Trendlines are the most essential tool for technical analysis. They define a market’s direction, identify dynamic support and resistance, and generate reliable trading signals. Learning how to draw trend lines correctly is critical for disciplined analysis.

This guide will give you the clear, objective steps needed to draw and apply valid trendlines immediately, helping you move from guesswork to informed trading.

Key Takeaways

- Trendlines define market direction and act as dynamic support (uptrend) or resistance (downtrend).

- A valid trend line requires connecting at least three significant swing points to confirm its reliability.

- Always draw on higher time frames (H4, Daily) as these provide more objective and reliable signals.

- The most actionable signals come from a price reversal off the line or a decisive breakout signaling a trend reversal.

- To minimize false signals, confirm trend line activity using volume or other technical indicators.

2. What Are TrendLines?

A trend line is a straight line drawn on a price chart that connects two or more significant pivot highs or pivot lows. It is a fundamental charting tool used in technical analysis trend lines to visually represent the prevailing price direction and speed of an asset’s price movement (StockCharts, n.d.).

The primary function of a trend line is to visually define the market’s current direction, fulfilling the goal of how to find a trend. It is the simplest tool technical analysts use, based on the principle that “the trend is your friend.”

A trend line provides several critical insights:

- Dynamic support and resistance: It creates a moving barrier. When drawn under the price, it acts as a buying zone; when drawn over the price, it acts as a selling zone. This aids in setting entry/exit points.

- Assessing trend health: The line’s slope reveals the trend’s strength: a steep slope indicates strong, but possibly unsustainable, momentum. Trend angles help here.

- Validating patterns: Trendlines are critical for validating patterns during periods of price contraction.

- Timeframe independence: Trendlines are universally applicable and reliable across all timeframes, from one-minute charts to weekly charts.

3. Types of TrendLines

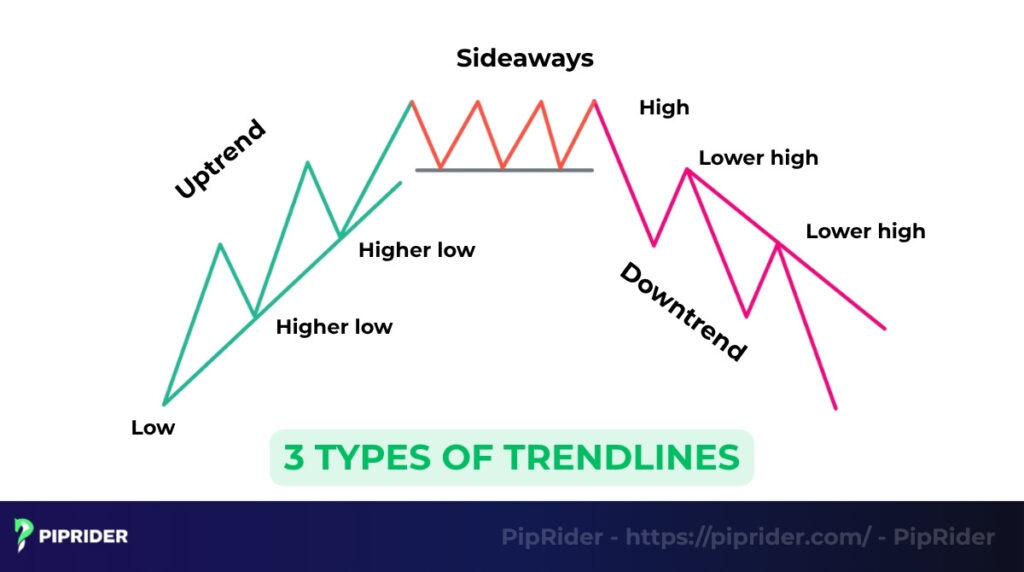

When drawing trendlines, traders will encounter three main types of trendline, each defining a different market condition. Understanding these is essential because each dictates a unique trading approach:

- Uptrend Line (Ascending): Connects the higher lows in a rising market. This line acts as dynamic Support, confirming a healthy bullish trend where demand is strong.

- Downtrend Line (Descending): Connects the lower highs in a falling market. This line acts as dynamic resistance, confirming a bearish trend where supply is strong.

- Horizontal Trend Line (Sideways): Connects equal highs or lows. This line defines a range-bound market, setting static Support and Resistance levels during a period of market indecision.

