The Stochastic Oscillator, a classic momentum indicator developed by Dr. George C. Lane in the 1950s, is essential for identifying potential trend reversals. Unlike trend-following tools, the Stochastic excels at measuring the speed and magnitude of price within a recent range.

This function allows traders to pinpoint overbought and oversold extremes, making it the ideal tool for finding high-probability entry signals in choppy, range-bound markets. Piprider will detail the definition and the most profitable Stochastic Oscillator strategies that leverage its unique strength.

Key Takeaways

- The Stochastic Oscillator is a momentum tool ideal for identifying overbought/oversold signals in ranging markets.

- As a faster and more sensitive indicator than the RSI, it provides earlier signals but is prone to noise in strong trend.

- Key signals are generated by a crossover of its %K and %D lines within the overbought (>80) or oversold (<20) zones.

- The standard 14, 3, 3 setting offers a reliable and balanced starting point for most traders and timeframes.

- The indicator should be used as a confirmation tool, as its signals must always be validated by price movement at key levels.

1. What Is The Stochastic Oscillator?

Stochastic Oscillator is a momentum indicator, which compares a security’s closing price to its recent high-low range to identify overbought or oversold trading conditions. The Stochastic was developed by stock trader Dr. George C. Lane in the late 1950s. It doesn’t follow price or volume, but rather the speed or momentum of price.

The fundamental principle, in Dr. Lane’s own words, is that “momentum changes direction before price.” During a strong uptrend, closing prices cluster near the top of the range. The Stochastic Oscillator is specifically designed to detect the subtle shift in momentum as closing prices start to fall away from the high, even if the asset’s price is still rising (Lane, 1984; Investopedia, 2025).

The Stochastic isn’t designed to follow long, powerful trends like the MACD. Instead, it excels at one specific job: measuring the momentum of price within a recent range to identify those “bouncing ball” moments where a reversal is likely. Stochastic Oscillator’s core purpose is to identify potential reversals by determining where the current closing price is in relation to its recent high-low range. This indicator is plotted as two lines, known as %K and %D, that move between 0 and 100.

2. How To Calculate the Stochastic Oscillator?

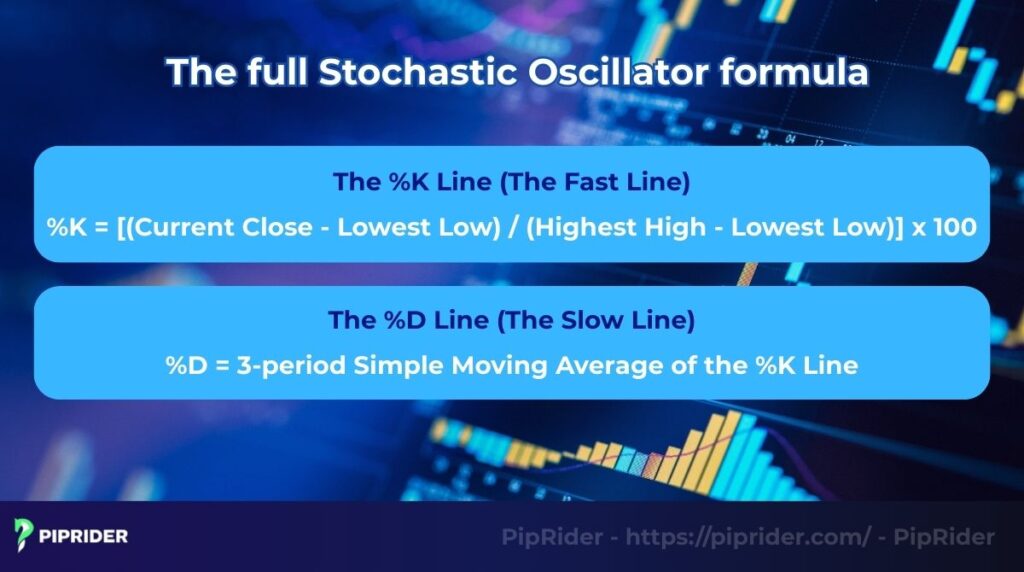

The Stochastic Oscillator’s calculation is designed to answer one simple question: “Where is the current price relative to its recent high-low range?” To do this, the indicator’s formula generates two primary lines: the %K line and the %D line. Let’s break down how each one is calculated.

