Have you ever felt helpless watching a major forex trend pass you by, just because the chart looked like a chaotic mess? I’ve been in that exact spot, wasting hours only to get shaken out by market noise.

Things only truly changed when I learned how to use the Alligator indicator. It became more than just a tool; it’s the compass that helps me navigate the most unpredictable markets.

Created by Bill Williams, this tool helps traders spot when the market is trending or just drifting sideways, saving you from bad trades. Whether you’re new to forex or sharpening your skills, this guide will show you how to use the Alligator Indicator to trade smarter.

Stick around for practical tips and a free cheat sheet to kickstart your journey!

Key Takeaways

- The Alligator Indicator uses three lines (Jaw, Teeth, Lips) to spot trends and flat markets.

- Learn how to set it up and read buy, sell, hold, and exit signals for forex trades.

- Learn recommended Alligator Indicator settings for day trading, swing trading, and scalping.

- Pair it with tools like RSI or Fractals to confirm signals and avoid false moves.

- Analyze an illustrative EUR/USD trade example to understand how it works in action.

- Explore its strengths, weaknesses, and answers to common questions for confident trading.

1. What is the Alligator Indicator?

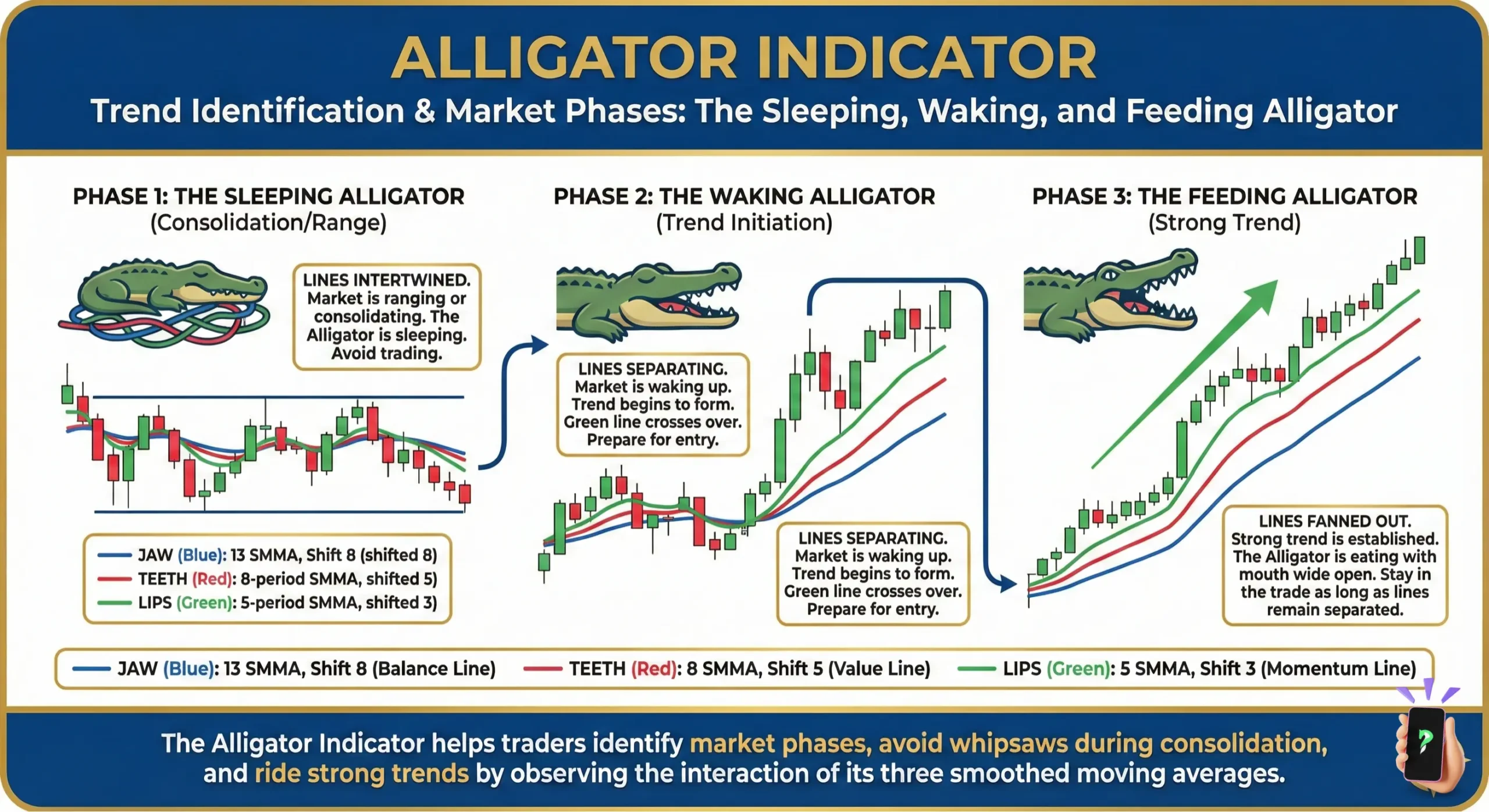

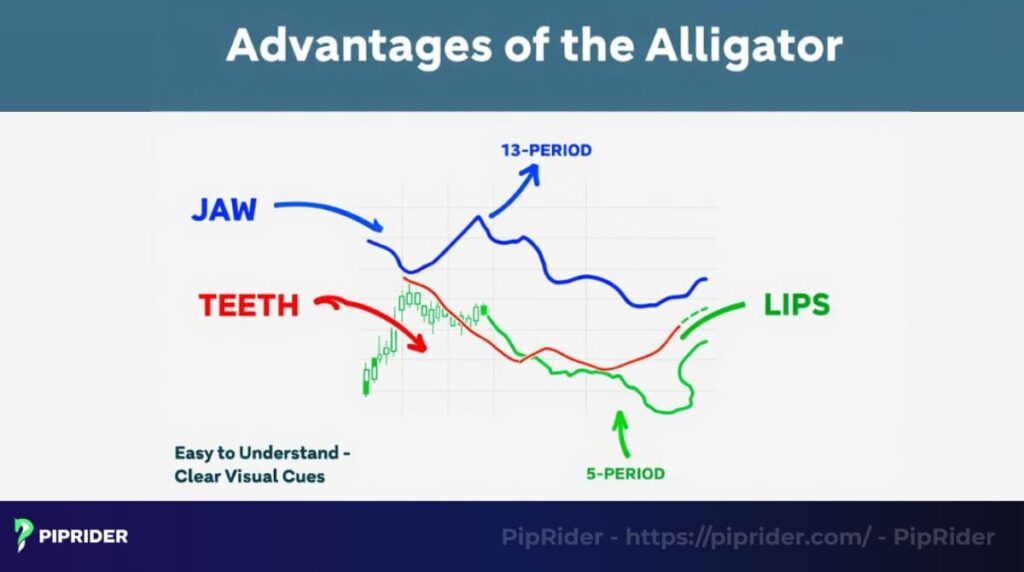

Created by Bill Williams in 1995, the Alligator Indicator uses three lines to show market trends. These lines, called the Jaw, Teeth, and Lips, are smoothed moving averages that act like an alligator’s mouth, opening and closing as the market moves.

Think of the Alligator Indicator as a guide that tells you when the forex market is ready to move or when it’s just taking a nap. It’s a simple tool that helps traders like you and me figure out if a trend is worth chasing. Let’s break down what it is and why it’s so useful.

- How it looks: The Jaw (blue line) is a 13-period smoothed moving average, shifted 8 bars forward. The Teeth (red line) is an 8-period average, shifted 5 bars. The Lips (green line) is a 5-period average, shifted 3 bars.

