Andrew Krieger is a legendary American currency trader. He became famous for one of the most aggressive and successful trades in history. In 1987, just after the “Black Monday” stock market crash, Krieger shorted the New Zealand dollar. This single, high-conviction move reportedly earned his bank, Bankers Trust, around $300 million. Krieger’s story is a powerful case study in macro analysis, courage, and the immense power of leverage.

This article will explore his biography, the legendary “Kiwi” short, and the timeless lessons his career still offers traders today.

Key Takeaways

- A highly successful currency trader at Bankers Trust, known as Andy Krieger to colleagues.

- He is famous for his massive 1987 short position against the New Zealand dollar (NZD), earning a reported $300 million.

- Krieger used bold, high-conviction macro analysis combined with extremely high leverage (reportedly 400:1).

- His career highlights the importance of acting decisively when in-depth analysis reveals a clear, overvalued market opportunity.

- The trade serves as a major case study on the extreme power (both for profit and loss) of using high leverage.

Quick Facts: Andrew Krieger

| Feature | Details |

| Famous Role | Currency Options Trader at Bankers Trust |

| Active Era | Late 1980s (Specifically 1986–1988) |

| Famous Trade | Shorting the New Zealand Dollar (NZD) in 1987 |

| Reported Profit | Estimated $300 Million for the bank |

| Known As | “The Kiwi Killer” |

| Trading Style | Global Macro, Aggressive Leverage via Options |

| Key Sources | The New Market Wizards (Schwager), The Money Bazaar (Mayer) |

1. Who Is Andrew Krieger?

Andrew Krieger is a legendary American currency trader and a prominent figure among famous forex traders who gained significant fame in the late 1980s while working at Bankers Trust. He is universally known for one spectacular trade: a massive short position against the New Zealand Dollar (NZD) in 1987.

At only 32 years old, Krieger was already one of the most successful traders on Wall Street. Unlike technical traders, he relied on deep fundamental analysis to identify market imbalances. His conviction was so strong that his position against the Kiwi reportedly exceeded New Zealand’s entire money supply at the time.

The trade was immensely profitable, reportedly earning the bank an estimated $300 million (New York Times, 1988). This single event, which caused a sharp drop in the currency’s value, earned him the enduring nickname “The Kiwi Killer.”

