In trading, a single reason is rarely enough to risk capital. Professional traders look for multiple, independent factors that all point to the same conclusion. The powerful technique is known as confluence in trading. This guide will teach you how to build a powerful confluence strategy, moving from simple single-signal trading to a more robust, multi-factor approach for identifying high-probability setups.

Key Takeaways

- Confluence in trading is the alignment of multiple, independent technical or fundamental analysis factors at the same price level.

- An area of confluence significantly increases the probability of a trade setup by confirming a signal from different perspectives.

- Key components include support/resistance, trendlines, chart patterns, indicators, and Fibonacci levels.

- While powerful, the main risk is “analysis paralysis” from using too many conflicting indicators.

1. What does Confluence Mean in Trading?

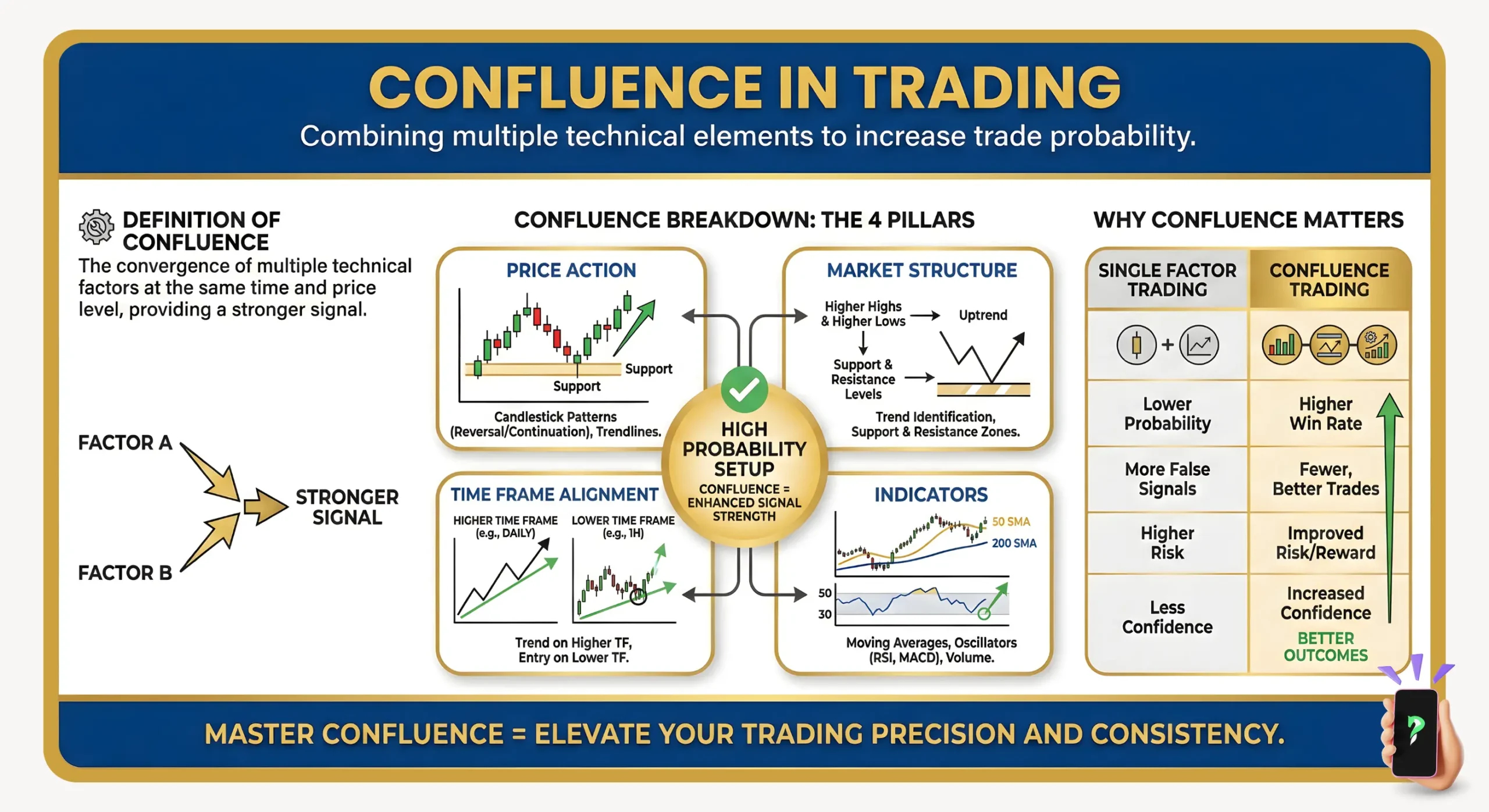

Confluence in trading is the alignment of multiple, independent technical signals that all point to the same conclusion at a specific price level. Instead of relying on a single indicator, a trader trading with confluence looks for a combination of factors, often including signals from various indicators, to build a stronger case for a trade.

