For any beginner in forex trading, understanding Free Margin is not optional, it’s critical. This metric is the simplest, most honest gauge of the account’s safety and real capacity to trade. Mismanaging it is the fastest route to facing a margin call and losing capital.

This essential guide clearly defines what is free Free Margin in forex trading. Piprider will break down the simple calculation, show its vital difference from Used Margin, and provide actionable examples. By the end, you will know exactly how to use it to protect your capital and make smarter, more responsible trading decisions.

Key Takeaways

- Free Margin is the available, unused capital in account that is unlocked (not collateral) and ready for new trades.

- It is a safety buffer. When it drops close to zero, traders are in danger of a broker-forced liquidation (stop-out).

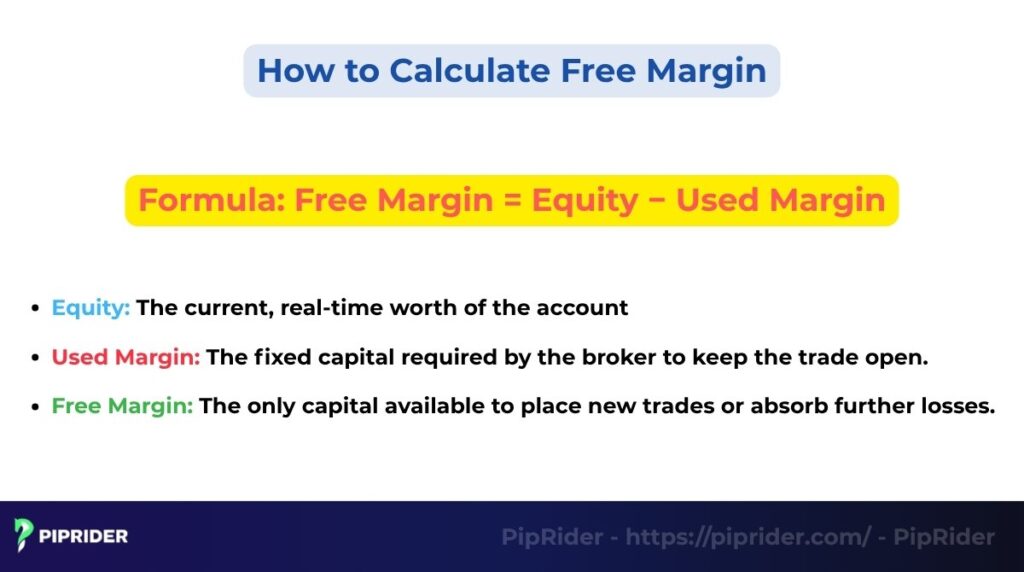

- The formula is simple: Free Margin = Equity − Used Margin.

- Monitoring it is the most effective tool for proper position sizing and managing overall risk exposure.

1. What is Free Margin in Forex Trading?

Free Margin is the amount of equity in the trading account that is unlocked. It represents the maximum amount of capital available margin at any given moment to fulfill two purposes:

- Open a new position.

- Absorb further losses from current open positions.

It acts as the vital safety buffer. The higher the Free Margin, the safer the account is from being forcibly closed by the broker (a stop-out) (Trendo, n.d.).

To truly understand what it means, differentiation from the other core concepts displayed on the trading platform is essential:

| Term | Definition | Role in Trading |

| Equity | The real-time value of the account. It is the initial deposit plus or minus the floating Profit/Loss (P/L) of all open trades. | Represents the true health and total value of the account at any moment. |

| Used Margin | The capital that is locked by the broker as collateral to keep current leveraged positions open. | Acts as the security deposit for the broker’s loan (leverage). |

| Free Margin | The difference between Equity and Used Margin. It is the unlocked capital. | The capacity to take on new risk and the primary defense against a margin call. |

In short: If all positions were closed, the Equity would become the new account balance, and the Used Margin would revert to zero, becoming part of the usable margin.