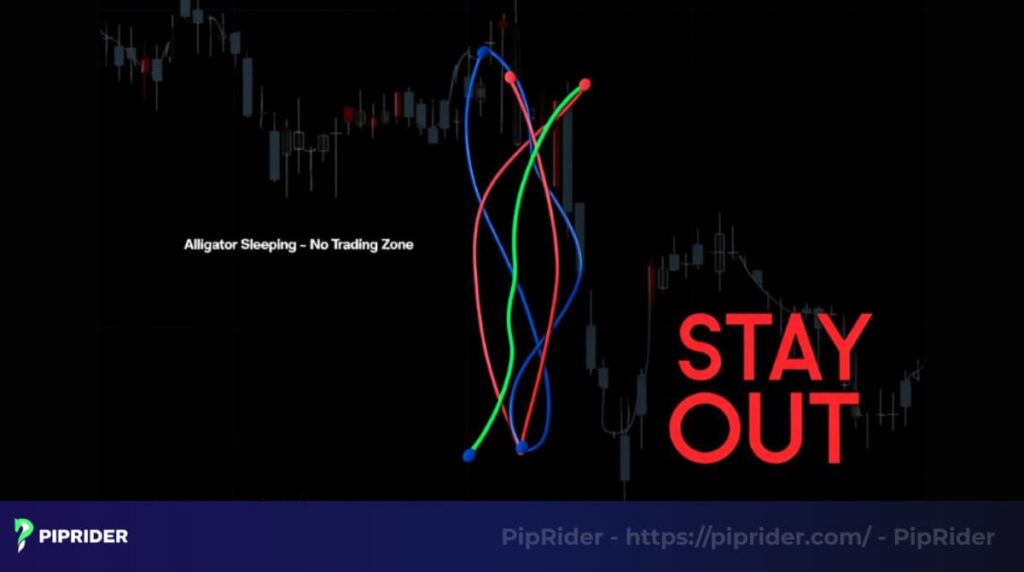

- What it does: When the lines spread apart, it’s like the alligator “eating,” signaling a strong trend. When they tangle up, the alligator is “sleeping,” meaning the market is flat. I’ve noticed this clear visual makes it easy to spot trading opportunities.

- Why it matters in forex: Forex markets only trend 15–30% of the time. The Alligator Indicator helps you focus on those trend periods to avoid wasting trades in choppy markets.

2. How to use Alligator Indicator in forex

Getting the hang of the Alligator Indicator in forex is like learning to read a roadmap for profitable trades. It’s not just about adding it to your chart, it’s about understanding its signals to catch trends and sidestep traps. Here’s how to make it work for you.

2.1. Setting up the indicator

Let’s start with the basics of getting the Alligator Indicator on your chart. It’s straightforward, even for beginners.

Most platforms like MetaTrader 4, MetaTrader 5, or TradingView have the Alligator built-in. Go to the indicator menu, search for “Alligator,” and add it with default settings: Jaw (13, 8), Teeth (8, 5), Lips (5, 3).

I’ve found that setting the colors to blue (Jaw), red (Teeth), and green (Lips) makes the chart easy to read. No need to calculate anything the platform does for you.

2.2. Reading the signals

Once it’s set up, the Alligator Indicator gives clear signals to guide your trades. Here’s what to look for.