For example, an area of confluence might occur where a key horizontal support level intersects with a rising trendline and a 61.8% Fibonacci retracement level.

The primary importance of a confluence strategy is that it increases the probability of a successful trade. Any single indicator can produce a false signal, but the likelihood of three or four independent signals all being false at the same time is significantly lower. Confluence acts as a powerful filter, helping traders to avoid low-quality setups and focus only on the strongest opportunities.

Psychologically, a confluence zone represents an area on the chart where multiple, different groups of traders are all looking to act. For example, trend traders may be buying at a trendline, support traders may be buying at a horizontal level, and Fibonacci traders may be buying at a retracement. When all these different perspectives align, it creates a powerful area of demand, making a reversal more likely.

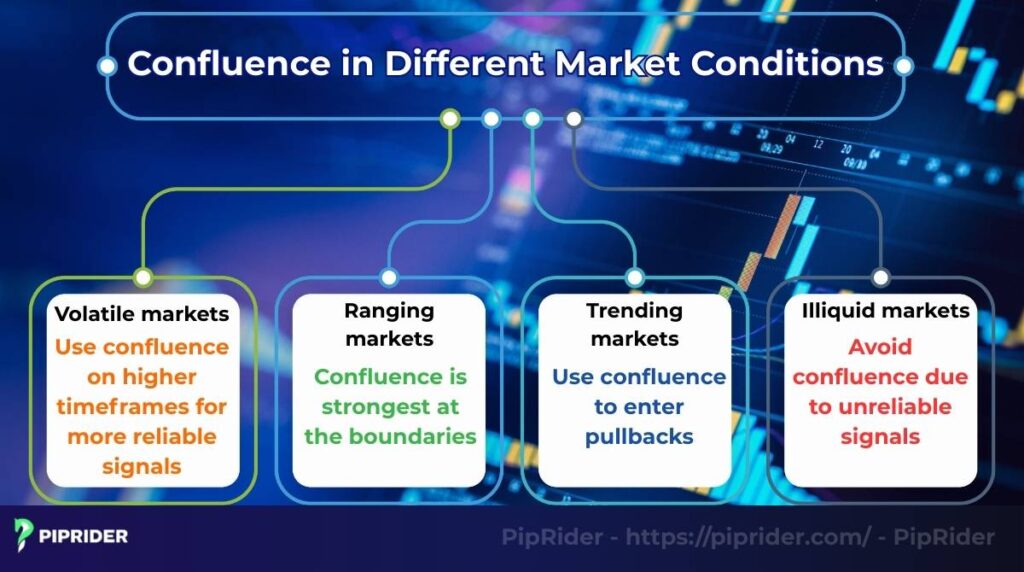

2. Confluence in Different Market Conditions

The factors that create a strong confluence setup can change depending on the current market environment. A successful trader knows how to adapt their technical analysis to different conditions.

- In highly volatile markets, prices can easily overshoot key levels. Therefore, confluence becomes even more critical. Traders should look for wider confluence zones and prioritize signals from higher timeframes, as they are less affected by short-term noise.

- In a range-bound market, the most powerful confluence occurs at the boundaries of the range. A trader looks for a combination of horizontal support/resistance, an overbought/oversold Relative Strength Index (RSI) reading, and a clear reversal candlestick pattern to confirm a trade at the edge of the range.

- In a trending market, confluence is used to find low-risk entry points during pullbacks. The ideal setup is where a Fibonacci retracement level, a key moving averages, and a rising trendline all intersect, providing a high-probability zone to rejoin the trend.

- Traders should be extremely cautious when applying confluence in low-volume or illiquid markets (e.g., during holidays or overnight sessions). Signals can be unreliable, and price movements can move erratically. It is often best to avoid trading confluence setups during these periods.