2. Andrew Krieger’s Biography & Career

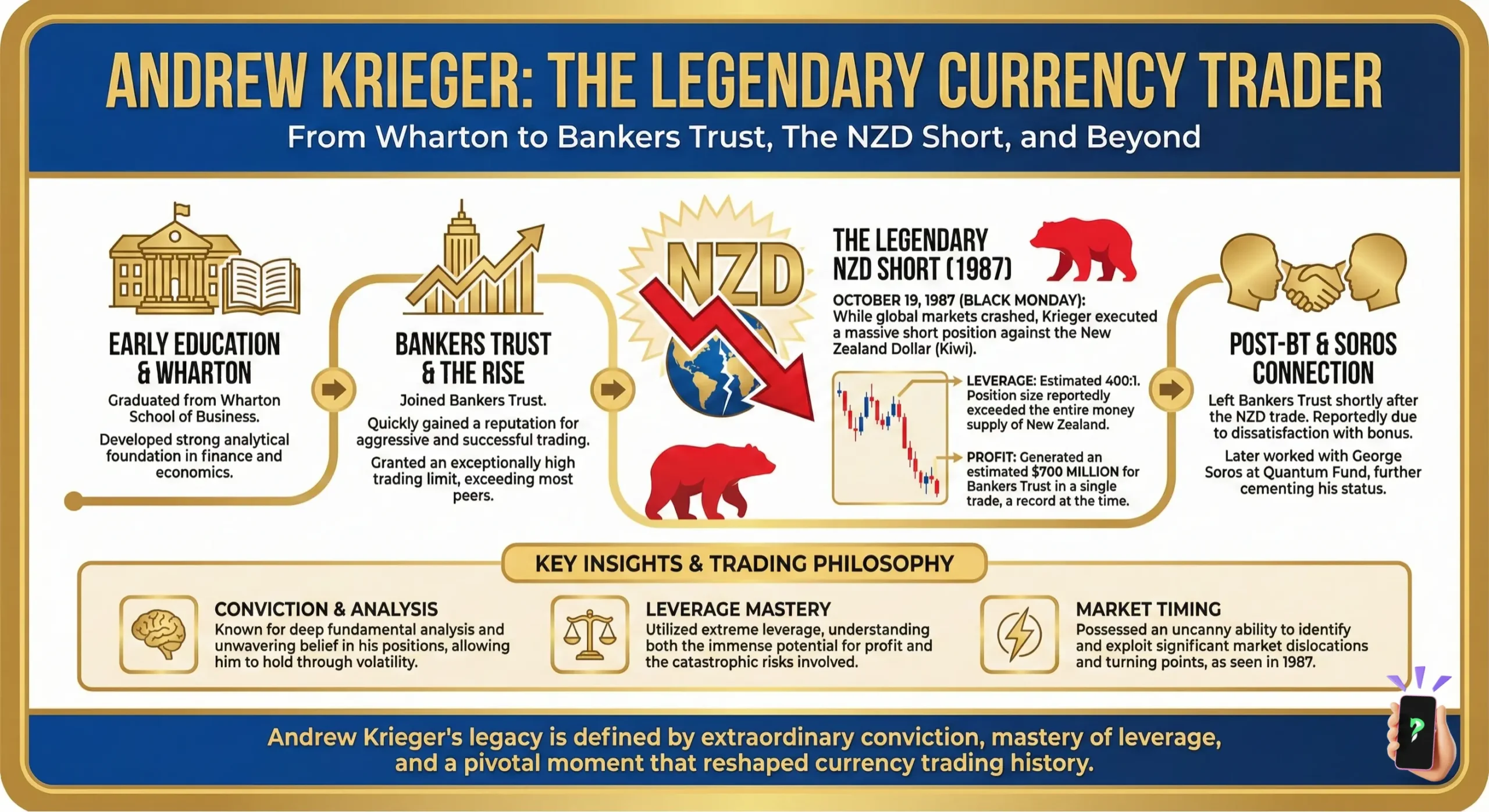

Andrew Krieger’s rise in the financial world was defined by intellectual rigor and unprecedented trust from his employers.

Educational Foundation

He graduated from the prestigious Wharton School of Business at the University of Pennsylvania. This academic background provided him with a sophisticated understanding of economics and financial derivatives, setting the stage for his analytical approach.

Career Timeline: The Path to Legend

| Year | Milestone | Source |

| Early 1980s | Began trading career at Salomon Brothers (Options desk). | Market Context |

| 1986 | Joined Bankers Trust. Impressed management with options mastery. | Mayer (1988) |

| Oct 1987 | Executed the legendary NZD short trade (approx. $300M profit). | Fresh Air Archive |

| Feb 1988 | Resigned from Bankers Trust due to compensation disputes. | NY Times (1988) |

| Late 1988 | Joined Soros Fund Management to work with George Soros. | Schwager (1992) |

The Bankers Trust Era (The Peak)

It was at Bankers Trust where Krieger truly made his mark. According to Martin Mayer in The Money Bazaar (1988), Krieger’s aptitude for Currency Options was so respected that management granted him a trading limit of $700 million.

- Significance: This capital gave Krieger the firepower of a small central bank, allowing him to execute strategies that other traders could only dream of.

- Context: A standard limit for a top trader at the time was typically only $50 million.