2.1. The Full Stochastic Oscillator Formula

The indicator consists of two lines, and their formulas are as follows:

| %K Line (The Fast Line) %K = [(Current Close – Lowest Low) / (Highest High – Lowest Low)] x 100 |

| %D Line (The Slow Line) %D = 3-period Simple Moving Average of the %K Line |

Let’s explain what these lines represent in simple terms.

- The %K Line: The choice depends on what the market is doing. If it’s in a powerful, unambiguous trend, we use the MACD to confirm its strength. However, if conditions are choppy and moving sideways in a range, we switch off the MACD and use the Stochastic to find potential turning points.

- The %D Line: Because the %K line can be erratic, the %D line is created by taking a 3-period simple moving average of it. Its only job is to be a smoother, slower version of %K. This smoothing helps filter out market noise. The most powerful trading signals are generated when these two lines interact, specifically when the fast %K line crosses over the slow %D line.

2.2. A Simple, Practical Example

Let’s imagine the following data for a stock over the last 14 days:

- Highest High = $150

- Lowest Low = $100

- Today’s Closing Price = $145

First, calculate the %K value:

| %K = [($145 – $100) / ($150 – $100)] x 100 = [$45 / $50] x 100 = 90 |

A %K value of 90 indicates the price closed at 90% of its total 14-day range, which is very high and signals strong buying pressure. Now, to get the %D value, the indicator would need the %K values from the two previous days. Let’s say they were 85 and 88. The %D would be:

| %D = (90 + 88 + 85) / 3 = 87.67 |

3. Understanding The Stochastic Oscillator

Now that the lines are built, let’s focus on the most important part: how to read the signals they produce. There are three primary types of signals to master: overbought/oversold levels, crossovers, and divergences.

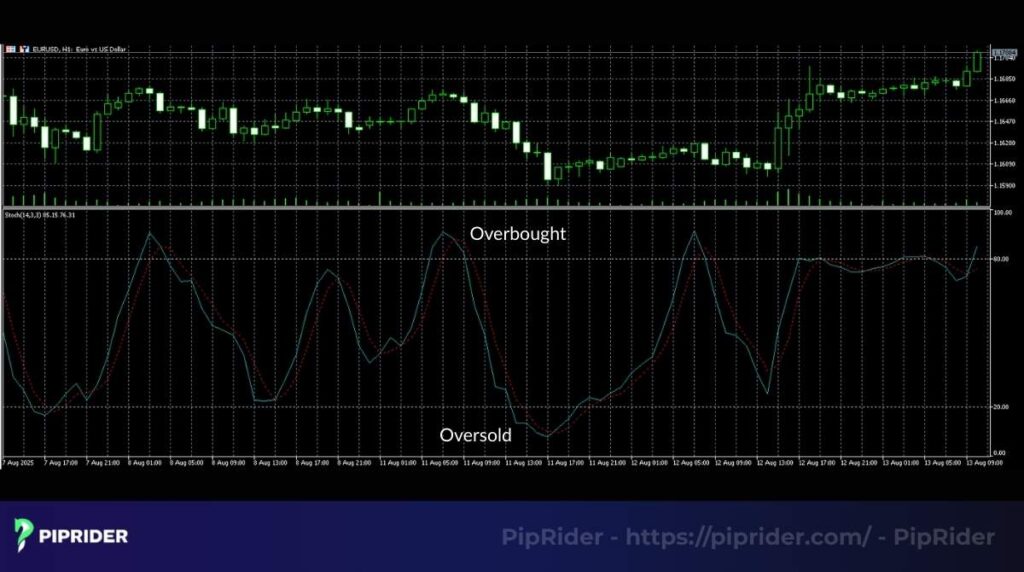

3.1. Overbought And Oversold Zones

Overbought and oversold zones is the most basic function of the Stochastic. The indicator uses two key thresholds to define market extremes:

- Overbought (above 80): When both the %K and %D lines move above the 80 level, it signals that the market is potentially overbought. This means the price has closed near the top of its range for an extended period, and the bullish momentum might be getting exhausted.

