Identifying the very beginning of a new trend is a key goal for any trader. The Vortex Indicator (VI) is a technical analysis tool specifically designed for trend identification, pinpointing the start of a new trend and confirming its direction. Drawing inspiration from the natural swirling vortex motion, the indicator captures the market’s underlying positive and negative trend movements. This guide explains its formula, interpretation, and how to use it for effective trend trading.

Key Takeaways

- The Vortex Indicator tracks trend direction with two lines: +VI (bullish) and -VI (bearish).

- Crossovers between the +VI and -VI lines signal the start of a new trend.

- It is prone to false signals (whipsaws) in sideways or choppy markets.

- Works best when combined with other indicators like the ADX or RSI for confirmation.

1. What Is the Vortex Indicator (VI)?

The Vortex Indicator (VI) is a technical analysis tool designed to identify the start of a new trend and confirm its direction. Developed by Etienne Botes and Douglas Siepman and introduced in 2010, its primary function is to help traders catch trends right as they begin to form (Investopedia, 2024). Drawing inspiration from the natural swirling motion of a vortex, the indicator captures the market’s underlying positive and negative trend movements.

It achieves this by plotting two oscillating lines that represent the ongoing battle between buyers and sellers:

- The Positive Vortex (+VI) measures the strength of upward price movement from one period’s low to the next’s high, representing the force of the bulls.

- The Negative Vortex (-VI) measures the strength of downward price movement from one period’s high to the next’s low, representing the force of the bears.

2. How the Vortex Indicator Works

The Vortex Indicator operates on a simple premise: it measures the distance between the highs and lows of consecutive periods to gauge trend direction. The +VI line specifically tracks upward price movement, representing bullish momentum, while the -VI line tracks downward price movement, representing bearish momentum.

The core trading signals are generated when these two lines intersect:

- A bullish signal occurs when the +VI line crosses above the -VI line. This indicates that the upward trend movement is overpowering the downward movement, signaling the potential start of a new uptrend.

- A bearish signal occurs when the -VI line crosses above the +VI line. This suggests that bearish momentum is taking control, pointing to the beginning of a new downtrend.

The Vortex Indicator’s components are calculated similarly to those of the Directional Movement Index (DMI), but they serve different functions. The VI is designed to signal a change in trend direction, while the DMI’s ADX line measures trend strength.

3. The Vortex Indicator Formula

The Vortex Indicator’s calculation involves a few key steps that measure upward and downward price movements and then normalize them against the asset’s recent volatility.

3.1. Step-by-Step Calculation

The indicator is built from the ground up using these five components:

1. True Range (TR): First, the indicator calculates the True Range to measure volatility. The TR is the greatest of the following:

- Current High minus Current Low

- The absolute value of the Current High minus the Previous Close

- The absolute value of the Current Low minus the Previous Close

2. Positive Vortex Movement (VM+): Next, it measures the distance between the current high and the previous low to capture upward movement.

VM+ = |Current High – Previous Low|

3. Negative Vortex Movement (VM-): It then measures the distance between the current low and the previous high to capture downward movement.

VM- = |Current Low – Previous High|

4. The +VI and -VI Lines: Finally, the indicator sums the VM+ and VM- values over a specific period (typically 14) and divides them by the sum of the True Range over the same period. This normalizes the trend movement against volatility.

+VI = Sum of VM+ over ‘n’ periods / Sum of TR over ‘n’ periods

-VI = Sum of VM- over ‘n’ periods / Sum of TR over ‘n’ periods

The default parameter length for ‘n’ is 14 periods, but traders can adjust this to fit their specific trading style: a shorter period for more sensitivity or a longer one for less noise.

Read more:

How to use Forex level indicators to enter like a pro (2025)

Confused by charts? A beginner’s arrow trend indicators guide

4. How to Interpret the Vortex Indicator

Interpreting the VI is a visual process focused on the interaction between the +VI and -VI lines. Traders primarily look for three things: crossovers, trend strength, and potential divergences.

4.1. Bullish and Bearish Crossovers

The most direct trading signals from the VI are generated by crossovers, which indicate a potential shift in trend direction.

- A bullish crossover occurs when the +VI line crosses above the -VI line. This is a signal that a new uptrend may be forming.

- A bearish crossover occurs when the -VI line crosses above the +VI line. This signals that a new downtrend may be starting.

