkake. Avoiding these common mistakes is essential for maintaining accuracy and risk control.

- Entering before confirmation: The single biggest mistake is entering on the False Breakout (C3) or before Candle 4 has fully reversed and broken the C2 boundary. Patience is critical; an early entry invalidates the low-risk thesis of the pattern.

- Confusing Inside Bars with Hikkake: Mistaking every Inside Bar setup for a Hikkake is dangerous. The Hikkake requires the specific C3 False Breakout and the C4 reversal; a standard Inside Bar is usually a continuation signal.

- Ignoring overall trend context: Trading Hikkake reversals against a massive, established higher-timeframe trend drastically reduces the probability of success. Use the Hikkake to confirm a reversal at a key structural level, not to blindly predict major market pivots.

12. Frequently Asked Questions (FAQs)

13. Conclusion

The Hikkake Pattern is a powerful reversal setup because it profits directly from the failure of other traders’ breakout attempts. Its structure, defined by the Inside Bar setup and subsequent false move, provides an objective signal. The core principle is simple: the failure of the expected move often signals the direction of the true move.

Success with the Hikkake hinges entirely depends on discipline and confirmation. Always wait for the Confirmation Candle (C4) to close and execute precise risk control. The pattern itself provides the ideal boundary: placing the stop-loss just beyond the extreme of the false breakout (C3) ensures a low-risk trade profile.

To master this and other high-probability setups, consistent education is vital. Continue developing your price action expertise by following the Analysis section at Piprider for the latest articles and strategy guides.