4. How to Draw Trend Lines: 5 Detailed Steps

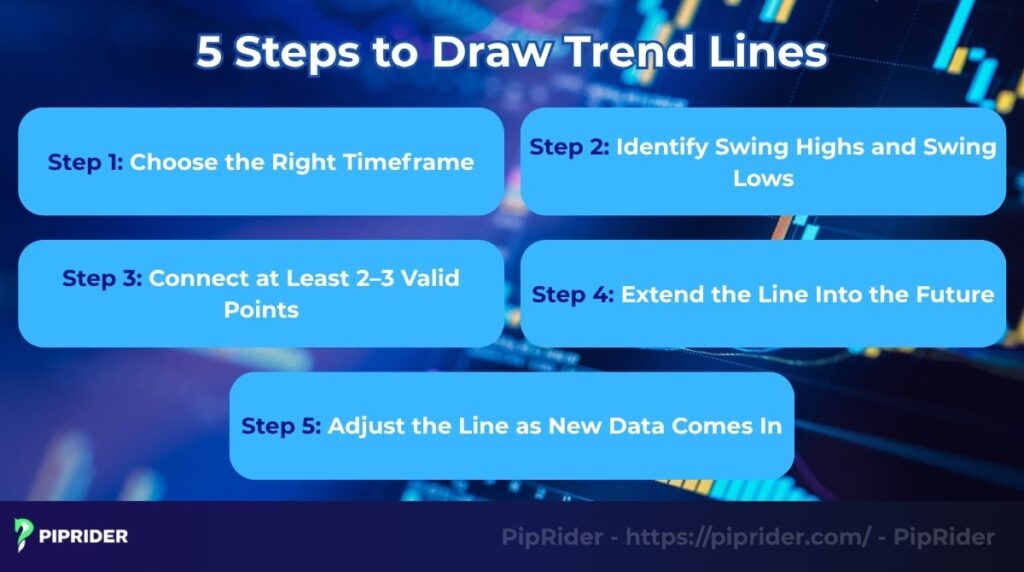

Drawing a valid trend line requires discipline, not guesswork. Follow these five objective steps to draw reliable trend lines in charts and give you a real edge in the stock market drawing easy.

Step 1 – Choose the Right Timeframe

Always start analysis on higher timeframes (H4, Daily). Lines drawn on these charts filter out market “noise” and are respected by far more institutional traders, providing significantly more reliable signals than those on lower.

Step 2 – Identify Swing Highs and Swing Lows

The foundation lies in the swing points, the most significant key turning points on the chart. Identify the swing lows for an uptrend and the swing highs for a downtrend. Focus only on the most obvious pivots; ignoring smaller, random fluctuations is the first rule in accurate trend line stock market analysis.

Step 3 – Connect at Least 2–3 Valid Points

While two points define the line’s slope, it is not considered confirmed until the price has touched it at least three times. This third touch validates the line’s significance.

Critical Tip: Ensure the line connects the wicks (extremes) of the candles, not the body, as a line that cuts through the candle body is structurally invalid.

Step 4 – Extend the Line Into the Future

Once two or three validated points are established, extend the line far to the right of the current price. The extended line represents the forward-looking forecast, showing the exact location to anticipate future trading opportunities: where the price is expected to either rebound or break (a core purpose of the equation of a trend line).

Step 5 – Adjust the Line as New Data Comes In

A trend line is not static because markets are constantly changing speed. Always respect new data: If the market accelerates or decelerates, creating a new, sustained swing point that is clearly respected, the line must be redrawn using the new pivot points. This adjustment ensures the analysis remains relevant to the current market reality.

5. Common Mistakes When Drawing TrendLines

Avoid these pitfalls to ensure trend lines in technical analysis is objective and reliable:

- Forcing the line: Never manipulate the line to cut through the main body of the price movement. If you have to force the line to connect a third point, it is invalid and will lead to false signals.

- Cluttering the chart: Resist the urge to draw a multitude of trending lines. Focus only on the most significant, obvious trends on higher timeframes (H4, Daily) to maintain a clean and effective chart.

- Confusing lines and channels: Understand the difference: a single trend line defines demand zone or supply zone, while a trend channel uses a parallel line to define the profit-taking boundary, avoiding a critical mistake in technical analysis.

6. Pro Methods and Tools for Drawing Trend Lines

Moving beyond the basics requires leveraging professional tools and confirmation techniques to boost confidence in your trade setups.

6.1. Using Charting Tools

For consistency, always use your platform’s dedicated trendline tool (MT4, TradingView, v.v.). Select the “Ray” option to automatically extend the line into the future, defining your forecast zone. For long-term analysis, check your lines on the Logarithmic Scale for a more accurate view of percentage growth over time.

6.2. Confirming with Indicators

A trend line’s signal is far stronger when confirmed by other analysis tools. Look for high trading volume on a rejection or break, as this suggests big players are involved. Seek confluence where the trend line aligns with a major Moving Average (MA). The trend confirmation using golden crosses can validate these bounce points. Use RSI/Stochastic to confirm if the market is oversold or overbought at that level.

6.3. Advanced Techniques

Draw the primary trend line on a Daily or Weekly chart; this Multi-Timeframe Analysis ensures you never trade against the major trend. You can also use internal trend lines on lower time frames for micro-entries. Additionally, draw a parallel line on the opposite side of the price to create a trend channel. This technique defines the likely price boundaries, giving you clear profit targets and structured trading zones.

7. Trend Line Trading Strategies

Trendlines aren’t just for analysis; they are designed for action. The most reliable trendline trading strategies center on two key market events: when the price bounces off the line, and when the price breaks the line.

7.1. The Bounce Strategy (Trend Continuation)

This strategy assumes the established trend will continue, allowing traders to enter in the direction of the existing movement.

How it Works: Look for the price to return to, and then decisively reject, the validated trend line.

