In the fast-paced world of day trading, profitability is not determined by how much you make on your winning trades, but by how little you lose on your losing ones. Day trading risk management is the art and science of protecting your capital, the single most important skill that separates consistently profitable traders from the 90% who fail.

This guide provides the essential rules, strategies, and tools you need to control losses, manage your emotions, and trade smarter for the long term.

Key Takeaways

- Never risk more than 1% of your total account balance on a single trade to ensure long-term survival.

- A non-negotiable rule to prevent a small, manageable loss from turning into a catastrophic one.

- Protect yourself from emotional “revenge trading” by stopping for the day after a predetermined number of losses.

- The trade size should be determined by the stop-loss distance and risk tolerance, not by potential profit.

- Successful trading is a game of defense. The primary goal is to preserve capital; profits will follow.

1. Why Risk Management Matters in Day Trading

Day trading is a high-stakes environment defined by speed and volatility. While the potential for high rewards is alluring, the risk of rapid, significant losses is equally real. In this arena, risk management isn’t just a good habit; it’s the fundamental skill that ensures survival.

Statistical evidence consistently shows that a vast majority of day traders, often cited as over 80%, fail within their first year. The primary reason isn’t a lack of winning strategies but a failure to control losses. They focus on chasing profits instead of the true goal of a professional trader: capital preservation.

Effective risk management is the non-negotiable line that separates amateurs from professionals. Amateurs seek the thrill of a big win, while professionals adopt a defensive posture. They focus relentlessly on protecting their account equity, as they know that if the downside is managed, the upside will take care of itself.

2. Understanding Trading Risk

Before traders can manage risk, they must understand what it is and where it comes from. In trading, risk isn’t just about losing money; it’s about the various factors that can cause a trade to go wrong.

2.1. What Is Risk in Day Trading?

At its core, risk is the potential for a difference between the expected outcome of a trade and its actual result. For day traders, this market risk is significantly amplified. The use of leverage means even small price changes can result in large losses, while the speed of intraday markets leaves very little room for error (U.S. Securities and Exchange Commission [SEC], 2020).

2.2. Common Types of Risk

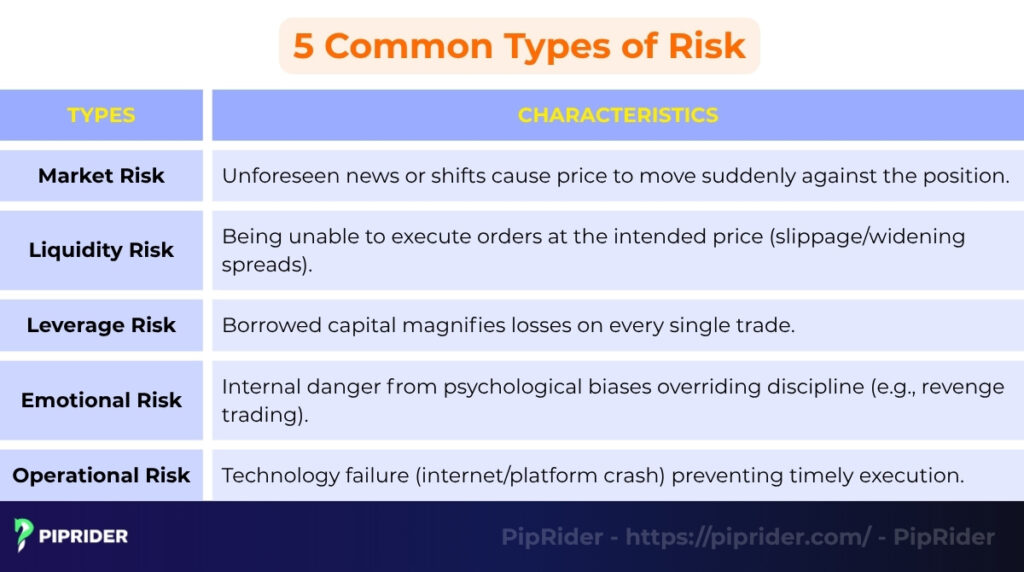

Day traders face several distinct types of risk every time they enter the market, with market risk being the most prevalent:

- Market Risk: The most obvious risk is that the market will suddenly move against a position due to unforeseen news or a shift in sentiment.

- Liquidity Risk: The risk of being unable to enter or exit a trade at the desired price. This often appears as slippage (an order fills at a worse price) or a sudden widening of the spread.

- Leverage Risk: The risk that losses are magnified due to borrowed capital. This amplifies the underlying market risk on every trade.