Read more:

11 Best CFD Trading Strategies For Every Trader 2025

Trading Checklist: 10 Key Steps Before Entering Any Trade

Wyckoff Methodology: Principles, Cycles & Trading Strategies

3. Key Components of Confluence in Trading

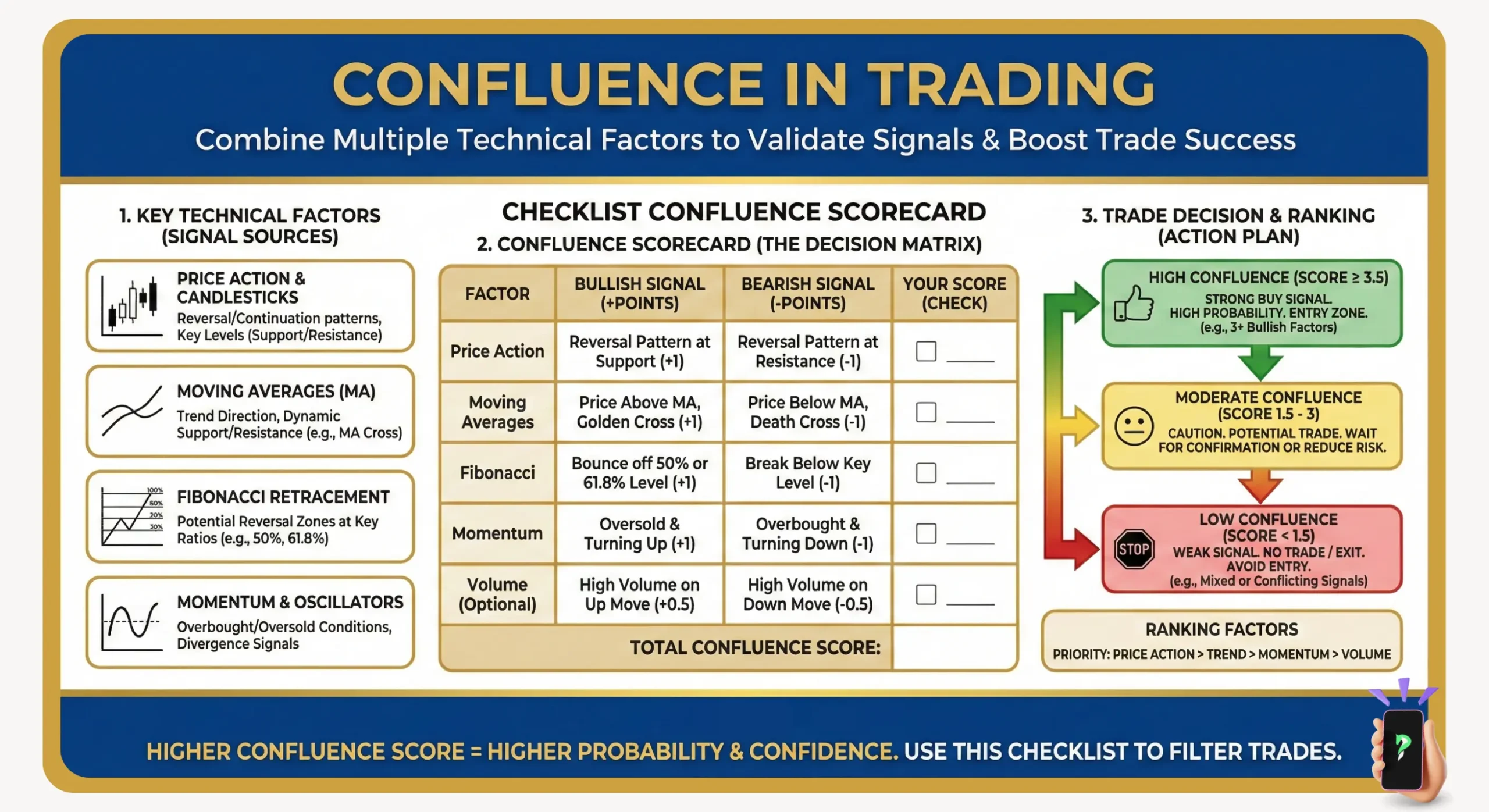

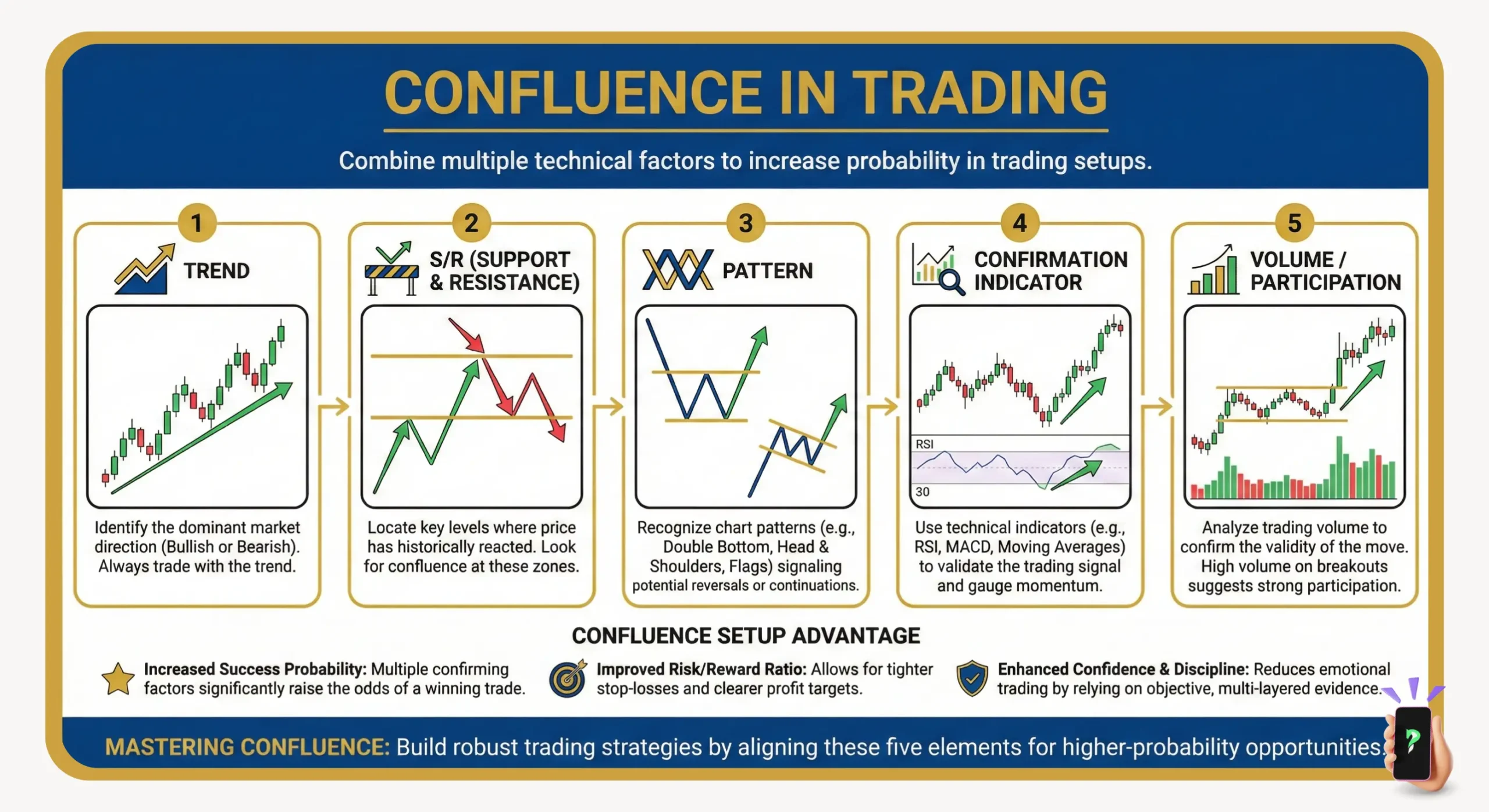

A powerful strategy is built by “stacking” several components, including chart patterns, support/resistance levels, and signals from technical indicators. The more independent factors that align, the higher the probability of the setup.

3.1. Indicator Signals (RSI, MACD, Stochastic, etc.)

Indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) help spot momentum shifts, adding weight to a confluence setup.

For example, when price tests a major support level:

- RSI Confirmation: The RSI might show oversold conditions (below 30) or bullish divergence, suggesting selling pressure is waning.