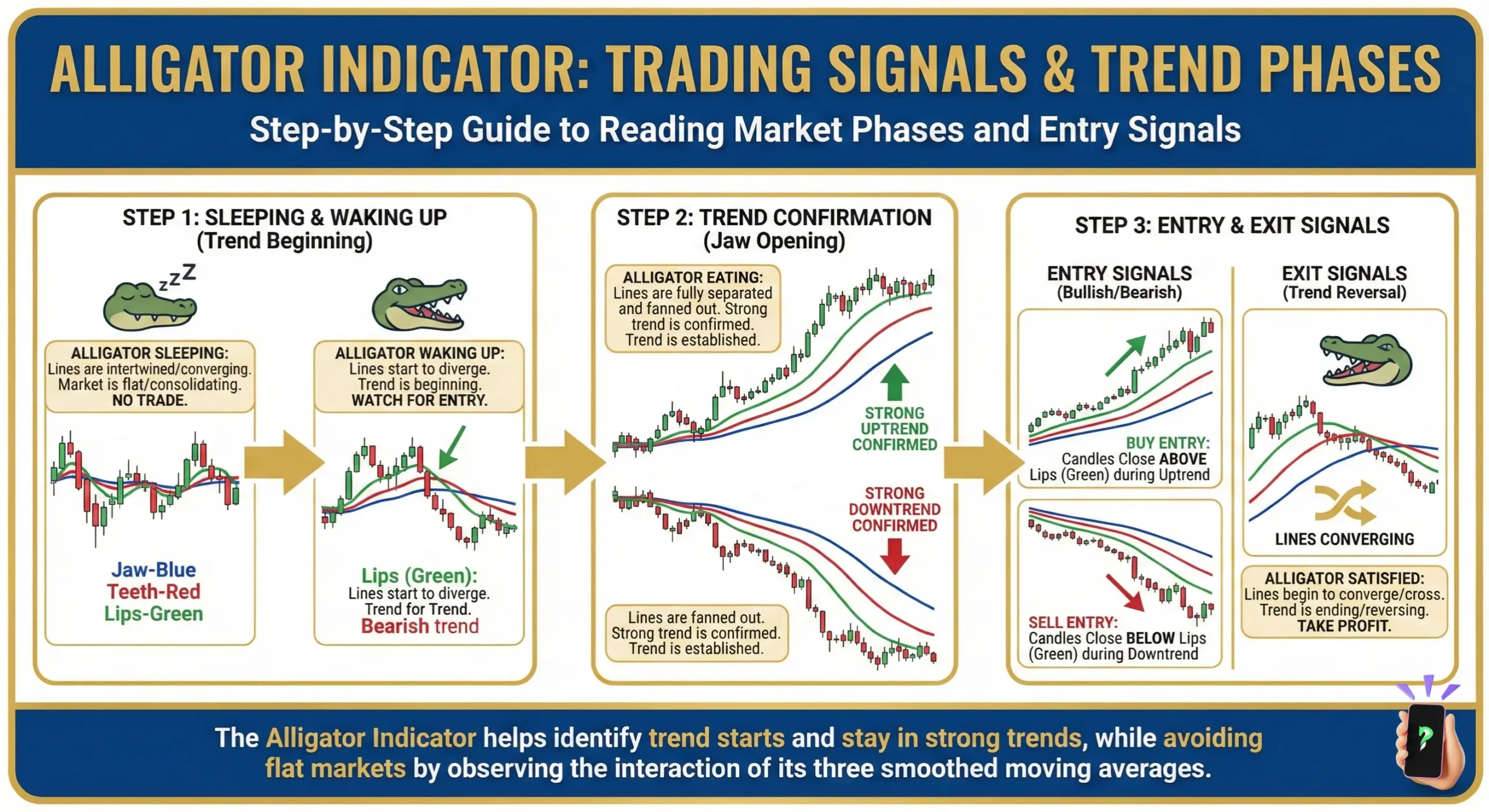

- Buy signal: When the green Lips line crosses above the red Teeth and blue Jaw, the alligator is “waking up,” hinting at a bullish trend. This is your cue to consider buying.

- Sell signal: If the Lips cross below the Teeth and Jaw, it’s a bearish signal, suggesting a potential sell. The alligator is waking up to a downward move.

- Hold the trend: When the lines spread apart and move in one direction, the alligator is “eating”. Stay in the trade as the trend continues or look for a trend continuation pattern to add to your position.

- Exit the trade: When the lines start to converge or tangle, the alligator is “sated,” signaling the trend may be over. It’s time to take profits or step back.

2.3. Avoiding false signals

Choppy markets can trick even the best traders, so here’s how to stay safe with the Alligator Indicator.

- Stay out when the lines crisscross tightly, the alligator is “sleeping,” and the market is choppy. However, savvy traders might watch for a hikkake pattern here to spot potential false breakouts before the true trend emerges.

- I’ve noticed using higher timeframes like H1 or H4 reduces noise and makes signals clearer. A quick check with another tool, like RSI, can confirm if the trend is legit.

Table: Alligator Indicator signals

| Signal type | Line movement | Action |

| Buy | Lips cross above Teeth and Jaw | Enter a buy trade |

| Sell | Lips cross below Teeth and Jaw | Enter a sell trade |

| Hold | Lines spread apart, moving together | Stay in the trade |

| Exit | Lines converge or tangle | Take profits or exit |

3. Best Alligator Indicator settings for forex trading

There is no single “best” setting for every situation, but adjusting the Alligator Indicator can make a big difference in your trading results. Different trading styles and market conditions require specific tweaks. Here’s how to customize the Alligator Indicator’s settings to fit your forex trading strategy.

3.1. Default settings for most traders

The default settings are a great starting point for most forex pairs. They’re simple and work well in many cases.

- Use Jaw (13, 8), Teeth (8, 5), and Lips (5, 3) for major pairs like EUR/USD or USD/JPY. These settings balance speed and reliability on H1 or H4 charts.

- I’ve found the defaults shine in steady markets, catching trends without too much noise. Try them out on a demo account initially to gain confidence.

3.2. Adjusting for trading styles

Your trading style whether you’re in and out fast or holding longer changes the settings you’ll want. Here’s what works.