- Emotional Risk (Trader Risk): The internal risk from a trader’s own psychology. This includes revenge trading after a loss, holding onto a losing trade out of hope, or taking on too much risk due to overconfidence.

- Operational Risk: The risk of technology failure. This can be anything from an internet connection dropping to a trading platform crashing at a critical moment.

3. Core Day Trading Risk Management Rules

Effective day trading risk management isn’t a suggestion; it’s a set of non-negotiable rules. These five core principles are the foundation of any successful day trading plan and are designed to protect capital above all else.

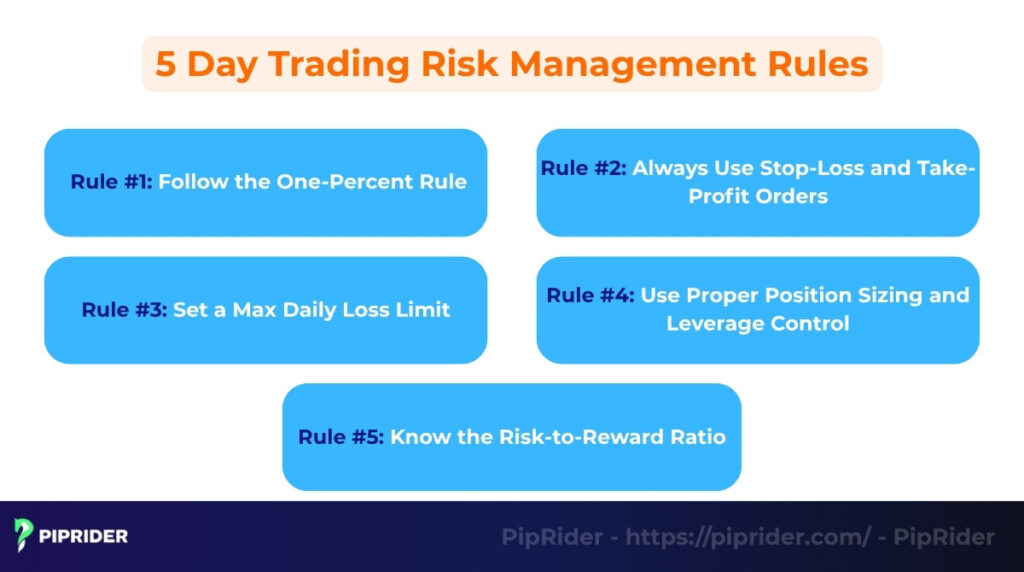

3.1. Rule #1: Follow the One-Percent Rule

This is the golden rule of trading survival. The one-percent rule dictates that a trader should never risk more than 1% (or a maximum of 2%) of their total account balance on a single trade. This risk threshold is critical.

For example, on a $10,000 account, the maximum acceptable loss per trade is $100. This ensures that even a long string of consecutive losses won’t wipe out an account, giving the trader the staying power to trade another day.

3.2. Rule #2: Always Use Stop-Loss and Take-Profit Orders

Every single trade must have a predefined exit plan for both a loss and a win.

- A stop-loss order is a trader’s mandatory safety net. It automatically closes a position at a predetermined price, preventing a small, manageable loss from becoming a catastrophic one.

- A take-profit order locks in gains when a target is reached. This enforces discipline and prevents a winning trade from turning into a loser out of greed.

Depending on market conditions, a fixed stop-loss or a volatility-based stop, such as one determined by the Average True Range (ATR), can be used.

3.3. Rule #3: Set a Max Daily Loss Limit

To protect against emotion-driven decisions, a “circuit breaker” is essential. A maximum daily loss limit is a hard rule that forces a trader to stop for the day once a certain percentage of the account, typically 3% to 5%, has been lost.

This rule is the best defense against emotional revenge trading, the destructive urge to “win back” losses by taking bigger, riskier trades.

3.4. Rule #4: Use Proper Position Sizing and Leverage Control

A position size (how many lots are traded) should never be arbitrary. It must be calculated based on the stop-loss distance and the 1% risk rule. A wider stop-loss requires a smaller position size, and a tighter stop allows for a larger one, but the total dollar amount at risk remains the same.

Furthermore, it’s wise to avoid the temptation of excessive leverage. For most intraday setups, using leverage greater than 10:1 dramatically increases the risk of a margin call from a small price move.

3.5. Rule #5: Know the Risk-to-Reward Ratio

Before entering any trade, a proper risk assessment must ensure the potential reward justifies the risk. The Risk-to-Reward (R:R) ratio compares the potential profit of a trade to its potential loss. A common minimum is 1:2, meaning the aim is to make at least $2 for every $1 risked.