- Oversold (below 20): When both lines drop below the 20 level, the market is considered oversold. This suggests the price has been closing near the bottom of its range, and the selling pressure may be running out of steam. A crucial point to remember is that a trader should not sell just because the indicator is overbought.

During a powerful market move, it can stay in the overbought area for a considerable amount of time. A more reliable signal often occurs when the lines move back out of these extreme zones.

3.2. Signal Crossovers (%K Crossing %D)

Within most strategies involving the Stochastic Oscillator, the crossover is the most frequently used signal for entering a trade. It simply indicates a potential shift in short-term momentum where the faster %K line intersects the slower %D line.

A bullish crossover is generated when the faster %K line moves from below to above the slower %D line. This signal is considered most reliable in the oversold zone (below 20), and it’s a classic “buy the dip” signal.

A bearish crossover appears when the faster %K line moves from above to below its slower counterpart. This particular signal is strongest when it happens in the overbought zone (above 80), suggesting the rally is over and it’s time to sell.

3.3. Regular Vs. Hidden Signals

This type of analysis is a more sophisticated method for interpreting the Stochastic. The technique offers valuable market intelligence by identifying a mismatch between the trajectory of the price and the movement of the indicator.

Regular signals: A potential Trend Reversal

- Bullish divergence: The price makes a new low while the indicator carves out a higher one, providing a strong indication that selling forces are waning and the downtrend could be approaching its conclusion.

- Bearish divergence: The price forges a new higher high while the Stochastic prints a lower one. Such a pattern acts as a heads-up that buying interest is decreasing and the current uptrend may be coming to an end.

Hidden signals: A potential Trend Continuation

- Bullish divergence: The price creates a higher low (typical of a healthy pullback) while the Stochastic records a fresh, lower reading, creating a fantastic “buy the dip” signal. This pattern suggests that though the indicator hit an extreme low, the price held strong, and the primary uptrend is likely to resume.

- Bearish divergence: During a rally within a downtrend, the price forms a lower high while the Stochastic registers a new, higher one, signaling a great opportunity to sell the counter-move and rejoin the overall trend.

4. Stochastic Oscillator Best Settings

The ability to customize its parameters is one of the Stochastic’s most powerful qualities. While the default Stochastic Oscillator settings are an excellent starting point, a trader can adjust its parameters to match a specific trading style and the volatility of the asset being traded.

4.1. Understanding The Parameters: What Does 14, 3, 3 Mean?

The standard Stochastic Oscillator 14, 3, 3 setting is the default on almost every platform. Here’s what each number represents:

- The first number (14) represents the look-back period for the %K line.

- The second number (3) is the period used for the simple moving average that creates the slower %D line.

- The third number (3) is the slowing period. This applies an extra layer of smoothing, which is why “Slow Stochastic” is often the default. A setting of 1 here would create the fast stochastic.

4.2. A Comparison Of Common Settings

The settings can be grouped into three main categories based on desired responsiveness.

| Setting | Type | Speed | Best for |

| 5, 3, 3 | Short-term / Fast | Very Fast | Capturing very quick momentum shifts for scalping or aggressive day trading. |

| 14, 3, 3 | Default / Standard | Balanced | The classic setting for swing trading and most day trading strategies. |

| 21, 5, 5 | Long-term / Slow | Very Slow | Filtering out short-term noise to identify major, weekly turning points for position trading. |

4.3. Recommended Settings By Style And Asset Class

Here are some general recommendations for where to start testing.

- Scalping (M1, M5): Start with 5, 3, 3. This setup requires the indicator to be as responsive as possible, but it must be combined with strong price action skills to filter the noise.

- Day and Swing Trading (M15, H1, H4): The default 14, 3, 3 is the industry standard for a reason. For these particular styles, it offers the most dependable signals.

- Position Trading (Daily, Weekly): Use a slower setting like 21, 5, 5 to focus only on the most significant, long-term market cycles.

When it comes to different assets:

- For forex trading, the standard 14, 3, 3 setting performs very effectively on both major and minor pairs across different trading sessions.

- Stocks: A slightly slower setting, like 21, 5, 5, can be more reliable for individual stocks, which can sometimes be more volatile than forex pairs.

- Crypto: Due to the extreme volatility of cryptocurrencies, a faster setting like 5, 3, 3 or 8, 3, 3 might be necessary to capture the rapid price movements, but this requires a very aggressive trading style. The fast stochastic is often preferred here.