4.2. Strength Confirmation

The distance between the two lines provides a quick visual gauge of the trend’s strength.

- When the gap between the +VI and -VI lines widens after a crossover, it confirms that the new trend is gaining strength.

- If the two lines are intertwined and cross back and forth frequently, it indicates a weak, choppy, or sideways market, and crossover signals should be ignored.

4.3. Divergence and Early Warning Signals

While less common, divergences can provide early warnings that a trend is losing steam and may be due for a reversal.

- If the price is making higher highs, but the +VI line is failing to make higher highs, it suggests that the uptrend is losing its underlying strength.

- If the price is making lower lows, but the -VI line is not making higher highs, it indicates that the downward momentum is fading and a bullish reversal could occur.

5. Using the Vortex Indicator in Trading

The Vortex Indicator is a powerful tool, but it’s not a complete trading system on its own. To maximize its effectiveness and filter out false signals, especially in choppy markets, it should always be used as part of a broader technical analysis process.

A common best practice is to combine the VI with other technical indicators. For example, a trader might use a long-term Moving Average to define the primary trend direction and only take VI crossover signals that align with that trend. Oscillators like the RSI or MACD can also be used to confirm that momentum is shifting in the direction of the crossover.

Furthermore, the strongest signals often occur when they are confirmed by other market context. A bullish VI crossover is far more reliable when it’s confirmed by other market context. For instance, a signal that happens right at a key support level or is accompanied by a surge in trading volume carries much more weight than one appearing in isolation.

6. Vortex Indicator Trading Strategies

The Vortex Indicator’s signals can be effectively integrated into structured trading strategies. By combining its crossover signals with other filters, traders can create a more robust system for entering and managing trades.

6.1. Basic Crossover Strategy

This basic crossover trading strategy combines the VI’s trend-direction signal with a short-term moving average (MA) to act as a trend filter. The goal is to only take crossover signals that align with the current price momentum.

- Buy Signal: The +VI line crosses above the -VI line AND the price closes above the 20-period MA.

- Sell Signal: The -VI line crosses above the +VI line AND the price closes below the 20-period MA.

6.2. Vortex + ADX Filter

The VI’s biggest weakness is false signals in sideways markets. This strategy adds the Average Directional Index (ADX) to filter for trend strength, ensuring you only trade when the market has clear momentum.

The rule is simple: only consider a VI crossover signal if the ADX is above a predetermined level, typically 20 or 25. If the ADX is below this threshold, all crossover signals are ignored, effectively filtering out noise during a ranging market.

6.3. Scalping or Swing Setup

For short-term trading on timeframes like the 1-hour (H1) or 4-hour (H4), the VI can be paired with an oscillator like the Relative Strength Index (RSI) to catch reversals from overbought or oversold conditions.

- Buy Signal: The +VI line crosses above the -VI line while the RSI is rising from below the 30 level (oversold).

- Sell Signal: The -VI line crosses above the +VI line while the RSI is falling from above the 70 level (overbought).

7. Vortex Indicator vs. Directional Movement Index (DMI)

At first glance, the Vortex Indicator (VI) and the Directional Movement Index (DMI) appear similar, as both use positive and negative lines to analyze trends. However, they are designed to answer different questions: the VI focuses on identifying the start of a new trend, while the DMI focuses on measuring the strength of the current trend.

Here is a direct comparison of their key differences:

| Aspect | VI | DMI |

| Components | Two lines: +VI and -VI. | Three lines: +DI, -DI, and ADX. |

| Main Goal | To detect the beginning of a new trend. | To measure the strength of the current trend. |

| Signal Logic | A simple crossover between the +VI and -VI lines. | A crossover between +DI and -DI, filtered by the ADX line. |

| Typical Use | Trend-following and breakout strategies. | Trend strength confirmation and filtering sideways markets. |

In short, a trader uses the Vortex Indicator to answer the question, “Is a new trend starting now?” In contrast, a trader uses the DMI to answer, “Is the current trend strong enough to trade?” Many advanced strategies use the VI to find a potential entry and the DMI’s ADX line to confirm it.

8. Example of the Vortex Indicator in Action

Theory is one thing, but seeing the Vortex Indicator on a real chart is the best way to understand its signals. Let’s look at a EUR/USD daily chart to see how the VI identifies trade opportunities.