This ensures that a trading system can remain profitable even with a win rate of only 50%. Through backtesting, traders can verify that their system has a positive expectancy with a favorable R:R ratio.

4. How to Manage Risk in Trading Strategies

Risk is not one-size-fits-all; it changes based on a trader’s approach and strategy. Understanding these unique risk profiles is essential for applying the right controls.

4.1. Systematic vs. Discretionary Approaches

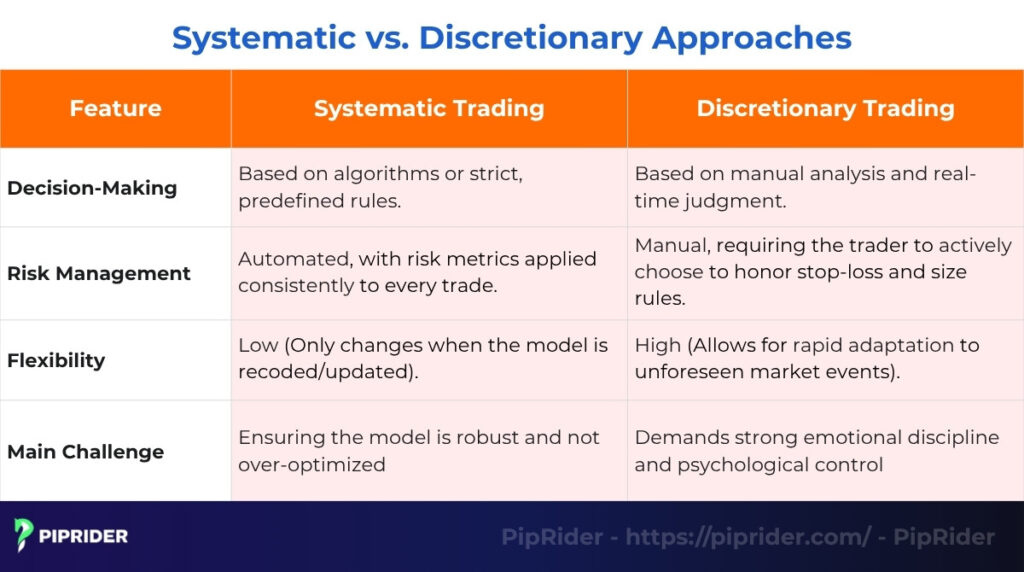

A trader’s overall approach dictates how risk is managed.

- Systematic Trading: This good strategy for risk relies on algorithms or strict, predefined rules. Risk is managed automatically, with consistent risk metrics on every trade. The main challenge here is ensuring the model is robust and not over-optimized.

- Discretionary Trading: In contrast, discretionary trading is defined by manual decision-making based on real-time analysis. This approach demands stronger emotional discipline, as the trader must actively choose to honor their stop-loss and position size rules in the heat of the moment.

4.2. Scalping vs. Momentum vs. Reversal Risk Profiles

Different day trading styles are exposed to different primary risks.

- Scalpers aim for very small profits on many trades, so their biggest risks are execution-related. Slippage and spread costs can easily turn a winning trade into a losing one.

- Momentum traders chase assets that are already moving strongly. Their main market risk is being caught in a sudden, sharp reversal, often triggered by unexpected news or volatility spikes.

- Reversal traders try to enter a trade as the trend is changing. Their primary risk is entering too early and “catching a falling knife”, trying to buy an asset that continues to plummet.

5. Technical Tools for Day Trading Risk Management for Traders

Beyond setting rules, traders can use specific technical tools to measure risk in real time and make more informed decisions. These trading risk management tools help quantify volatility and provide objective data for setting stops and managing positions.

5.1. Using Technical Indicators for Risk Control

Several standard technical analysis indicators are excellent for day trading risk management.

- Average True Range (ATR): The ATR indicator measures market volatility. Instead of using a fixed pip stop-loss, a trader can set a dynamic stop loss based on a multiple of the ATR (e.g., 2x ATR). This ensures the stop is wider in volatile markets and tighter in quiet ones.

- Bollinger Bands: These bands widen during high volatility and contract during low volatility. A period of extreme contraction, known as a “squeeze,” often signals that a high-risk, explosive move is imminent.

- Moving Average (MA): A simple long-term moving average (e.g., the 200 EMA) acts as a powerful trend filter. A trader might only take long trades when the price is above the MA, which helps prevent fighting the dominant market trend.

5.2. Diversify and Hedge Positions

While day traders focus on short-term moves, managing exposure across assets is still a crucial risk principle.