2. How Free Margin Works

Understanding the static definition of this margin is only the start; its practical function lies in dictating a trader’s real-time actions and safety margin.

It acts as the primary buffer to absorb unexpected losses, ensuring margin trading activity is managed responsibly. It is the direct measure of account liquidity and forces traders to adopt proper risk discipline, ensuring they don’t overcommit their capital.

- Opening Trades: To open a new position, the required Used Margin must be less than or equal to the current Free Margin. If Free Margin is $0, the trading platform will reject any new orders.

- Holding Trades (Maintenance): As a trade stays open, its floating Profit or Loss (P/L) constantly alters the Equity level. This, in turn, changes the Free Margin. A loss reduces Free Margin, tightening the safety buffer (Equiti, n.d.).

3. How to Calculate Free Margin

The calculation is the foundation of all Forex risk management.

3.1. The Basic Formula

The formula is the fundamental equation connecting the three key account components. It represents the logical difference between the total real-time value of the account and the capital currently being used as collateral.

| Free Margin = Equity − Used Margin |

Detailed Breakdown:

- Equity (Total Value): The current, real-time worth of the account (Balance ± Floating P/L).

- Used Margin (Locked Capital): The fixed capital required by the broker to keep the trade open (collateral). This value is unavailable for new activity.

- Free Margin (Available Capital): The remainder. This is the only capital available to place new trades or absorb further losses.

The formula shows that a change in Equity (driven by trade performance) directly changes the Free Margin, making it the primary account health indicator.

3.2. Example: No Open Trades

If a trader has not opened any positions, the Used Margin is $0.

- Starting Balance: $5,000

- Equity: $5,000 (since Profit/Loss is $0)

- Used Margin: $0

- Calculation: $5,000−$0=$5,000

Conclusion: When there are no active trades, all capital in the account is Free Margin.

3.3. Example: With an Active Trade

A trader has a Balance of $5,000 and opens a 1-lot trade, requiring a Used Margin of $1,000 (due to leverage).

| Scenario | Equity (Balance ± P/L) | Used Margin | Free Margin | Interpretation |

| Initial Trade | $5,000 | $1,000 | $4,000 | $4,000 is available for new risk. |

| Loss of $500 | $4,500 | $1,000 | $3,500 | Loss is absorbed by Free Margin |

| Profit of $200 | $5,200 | $1,000 | $4,200 | Profit increases Free Margin |

Conclusion: Free Margin is the value that changes dynamically with trade performance, making it the most critical number to monitor for account health.

4. Why Free Margin Matters

Understanding and monitoring Free Margin is vital because it directly impacts the trading capacity, safety, and longevity in the market.

- The available balance for new positions. Free Margin is the only capital that can be utilized to open a new trade. If it is less than the required collateral (Used Margin), the trading platform will reject the order.

- The primary cushion against floating losses. It serves as the account’s essential safety buffer. When open positions move against the trade, resulting losses are immediately deducted from it, protecting the minimum required collateral.

- The direct protection from margin calls and stop-outs. By maintaining a high Free Margin, traders keep a safe distance from the broker’s critical liquidation threshold. A shrinking Free Margin is the direct indicator that the account is approaching a Margin Call (a broker warning) (IG UK, n.d.).

Read more:

What Is the Difference Between Forex and Binary Options?

Forex Order Blocks: Complete Guide with Examples & Strategies

5. Margin vs Free Margin vs Leverage

While all three terms are fundamental to trading and risk, they measure entirely different aspects of your account. Understanding their interaction is key to safe management.

5.1. Key Differences Explained

Although all three terms are fundamental metrics on a trading platform, they serve distinct purposes in managing risk and capacity:

| Term | What it Measures | Calculation Basis | Primary Focus |

| Free Margin | The dollar amount of capital available for new trades or loss absorption. | Equity−Used Margin | Capacity (The capital available for new risk). |

| Margin Level | The health ratio of the account, expressed as a percentage. | (Equity/Used Margin)×100 | Safety (How close the account is to a stop-out). |

| Leverage | The multiplier that determines the size of the required collateral. | Trade Size/Required Margin | Multiplier (The credit line offered by the broker). |

In short, leverage sets the Used Margin. Free Margin is the buffer against loss. Margin Level is the safety ratio that tells the trader if the buffer is sufficient (FOREX.com, n.d.).