5. Backtesting The Stochastic Oscillator

A strategy is nothing more than a hypothesis until it is tested against historical price history. From our experience, the process of backtesting is what transforms a trader from someone who thinks they have a good idea into someone who knows they have a statistical edge. Let’s walk through a basic backtest of a simple Stochastic strategy to see how it’s done.

5.1. The Backtesting Setup: Timeframe And Data

To run a meaningful test, the parameters must be clearly defined.

- The asset: Use EUR/USD, as it’s a highly liquid pair with predictable behavior.

- The timeframe: Use the 4-hour (H4) chart. This is a popular timeframe for swing trading that filters out a lot of the daily noise.

- The data period: The strategy will be tested on a full year of historical data, from January 1, 2023, to December 31, 2023 to cover different market conditions. This allows us to observe how the moving average performs across various cycles.

5.2. Analyzing The Results

After running the simulation over the entire year of data, the platform would generate a performance report. This is where traders look at the raw, unbiased numbers.

A hypothetical result:

- Net profit: +8.5%

- Total trades: 58

- Percent profitable: 45%

- Profit factor: 1.35

- Max drawdown: -5.2%

Interpretation: At first glance, a win rate of 45% might seem poor. However, this is typical of many successful mean-reversion systems. With a risk-to-reward ratio of 1:1.5, the winning trades are larger than the losing ones, resulting in a positive “expectancy” per trade.

As detailed in Dr. Van K. Tharp’s classic book, Trade Your Way to Financial Freedom, a positive expectancy is the statistical foundation of any profitable trading system (Tharp, 1999). The acceptable max drawdown of 5.2% further reinforces that this simple strategy had a positive historical edge.

5.3. Adjusting Parameters And Re-Testing

The final step is optimization. What happens if the settings are changed? The same test could be re-run with a faster Stochastic Oscillator(e.g., 8, 3, 3) or a slower one (e.g., 21, 5, 5). The goal is to see if the results can be improved, perhaps by increasing the profit factor or reducing the drawdown. This cycle of testing, analyzing, and refining is fundamental to building a solid trading strategy.

6. Effective Trading Strategies Using The Stochastic Oscillator

An indicator’s signals are only useful when they are part of a complete strategy. A strategy provides a disciplined framework that tells a trader not just when to enter, but also how to manage the trade. Let’s explore several powerful ways to build a Stochastic Oscillator strategy.

6.1. Trend-Following: Trading Pullbacks In A Strong Trend

Counterintuitively, the Stochastic’s greatest strength can be found within a strong trend. Its responsiveness becomes a powerful asset for timing precise “buy the dip” entries during temporary pullbacks.

Using a long-term moving average (like the 100 EMA) to define the primary trend. Then wait for the price to make a temporary pullback, which will send the sensitive Stochastic into the oversold zone, giving a high-probability entry to rejoin the main trend.

- Case Study: A textbook example occurred on the USD/JPY H1 chart during the strong uptrend of mid-May 2024. The price was holding consistently above the 100-period EMA. Around May 21st, 2024, the price made a significant pullback, causing the Stochastic (14,3,3) to drop below the 20 level. The subsequent bullish crossover provided a high-confidence entry around the 156.40 price level to rejoin the primary bullish trend.

6.2. Range-Trading: The Classic Overbought/Oversold Bounce

The classic, textbook application for the Stochastic Oscillator is in a ranging market, which is where the indicator truly shines.

In a sideways market, the 80 level represents a “too expensive” price, while the 20 level indicates a “too cheap” one. The Stochastic is used to confirm that a price has reached an extreme and is likely to bounce back toward the middle of the range.

The Rules for a Sell Trade:

- Identify the range: Confirm that the price is in a clear, horizontal channel.

- Wait for the test: Watch as the market approaches the resistance level at the top of the range.

- Get the signal: Wait for the Stochastic to move above 80 and then give a bearish crossover (%K crossing below %D).

- Entry: Enter a short position after the signal is confirmed, with a stop loss just above the resistance level.

6.3. The Disagreement Strategy

The Disagreement Strategy can help spot the end of a trend before it’s obvious on the price chart.