- In an Uptrend: When price hits the Uptrend Line, enter a Buy position as the turnaround occurs.

- In a Downtrend: When price hits the Downtrend Line, enter a Sell position as the bounce occurs.

Risk Management: The stop-loss order is placed just beyond the trend line and the most recent swing point, protecting the trade if the bounce fails.

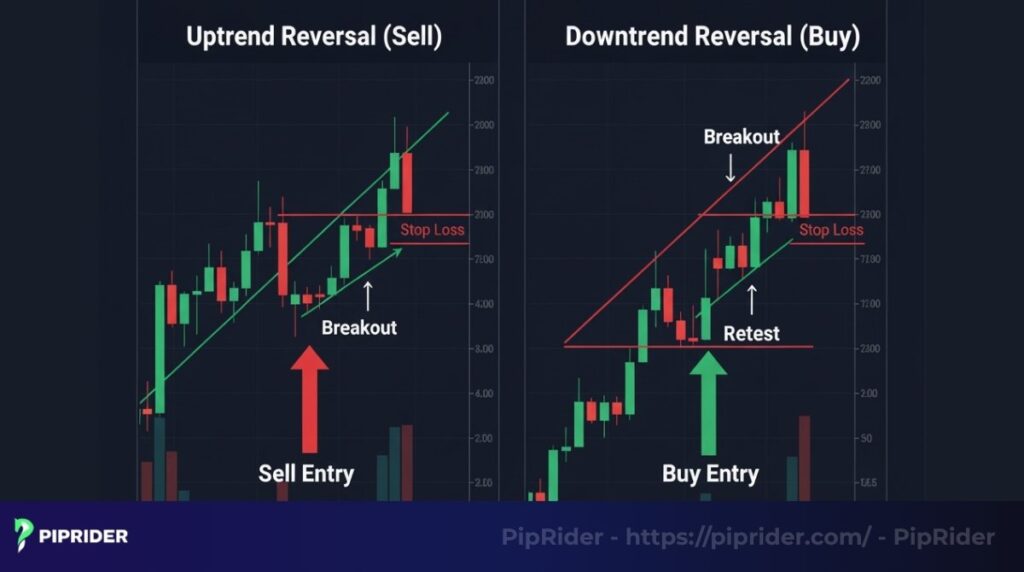

7.2. The Breakout Strategy (Trend Reversal)

This strategy signals a potential end to the current trend and the start of a new one.

How it Works: Wait for the price to decisively violate the trend line.

- Uptrend: When the price closes convincingly below the Uptrend Line, it signals weakness. Enter a Sell position.

- Downtrend: When the price closes convincingly above the Downtrend Line, it signals strength. Enter a Buy position.

The Retest: For a lower-risk entry, wait for the price to retest the broken trend line (which often switches its role from demand zone to supply zone, or vice versa) before continuing in the new direction.

7.3. Combining TrendLines with Support/Resistance

For a higher-probability setup, combine the dynamic trend line with static support/resistance levels marked on the chart.

The Confluence: Look for an instance where a horizontal support/resistance level converges with the dynamic trend line.

The Signal: If the price bounces off a zone where the Uptrend Line meets a previous horizontal support level, the resulting trading signal is significantly stronger than using either tool alone. This multi-tool approach drastically improves the odds of a successful trade.

8. Pros and Cons of Using TrendLines

Trendlines are powerful, but like any tool, they have limitations. A disciplined trader must understand both the advantages and disadvantages.

| Advantages (Pros) | Disadvantages (Cons) |

| Simplicity and clarity: They are easy to draw and visually intuitive, making them accessible even for absolute beginners. | Subjectivity: Different traders may connect different swing points, leading to varied interpretations about market trends and potentially unreliable signals. |

| Versatility: Applicable across all financial markets (forex, stocks, crypto) and any timeframe (from 1-minute to monthly). | False breakouts: Price often moves just beyond the line only to reverse immediately, trapping traders who acted too quickly on the break. |

| Dynamic S&R: They provide dynamic support and resistance levels, giving better entry and exit points than static horizontal lines in a trending market. | Lagging tool: The line is always drawn based on past price action. It does not predict the future but helps manage the current trend. |

| Foundation of analysis: They form the basis for more advanced tools like trend channels and serve as a crucial confirmation tool for other indicators. | Need for confirmation: Trendlines should never be used alone. Their signals require confirmation from volume or other technical indicators. |

9. FAQs (Frequently Asked Questions)

10. Conclusion – Your Checklist for Drawing Success

Mastering how to draw trend lines correctly requires discipline, not talent. Success comes from adhering to objective rules. Use this simple three-step checklist to ensure your lines are always reliable:

- Validate: Connect the wicks (extremes) and require a minimum of three touches for a confirmed line.

- Filter: Use higher timeframes (H4 and Daily) to filter out market noise and focus only on the main, reliable trend.

- Confirm: Never trade solely on a trend line break or reversal. Always wait for confirmation from volume or other indicators.

Final advice for the beginner: Keep it simple, practice often, and only trade the most obvious trendlines. Your objective lines will directly enhance your confidence and improve your trading decisions.