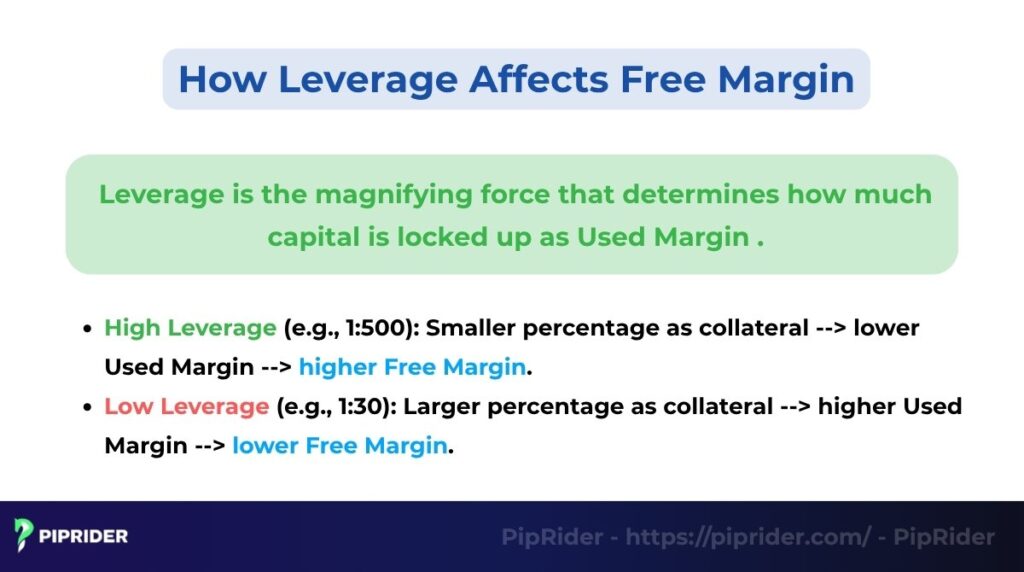

5.2. How Leverage Affects Free Margin

Leverage is the magnifying force that determines how much capital is locked up as Used Margin (CFI Trading, n.d.).

- High Leverage (e.g., 1:500): The broker demands a smaller percentage of the trade value as collateral, resulting in lower Used Margin. This leaves the account with a higher Free Margin.

- Low Leverage (e.g., 1:30): The broker demands a larger percentage as collateral, resulting in higher Used Margin. This leaves the account with a lower Free Margin.

The takeaway: Higher leverage increases Free Margin initially, giving traders more freedom to open positions, but this also increases the potential for rapid loss if position sizing is not managed strictly.

5.3. Understanding Margin Level

The Margin Level is arguably the most critical number for avoiding a stop-out because it directly incorporates both Free Margin and Used Margin into a ratio.

| Margin Level = (Equity / Used Margin) × 100 |

- When the Margin Level is high (e.g., above 1000%), the Free Margin buffer is robust.

- When the Margin Level approaches the broker’s minimum threshold (often 100% or 50%), it means Free Margin is extremely low or negative, triggering the Margin Call or the Stop-Out process.