Diversification means avoiding an “all-in” approach on a single asset or highly correlated pairs (like EUR/USD and GBP/USD). Spreading risk across different, uncorrelated assets can cushion the impact of a sudden adverse move in one market.

Hedging is a more advanced technique to protect against downside risk. While less common for retail day traders, this can involve using instruments like options to offset potential losses in a primary position.

6. The Psychological Side of Risk Management

Even the best risk management rules are useless if a trader lacks the discipline to follow them. The psychological aspect of risk management is often the hardest part to master. It requires effective emotional management to control powerful emotions like fear, greed, and the urge for revenge trading. This is a form of trader risk.

The first step is a crucial mindset shift: traders must accept losses as a normal cost of doing business, not as a personal failure. A losing trade that follows the rules is a good trade. This mental reframing helps detach ego from the outcome, allowing for objective decision-making.

A trading journal is an essential tool for this process. It’s not just for logging entry and exit points; it’s for documenting emotional state. This form of performance analysis helps a trader identify destructive patterns, such as breaking rules after a loss.

Finally, implementing hard “cool-off” rules is non-negotiable. For example, a rule might be to stop trading for the day after three consecutive losses or after hitting the max daily loss limit. This forces a break, preventing a bad day from turning into a disastrous one.

7. Real-World Example – Applying Risk Management to a Trade

Let’s translate these rules into a practical trade. This example shows how a disciplined trader calculates and controls risk before ever placing an order.

The Scenario:

- Account Balance: $10,000

- Maximum Risk per Trade: 1%

- Trade Setup: A long entry on EUR/USD with a pre-defined stop loss of 20 pips.

Step 1: Calculate Risk in Dollars

The first step is to determine the maximum acceptable loss for this single trade.

$10,000 (Account Balance) * 1% (Risk) = $100

The trader knows they cannot lose more than $100 on this trade.

Step 2: Calculate Position Size

Next, the trader determines the correct position size (lot size) that keeps the loss at $100 if the 20-pip stop is hit. Assuming a standard pip value for EUR/USD ($10 per pip for 1 standard lot):

- Risk per standard lot:

20 pips * $10/pip = $200

- Position Size Calculation:

Max Risk ($) / Risk per Lot ($) = $100 / $200 = 0.5

The correct position size is 0.5 standard lots.

Step 3: Define Outcomes

With the trade parameters set, the outcomes are clear:

- If the Stop-Loss is Hit: The trader loses $100. The account balance becomes $9,900. The loss is controlled and survivable.

- If a 1:2 Risk/Reward Target is Hit (40 pips): The trader profits $200. The account balance grows to $10,200.

Disciplined Trader vs. Reckless Trader

A disciplined trader follows these steps precisely. They accept the $100 loss as a business expense and move on. A reckless trader, driven by trader risk and emotion, might ignore the rules and buy 1 or 2 standard lots, risking $200-$400 on the same trade. A single loss for the reckless trader is 2-4 times more damaging.

8. Advanced Risk Reduction Techniques

Beyond the core rules of risk management, experienced traders employ sophisticated techniques to fine-tune their risk exposure and protect profits. These methods add a layer of dynamic control to a plan.

8.1. Scaling In and Out

This technique involves managing a position’s size after it has been opened.

Scaling in means adding to a winning position. A trader might enter with a smaller initial size and only add to the trade after the price has moved in their favor and shown signs of trend continuation.

Scaling out involves taking partial profits at predetermined targets. This approach secures some profit while letting the remainder of the position run.

8.2. Correlation Awareness

Correlation is the tendency for different assets to move in the same or opposite direction. Being aware of this is crucial for managing overall portfolio risk.

A common mistake is taking multiple trades on highly correlated pairs, such as long positions on both EUR/USD and GBP/USD. This effectively doubles the exposure to a single factor, like US dollar strength.

8.3. Downside Protection with Options

For traders in markets where options are available, they can serve as a powerful hedging tool. For instance, a trader can buy put options on a major index before a high-volatility event to hedge against market risk, providing a form of insurance against a sharp downturn.

9. Frequently asked questions about Day Trading Risk Management

10. The Bottom Line

Success in day trading is not defined by a secret strategy but by the disciplined execution of a robust day trading risk management plan. It is the result of combining strong risk rules with unwavering emotional control.

The primary goal of every day trader should be to survive first and profit later. By combining disciplined position sizing, non-negotiable stop-losses, and a strict respect for daily loss limits, a trader can protect their capital from the volatility of the market. Remember, great traders are not those who trade more but those who manage their risk better.

To see how these risk principles are applied in practice, explore our other articles in the Trading Strategies section at Piprider to discover more in-depth guides.