In the chart above, we can see two distinct signals:

- The Bullish Breakout Confirmation: At the first marker, the price breaks out of a consolidation range. Shortly after, the +VI line (green) crosses above the -VI line (red). This crossover acts as a powerful confirmation that the bullish breakout has momentum and is likely to continue.

- The Bearish Reversal Signal: Later, as the uptrend starts to lose steam, the price forms a lower high. The -VI line then crosses above the +VI line, signaling a bearish reversal. This gives the trader an early warning to exit their long position and consider a new short trade.

For extra confirmation, a trader could also check that the volume increases during the initial breakout, adding more weight to the VI’s bullish signal.

9. Advantages and Limitations of the Vortex Indicator

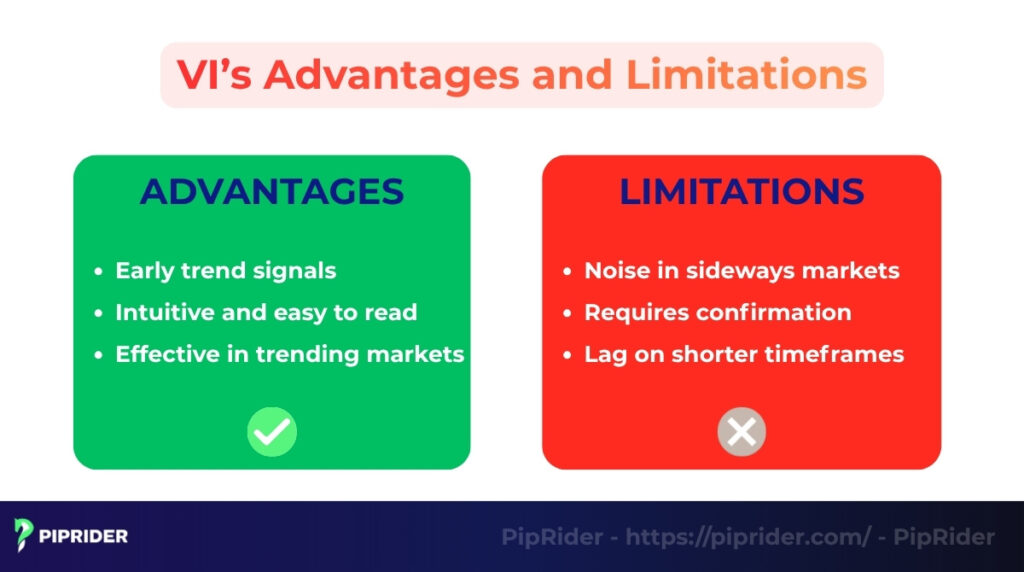

Like any technical tool, the Vortex Indicator has clear strengths and weaknesses. Understanding both is key to using it effectively.

9.1. Advantages

The primary strengths of the VI lie in its focus on trend initiation and its clear visual signals.

- Early trend signals: Its primary strength is its ability to signal the very beginning of a new trend, often providing earlier entry points than many other trend-following indicators.

- Intuitive and easy to read: The indicator is visually straightforward. The crossover signals are clear and unambiguous, making it accessible even for beginner traders.

- Effective in trending markets: In a market with a clear, sustained direction (either up or down), the VI is highly effective at keeping a trader on the right side of the trend.

9.2. Limitations

To avoid common trading mistakes, it’s crucial to understand the indicator’s inherent weaknesses.

- Noise in sideways markets: Its biggest drawback is its poor performance in ranging or choppy markets. During these periods, the +VI and -VI lines will cross back and forth frequently, generating a series of false signals known as “whipsaws.”

- Requires confirmation: The VI only measures trend direction, not strength. Its signals are far more reliable when confirmed by another indicator, like the ADX for trend strength or the RSI for momentum.

- Lag on shorter timeframes: While it can be used on any timeframe, its lagging nature becomes more pronounced on very short timeframes, where it can be too slow to be effective for scalping.

10. Frequently asked questions about Vortex Indicator

11. The Bottom Line

The Vortex Indicator (VI) is a powerful and intuitive tool for traders focused on identifying new market trends. By clearly signaling a shift in market direction, it provides a solid foundation for any trend-following strategy.

For best results, its signals should be filtered using other indicators like the ADX, RSI, or a simple Moving Average. This combination creates a robust system that not only spots new trends but also confirms their strength, significantly improving trading accuracy. To discover more tools and strategies, follow Piprider and explore our in-depth guides in the Broker Reviews section.