- Day trading: Try shorter periods like Jaw (8, 5), Teeth (5, 3), Lips (3, 2) on M15 or M30 charts. These give faster signals but expect more false ones.

- Swing trading: Stick with defaults or go slightly longer, like Jaw (15, 10), on H4 or D1 charts. This catches bigger trends with less clutter.

- Scalping: Use very short settings, like Jaw (5, 3), on M5 charts, but pair with a fast moving average to filter signals. It’s tricky but can work for quick trades.

3.3. Tweaking for market conditions

Some forex pairs move wildly, while others are calmer, so adjust the Alligator to match. Here’s how.

- For volatile pairs like GBP/JPY, increase offsets (e.g., Jaw: 13, 10) to smooth out signals and avoid false breakouts.

- For stable pairs like EUR/USD, the default settings are usually enough. They keep things simple and reliable.

Table: Recommended Alligator Indicator settings

| Trading style | Jaw (Period, Offset) | Teeth (Period, Offset) | Lips (Period, Offset) | Recommended time frame |

| Day trading | 8, 5 | 5, 3 | 3, 2 | M15, M30 |

| Swing trading | 13, 8 (or 15, 10) | 8, 5 | 5, 3 | H4, D1 |

| Scalping | 5, 3 | 3, 2 | 2, 1 | M5 |

4. Integrating the Alligator Indicator with additional tools

The Alligator Indicator is powerful, but it’s even better when paired with other tools to confirm signals. I’ve learned that using it alone can sometimes lead to false moves, especially in tricky markets.

Here’s how to combine it with other indicators for stronger forex trades.

- Fractals: These mark key turning points on the chart. A bullish fractal above the Lips indicates a buy opportunity, whereas a bearish fractal below signals a sell.

- RSI (Relative Strength Index): RSI indicates whether a market is overbought or oversold.For a buy signal, check that RSI is below 70 to avoid entering at a peak.

- MACD: This tool confirms trend strength. A MACD line crossing above its signal line alongside an Alligator buy signal is a green light for trading.

- Support and resistance levels: Apply these to establish stop-loss or take-profit targets. If the Lips cross above the Jaw near a support level, it’s a stronger buy signal.

Read more:

Cup and Handle Candlestick Pattern: Definition, Strategies & Target

Flag Pattern Trading: How to Spot, Confirm & Trade Flags

Thrusting Pattern Candlestick: Definition, Types & Strategies

5. Benefits and drawbacks of the Alligator Indicator

No tool is perfect, and the Alligator Indicator has its strengths and weaknesses. Understanding both helps you use it wisely in forex trading. Here’s a clear look at what it does well and where it falls short.

5.1. Advantages of the Alligator

The Alligator Indicator is loved by traders for good reasons. Its simplicity and clarity make it a go-to for spotting trends.

- It’s easy to understand, even for beginners. The Jaw, Teeth, and Lips give clear visual cues for trends, like a roadmap for the market.

- It shines in trending markets, which happen 15–30% of the time. This helps you catch big moves when they count.

- You can use it on any forex pair or timeframe, from M5 for scalping to D1 for swing trading. I’ve found it works great on EUR/USD.

5.2. Limitations to watch out for

Every tool has downsides, and the Alligator is no exception. Knowing its limits keeps you from costly mistakes.

- It’s a lagging indicator, meaning signals come after the trend starts. This can delay your entry or exit.

- In choppy markets, which are 70–85% of the time, it gives false signals.I’ll never forget the times I tried to force trades while the ‘alligator was sleeping,’ only to watch my account slowly bleed from sudden reversals. It was a costly reminder of the value of staying patient.

- You may need to tweak settings for different pairs or styles. Practicing on a demo account prevents losses from experimentation.

6. Indicators that can be combined with the Alligator indicator

The Alligator Indicator is a powerful tool, but combining it with other indicators can significantly enhance its effectiveness by confirming signals and reducing false entries. Below are some of the best indicators to pair with the Alligator for more robust forex trading strategies.