6. What Affects the Free Margin

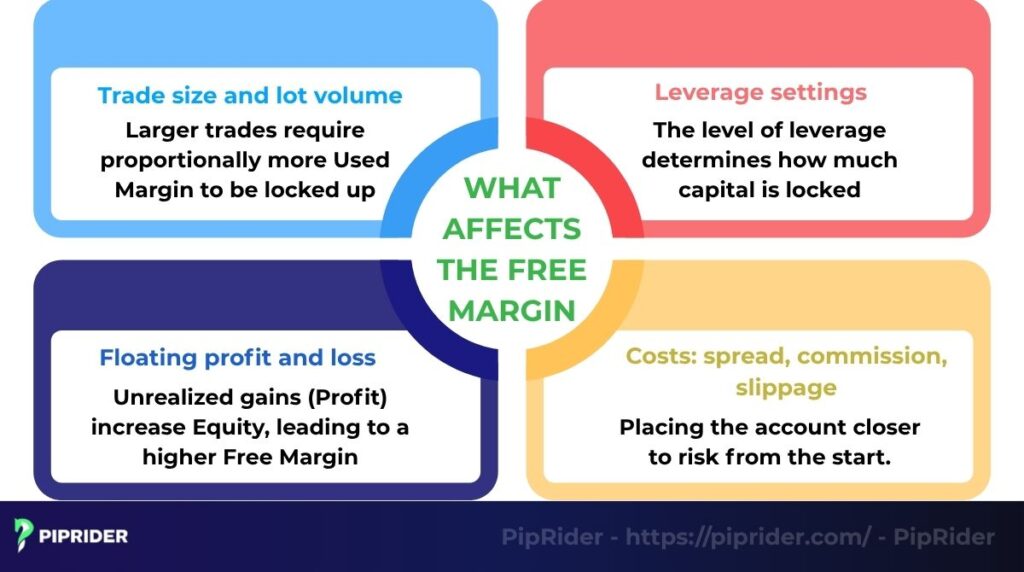

Free Margin is a constantly shifting figure, reacting immediately to any change in the account’s equity or margin requirements.

- Trade size and lot volume: The size of the position is the most direct influence. Larger trades require proportionally more Used Margin (collateral) to be locked up, instantly decreasing the buffer.

- Leverage settings: The level of leverage determines how much capital is locked. Higher leverage results in lower Used Margin, initially increasing this figure, though this dramatically raises the volatility risk.

- Floating profit and loss: Unrealized gains (Profit) increase Equity, leading to a higher Free Margin. Unrealized losses (Loss) decrease Equity, leading to a lower figure and tightening the safety buffer.

- Costs: spread, commission, slippage: These transaction costs are deducted immediately at execution. This initial loss immediately reduces the Equity and, therefore, places the account closer to risk from the start.

7. What Happens When Free Margin Is Zero?

When Free Margin is zero, the safety buffer is gone, and the account is critically exposed to the broker’s automatic risk mechanisms.

- Margin call explained: A Margin Call is the broker’s first alert, typically triggered when Equity equals Used Margin (Margin Level ≈100%). It requires you to immediately deposit more funds or close losing positions to restore the safety buffer.

- Stop out and forced closing: The Stop-Out level is the automatic liquidation point (e.g., Margin Level 50%). If reached, the broker automatically closes your largest losing trades to release Used Margin, preventing a negative account balance.

- Real consequences for traders: The result is an immediate loss of control and capital. Trades are closed at their maximum loss, leaving the account crippled with only minimal remaining equity.

8. Example

To demonstrate the real-world impact of margin concepts, let’s track the journey of a single trade.

8.1. A $1,000 account case study

| Account Parameter | Initial Value |

| Balance | $1,000 |

| Leverage | 1:100 |

| Trade Size | 0.2 Standard Lots (20,000 units of EUR/USD) |

| Required Margin (Used) | $200 (calculated as $20,000/100) |

| Stop Out Level | 50% |

8.2. Step-by-step calculation

- Step 1: Opening the Trade

- Used Margin: $200 (locked as collateral)

- Equity: $1,000 (P/L is 0 at the start)

- Free Margin: $1,000−$200=$800

- Margin Level: ($1,000/$200)×100=500%

- The account is healthy with an $800 buffer.

- Step 2: Floating Loss (Market moves against the trade)

- The trade moves against the trader, resulting in a floating loss of $700.