Looking for a clear disagreement between price and momentum. When the price makes a new high but the Stochastic Oscillator fails to do so, it’s a major warning sign that the trend is running out of power.

The Rules:

- Spot the disagreement: The price makes a higher high, but the indicator shows a lower one.

- Confirm the signal: Wait for a bearish crossover of the Stochastic lines while they are still in the overbought zone (>80).

- Entry: Enter a sell trade, with a stop loss placed just above the highest price peak.

6.4. Combining Stochastic Breakouts With Volume

Combining the Stochastic Oscillator with volume is a powerful technique for confirming a strong momentum shift. A “Stochastic Breakout” often refers to a decisive cross of the 50 centerline, which represents the midpoint between bullish and bearish momentum.

A true, powerful shift in momentum should be backed by strong participation from other traders. A volume indicator is used to confirm this participation. A Stochastic crossing the 50 line on low volume is suspect; a crossover on high volume is a sign of conviction.

- The Rules for a Buy Signal:

- Identify the signal: Watch for the Stochastic lines to cross decisively from below 50 to above 50. This indicates a shift from bearish to bullish momentum control.

- Confirm with volume: On the same candle as the crossover, a spike in volume should be visible that is noticeably higher than the recent average volume.

- Entry: This provides a strong entry signal, especially if it happens as the price is breaking out of a consolidation range.

6.5. Multi-Timeframe Confirmation

Multi-timeframe confirmation is a professional technique that may help increase the win rate of a strategy. Professional traders never trade a signal from one timeframe in isolation.

- Higher Timeframe (e.g., H4): Identify key trading levels (major support and resistance) and the overall market condition (trending or ranging).

- Lower Timeframe (e.g., M15): Look for the actual entry signal from the Stochastic.

Example: For instance, if a major resistance level is identified on the H4 chart, the next step is to drill down to the M15 chart. A trader would then wait for the Stochastic to give a bearish, overbought crossover signal. This confluence of a significant level on the higher timeframe with a momentum indicator on the lower one creates a very high-probability setup.

7. Advantages And Disadvantages Of The Stochastic Oscillator

No indicator is a magic bullet, and the Stochastic is a good example of a tool that is brilliant for one job and terrible for another. Understanding its specific strengths and weaknesses is absolutely critical for using it profitably.

7.1. The Advantages

When used in the right market condition, the Stochastic offers some clear and powerful benefits.

- Superior performance in ranging markets: This is its superpower. The indicator is one of the most effective tools for identifying potential turning points at the top and bottom of a sideways market.

- Early signal generation: Its high sensitivity allows it to provide a heads-up about potential momentum shifts much earlier than slower indicators like the MACD, which is invaluable for precise entry timing.

- Clear and objective crossover signals: The signal line between the %K and %D lines provides a simple, rule-based signal that removes guesswork from trade entries, especially in overbought or oversold zones.

7.2. The Disadvantages

Now for the reality check. Most traders who fail with the Stochastic Oscillator do so because they are not aware of its significant weaknesses.

- Unreliability in strong trends: This is its biggest weakness. In a powerful trend, the indicator can stay in the overbought or oversold zone for a long time, giving a stream of premature and costly counter-trend signals.

- Proneness to false signals: Its high responsiveness means the indicator often produces many crossovers that are just random market “noise.” For this reason, its signals must always be filtered with other forms of analysis.

- Tendency to encourage over-trading: The sheer number of signals the Stochastic produces can be a trap for new traders, creating a false sense of urgency and leading to low-quality trades.

8. Frequently Asked Questions (FAQs)

Here are some quick, no-nonsense answers to the questions traders ask most frequently about the Stochastic Oscillator.

9. Conclusion

The Stochastic Oscillator has earned its reputation by mastering the art of the reversal. Unlike trend-following tools, this indicator is a finely tuned instrument for measuring momentum, identifying when price movement is running out of steam.

Its true power is unlocked by embracing its niche: finding high-probability turning points in ranging markets and pinpointing precise “buy the dip” opportunities.This guide has provided the blueprint. The final step is to add this classic indicator to your charts and test the Stochastic Oscillator strategies we’ve discussed.

To continue this journey, explore more advanced guides in our best technical indicators category right here on Piprider.