| Indicator | How to use with Alligator | Why it works | Pro tip |

| Fractals | – Buy: Bullish fractal above Lips- Sell: Bearish fractal below Lips | – Highlights potential reversals or continuations- Enhances entry/exit timing alongside Alligator’s trend signals | Use on same timeframe as Alligator (e.g., H1 or H4) |

| RSI | – Buy: Confirm RSI < 70 when Alligator signals upward trend- Sell: Confirm RSI > 30 for downward trend | – Filters trades in overbought/oversold zones- Avoids late entries | Use 14-period RSI on H1 or H4 for confirmation |

| MACD | – Buy: MACD line crosses above signal line + bullish Alligator crossover- Sell: MACD line crosses below signal line + bearish Alligator crossover | – Confirms momentum strength- Avoids trading weak or fading trends | Use default MACD (12, 26, 9); test timing on demo |

| Bollinger Bands | – Buy: Price near upper band with bullish Alligator signal- Sell: Price near lower band with bearish Alligator signal | – Adds volatility context- Confirms breakout strength or overextension | Use 20-period, 2 standard deviation Bollinger Bands |

| Support & Resistance | – Buy: Bullish crossover near support- Sell: Bearish crossover near resistance | – Provides clear entry/exit zones- Aligns Alligator signals with price reaction zones | Use historical price or pivot pointsConfirm levels on higher timeframes (e.g., D1) |

Practical tips:

- Avoid overloading: Stick to one or two additional indicators to keep your analysis clear. Too many tools can lead to confusion or conflicting signals.

- Test combinations: Practice on a demo account to see which indicators work best with the Alligator for your trading style and preferred forex pairs.

- Align timeframes: Ensure all indicators are applied on the same timeframe as the Alligator to maintain signal consistency.

- Focus on confirmation: Use these tools to confirm Alligator signals rather than relying on them independently. For example, a buy signal from the Alligator is stronger if RSI and Fractals also support it.

By thoughtfully combining the Alligator Indicator with these tools, or comparing it with the GMMA indicator for trend strength analysis, you can improve your trade accuracy and confidence.

7. Illustrative Example: Analyzing a EUR/USD trade with the Alligator Indicator

To gain a clearer understanding of the Alligator Indicator’s functionality, consider a practical example. Analyzing a hypothetical trade scenario on the EUR/USD pair is a great way to learn its signals. Let’s walk through the steps of a trade scenario to see how this indicator is applied in practice.

7.1. Setting up the trade

First, you need to prepare your chart and confirm the signals. Here’s what I did.

- I applied the H4 timeframe on EUR/USD using the standard Alligator settings: Jaw (13, 8), Teeth (8, 5), Lips (5, 3). This timeframe balances clarity and trend reliability.

- I added RSI to check if the market was overbought or oversold. This helps avoid jumping into a trade at the wrong time.

7.2. Executing the trade

Here’s how the trade played out on EUR/USD, step by step.

- Entry: The green Lips crossed above the red Teeth and blue Jaw, signaling a bullish trend. RSI was at 60, showing the market wasn’t overbought yet.

- Stop-loss: I set the stop-loss below the blue Jaw line, about 20 pips below my entry, to protect against sudden drops.

- Take-profit: I aimed for a key resistance level 50 pips above, where the Lips started to converge with the Teeth, hinting the trend was slowing.

7.3. Trade outcome and lessons

The trade worked out, but it wasn’t perfect. Here’s what happened.

- The price climbed 50 pips, hitting my take-profit in about 12 hours. The Alligator’s “eating” phase kept me confident in the trend.

- The biggest lesson I learned is that combining it with RSI saved me from a hasty decision. If the RSI hadn’t shown there was still ‘room to run,’ I might have ignored this buy signal, fearing the market was already at its peak. Combining tools is key to boosting confidence.

- Always test trades like this on a demo account first. It builds confidence without risking real money.

8. Frequently asked questions about the Alligator Indicator

Traders frequently ask about the functionality of the Alligator Indicator in forex. I’ve compiled responses to the most common questions to provide clarity. Here’s what you need to know to use this tool confidently.

9. Conclusion and next steps

The Alligator indicator in forex is truly a powerful ally, but it’s not magic. It demands patience to get used to and discipline to follow. Instead of seeing it as a red-light, green-light signal system, think of it as a storyteller for the market’s condition. Start on a demo account, practice ‘listening’ to the story it tells, and you’ll find your confidence grow significantly.

Ready to dive deeper? Here’s how to keep learning and improve your trading.

Check out the Pip Rider blog for more tips in our best technical indicators category. It’s packed with tools to boost your skills.

If you’re new, explore our For Beginner blog section for easy-to-follow guides. They’re designed to make forex less intimidating.