- Equity: $1,000−$700=$300

- Used Margin: $200 (remains locked)

- Free Margin: $300−$200=$100

- Margin Level: ($300/$200)×100=150%

- The Free Margin has shrunk significantly, and the account is nearing danger.

- Step 3: Hitting Stop Out

- The trade moves further against the trader, incurring a floating loss of $900.

- Equity: $1,000−$900=$100

- Used Margin: $200

- Free Margin: $100−$200=−$100

- Margin Level: ($100/$200)×100=50% (The stop-out level)

- Since the Margin Level hit 50%, the broker automatically closes the position. The $900 loss is realized.

- Step 4: After Stop Out

- The trade is closed. The account resets.

- New Balance: $1,000−$900=$100

- Used Margin: $0 (no open trades)

- Free Margin: $100−$0=$100

8.3. Key lessons

- Free Margin is the lifeline: The initial $800 Free Margin was the maximum buffer the trade had. Once losses exceeded that, the core collateral ($200 Used Margin) was put at risk, leading to liquidation.

- Never use 100% Free Margin: The total risk taken ($200 Used Margin) was too high relative to the account size. To be safe, it should always remain a high margin percentage of the Equity.

- The stop out is automated: The broker closed the trade automatically to protect both parties, preserving only $100 of the initial $1,000 deposit.

9. How to Protect the Free Margin

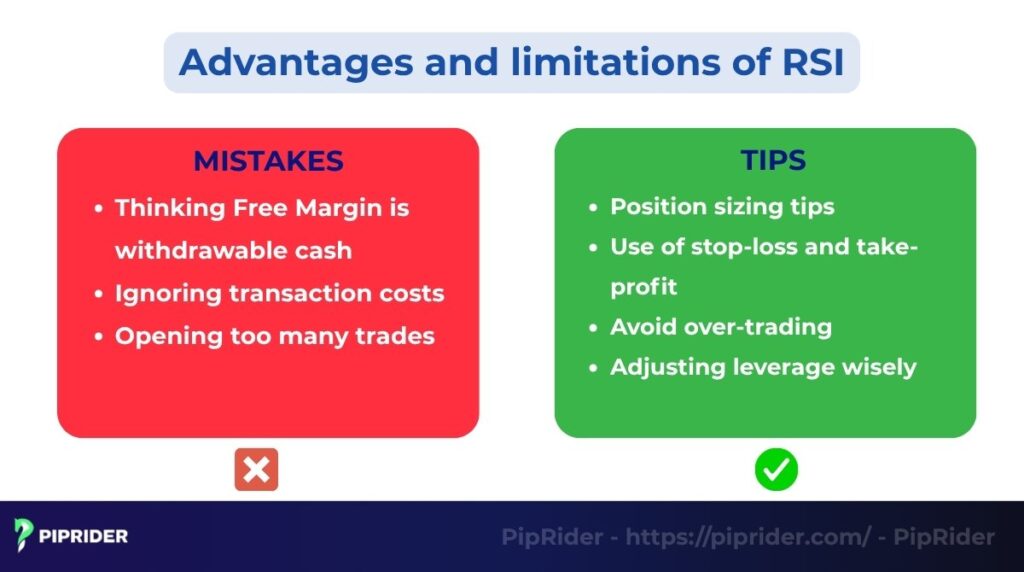

Maintaining a healthy Free Margin is the core of effective risk management and capital preservation in Forex. Here are key strategies:

- Position sizing tips: Never risk more than 1% to 2% of total Equity on a single trade. Use micro or mini lots to ensure the Used Margin remains a tiny fraction of the capital, thereby maximizing the safety buffer this cushion provides.

- Use of stop-loss and take-profit: Always implement a hard Stop-Loss (SL) to cap potential floating losses and prevent them from depleting this figure entirely. Utilize a Take-Profit (TP) to secure gains, as realized profits immediately increase Equity and, consequently, Free Margin.