- MACD Confirmation: Simultaneously, the MACD could signal returning bullish momentum, perhaps via a bullish crossover or a rising histogram.

While one signal alone is weak, seeing both align at key support creates strong confluence. This suggests the downward move may be losing steam, hinting at a potential reversal.

For trend strength confirmation, many experienced traders also incorporate the Directional Movement Indicator (DMI). This tool helps distinguish between a strong trend and a sideways market, adding a critical layer of verification to your confluence checklist.

3.2. Chart and Candlestick Patterns

These trading patterns visually represent the psychology of the market. A bullish engulfing candle or a double bottom pattern forming at a key level provides a clear signal that buying pressure is overwhelming selling pressure, adding a strong reason to consider a long trade.

3.3. Support and Resistance Levels

Key horizontal support levels or resistance levels are often the “anchor” of a confluence setup. These are static, high-probability zones where the price has reacted in the past. Finding other signals that align at these pre-defined levels is the essence of building a confluence trade.

3.4. Trend Analysis and Breakouts

Professional traders often say “the trend is your friend.” A buy setup is significantly stronger if it aligns with an established uptrend. A breakout from a consolidation pattern in the direction of the primary trend is a classic example of confluence, as it combines the pattern’s signal with the market’s overall momentum.

3.5. Higher Timeframe Analysis

A “top-down” analysis involves a trader first identifying a key level or trend on a higher timeframe (like the daily chart). They then zoom in to a lower timeframe (like the 1-hour chart) to look for a specific entry signal at that major level. This ensures the short-term trade is aligned with the bigger picture.

3.6. Correlation Between Multiple Markets

Using intermarket analysis is a more advanced technique. For example, a trader looking to sell the AUD/USD (a commodity-linked currency) might gain confidence if the price of key commodities like copper and iron ore are also showing weakness. This provides an additional layer of confirmation.

3.7. Combining Technical and Fundamental Analysis

Combining technical analysis and fundamental analysis creates some of the most powerful trade setups. For instance, if a central bank announces a surprise interest rate hike (fundamental), and a currency pair subsequently forms a bullish breakout pattern at a key technical level (technical), the confluence of both provides a very strong reason to buy.

3.8. Time of Day and Market Sessions

Signals that form during high-volume market sessions (like the London-New York overlap) are generally more reliable. This is because the price moves are driven by a larger number of participants, making them less prone to the false signals that can occur during quiet, low-liquidity periods.

4. How to Use Confluence in Trading (A Step-by-Step Framework)

Using confluence effectively is not about randomly adding indicators; it’s a systematic process of building a strong, evidence-based case for each trade. This framework guides a trader on how to identify, plan, and execute a high-potential trade.

4.1. Identifying High-Probability Setups

A powerful strategy begins with a primary “anchor” signal. This is usually the most significant and reliable factor on the chart, typically a strong horizontal support or resistance level on a higher time frame. Once the anchor is found, the goal is to “stack” at least two other independent, confirming factors, which might include trendlines, Fibonacci levels, or specific indicators that align at that same price zone.

Ultimately, this layering of independent factors is the backbone of robust Forex trading strategies. By systematically combining candlestick patterns with key levels, you filter out market noise and focus exclusively on high-probability opportunities.

4.2. Defining Entry and Exit Points

The confluence setup provides a clear, logical map for the trade.

- Entry: The entry is typically triggered by the final confirmation signal (e.g., the close of a pin bar).

- Stop-Loss: The stop-loss is placed at a logical invalidation point, just on the other side of the confluence zone.

- Take-Profit: A take-profit target should be set at the next major opposing level of market structure.

- Exit Points: The confluence setup also helps define your clear exit points so you can lock in gains or cut losses efficiently.

4.3. Multi-Timeframe Confluence in Practice

This powerful technique involves starting an analysis on a higher time-frame (e.g., the Daily chart) to identify the major trend and key “anchor” levels. They then zoom into a lower timeframe (e.g., the 4-Hour or 1-Hour chart) to look for specific entry signals.

4.4. Managing Risk with Confluence

Confluence does not eliminate risk, but it does help in managing it with greater precision. Because a confluence zone provides a very clear invalidation point, it often allows for a tighter, more logical stop-loss. This enables precise position sizing so a trader only risks a small, predefined percentage (e.g., 1-2%) of their capital.

This disciplined approach is the cornerstone of effective trading and risk management. By ensuring that every trade is backed by multiple defensive layers, you protect your portfolio from the inevitable volatility of the market.

4.5. Backtesting and Forward Testing

Before risking real capital on any strategy, it is essential to validate it. A trader should backtest their specific combination of signals and indicators on historical data and then forward-test the strategy on a demo account in live market conditions.

4.6. When to Stay Out of a Trade

A key part of a successful strategy is knowing when not to trade. If a trader only finds one or two weak factors aligning, or if a high-impact news event is imminent, it’s often best to stay on the sidelines and wait for a true A+ confluence setup.

4.7. Case Study: Confluence in Forex vs. Crypto Markets

The principles of the confluence model are universal, but the specific “ingredients” that create a high-potential setup can vary by market.

Forex Example: A Reversal on EUR/USD

- The Anchor (Daily Chart): First, we identify a major horizontal support level on the daily chart where the price has reacted strongly in the past.

- Confirmation Signals (4-Hour Chart): As the price retests this major support, we zoom into the 4-hour chart and find a rising trendline and the 61.8% Fibonacci retracement level aligning in the exact same area.

- The Entry Trigger (4-Hour Chart): With a powerful three-factor area of confluence identified, we wait for a final signal. A clear bullish engulfing candle forms, confirming buyer interest. An entry is taken at the close of this candle, with a stop-loss below the zone.

Crypto Example: A Breakout on Bitcoin (BTC/USD)

- The Anchor (Daily Chart): We identify a key horizontal resistance level on the daily chart that has rejected the price multiple times.

- Confirmation Signals (4-Hour Chart): As the price consolidates below this resistance, we see two confirming factors: the price is holding above the 50-period EMA (showing underlying strength), and a bullish ascending triangle chart pattern is forming.

- The Entry Trigger (4-Hour Chart): The entry is triggered on a decisive breakout candle that closes above the horizontal resistance, ideally on a spike in volume. The stop-loss is placed below the recent swing low within the triangle.

5. Benefits of Using Confluence in Trading

Adopting a strategy requires more patience and analysis, but the benefits to a trader’s performance and psychology are significant.

- Increasing the accuracy of signals: By requiring multiple, independent signals to align, confluence acts as a powerful filter. It helps eliminate low-potential setups, allowing traders to focus only on trades that have a higher statistical likelihood of success.

- Reducing false breakouts: A common trading pitfall is the “false breakout.” Confluence helps mitigate this risk, especially in high volatility environments. A breakout that is also confirmed by high volume, a trendline touch, and a momentum indicator signal is far less likely to be a false move.

- Building confidence in trading decisions: Trading is a psychologically demanding activity. When a trader has a strong, multi-faceted case for entering a trade, it builds conviction. This confidence makes it easier to stick to the plan, manage the trade objectively, and accept the outcome, win or lose.

6. Common Mistakes to Avoid

While a confluence strategy is powerful, traders can fall into several traps. Being aware of these common mistakes is key to applying the concept effectively.

- Overloading too many indicators: This is the most common mistake, often called “analysis paralysis.” A trader clutters their chart with too many indicators, leading to conflicting signals and indecision. A good confluence setup uses just a few (e.g., 2-4) strong, independent signals.

- Ignoring market context: A perfect technical analysis confluence setup can still fail if it goes against the broader market context. For example, a bullish confluence signal is much less likely to work if a major, negative news event is scheduled for release in the next few minutes. Always be aware of the bigger picture.

- Confirmation bias in analysis: Confirmation bias is the psychological tendency to only look for information that confirms your existing belief. A trader who wants to buy will actively look for bullish signals and ignore bearish ones. To avoid this, a trader must objectively assess all the evidence on the chart, both for and against their trade idea.

7. Frequently asked questions about confluence in trading

8. Conclusion

In conclusion, confluence in trading elevates a trader’s approach from simple signal-following to a systematic, probability-based process. By demanding multiple, independent reasons to enter a trade, a trader can significantly increase their odds of success and trade with greater confidence.

As with any new strategy, it is essential to test it thoroughly on a demo account before risking real capital. To continue building your trading system, we encourage you to explore more in-depth guides in our Trading Strategies & Forex Indicators category on Piprider.