- Avoid over-trading: Limit the number of concurrent positions. Every open trade converts available capital into Used Margin, shrinking your buffer. Aim to keep your Margin Level consistently high (e.g., above 500%) to ensure a substantial portion of your capital remains unlocked.

- Adjusting leverage wisely: Choose moderate or low leverage (e.g., 1:30 or 1:50). Lower leverage automatically forces you to use smaller trade sizes relative to your capital. This is the most effective way to protect the available margin from rapid erosion during adverse price movements.

10. Checking Free Margin on Trading Platforms

Knowing how to locate and monitor Free Margin on a trading terminal is as crucial as understanding the metric itself. The platform provides real-time visibility into the account’s health and immediate capacity to take on new risks.

- Platform location: Free Margin is found in the Terminal/Toolbox Window on platforms like MT4/MT5. It is the value of Equity minus the Used Margin, representing the cash buffer available for new trades or absorbing losses.

- Broker Alerts: Brokers use the Margin Level for critical warnings:

- Margin Call: An alert (often at 100%) requiring the deposit of more funds or the closing of positions.

- Stop Out: Automatic liquidation (often at 50%) where the system forcibly closes losing positions to protect the account from a negative balance.

- Proactive tools: Always calculate the potential Free Margin before opening a trade using a Margin Calculator. Maintain a personal Margin Level floor significantly higher than the broker’s Stop Out level (e.g., above 500%) to ensure constant risk control, as these requirements can vary based on the specific regulated forex brokers and margin rules applicable to your jurisdiction.

11. Common Beginner Mistakes

Even after understanding the technical definition, new traders often stumble due to practical misconceptions about how it works in a live account environment, rapidly converting their safety buffer into risk.

- Thinking Free Margin is withdrawable cash: Free Margin is a highly flexible risk capacity, not available cash for withdrawal. It changes instantly with floating profit/loss (P/L). Consequently, a withdrawal attempt can be rejected or cause the account to hit a Margin Call if it compromises the margin required for open positions.

- Ignoring transaction costs: Costs like Spread and Commission are realized losses deducted the moment a trade opens, instantly reducing Equity. This immediate loss means actual Free Margin is lower than anticipated from the start, placing the account closer to a liquidation level sooner.

- Opening too many trades: Every new trade consumes Free Margin to lock up new Used Margin. Rapidly opening multiple positions dramatically lowers the Margin Level, making the account highly vulnerable to even small floating losses which can swiftly trigger an automatic Stop Out (forced liquidation).

12. Free Margin Beyond Forex

The concept of Free Margin is universal across all leveraged trading products. It is always the measure of your account’s unused safety capital based on current market values.

- Stock Margin Accounts: In margin trading stock accounts, Free Margin is the equity in account exceeding the required Maintenance Margin (the minimum equity needed). If your portfolio value drops and it approaches zero, you face a Margin Call.

- CFDs and other Leveraged Products: For products like CFDs (Contracts for Difference), Futures, and Indices, Free Margin works identically to Forex: Equity − Used Margin. It is the critical buffer that prevents a broker-enforced Stop Out regardless of the underlying asset class.

13. FAQs

14. Conclusion

Understanding what is Free Margin in forex trading is the single most important lesson for new traders. It transforms abstract risk into a clear dollar amount (Equity − Used Margin), giving you control and preventing an automated Stop Out.

Key Takeaways for New Traders

- Free Margin is Your Safety Buffer: It is the available margin to absorb losses. Never mistake it for withdrawable cash.

- Prioritize Margin Level: Keep your margin levels high (ideally ≥500%). This ensures your buffer is strong and keeps you safe from automatic liquidation.

- Control is King: Protect your Free Margin by strictly limiting your Position Size (lowering Used Margin) and always using a Stop-Loss as part of your trading strategy.

To advance your trading discipline, immediately continue your education by following the Forex Overall section on Piprider. This resource covers mastering essential advanced topics, such as calculating precise lot sizes based on risk percentage and implementing advanced stop-loss strategies, which are crucial for long-term success.