3. The Trade That Shook New Zealand (1987)

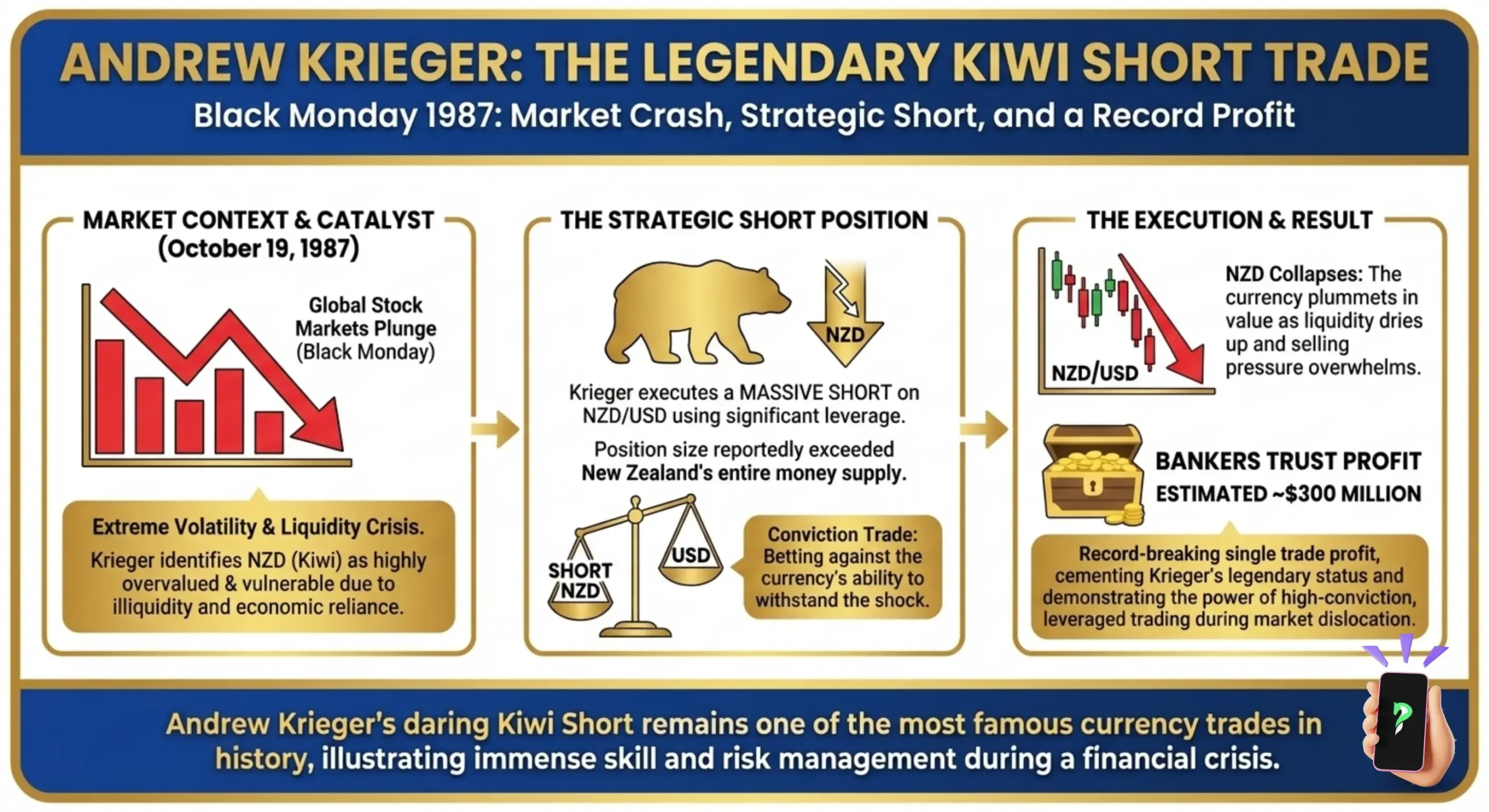

The trade that cemented Krieger’s legend occurred in late 1987. It serves as a classic case study in identifying and exploiting a major macro imbalance.

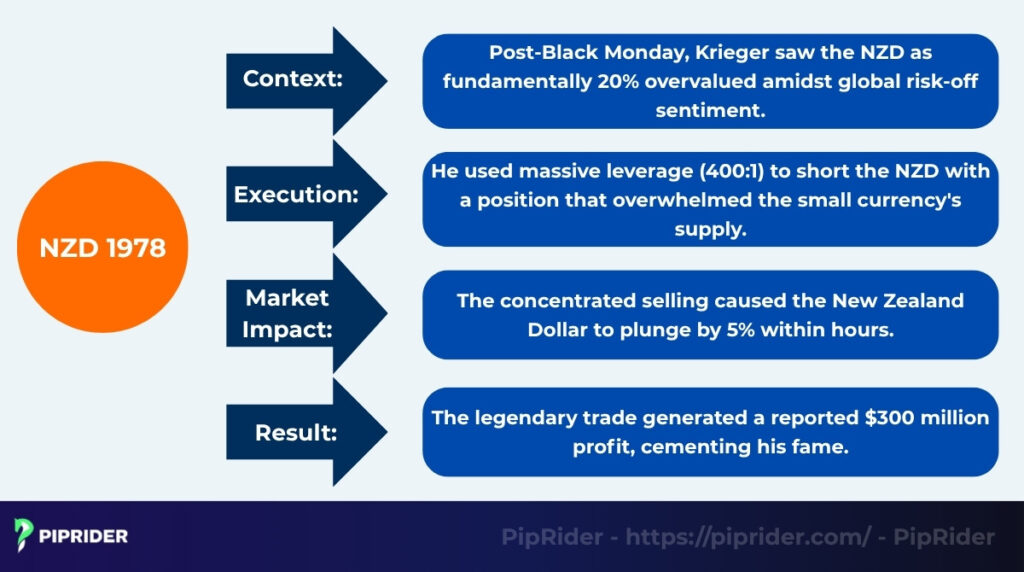

3.1. Market Context – The Post-Crash Anomaly

The trade took place in the shadow of the Black Monday stock market crash (October 1987). As panic spread, investors fled to safe-haven assets like the US Dollar. However, the New Zealand Dollar (NZD) remained unusually high, propped up by the country’s high-interest rates and a lack of liquidity.

3.2. Krieger’s Analysis: The 20% Gap

While others saw strength, Krieger saw fragility. As detailed in Schwager’s The New Market Wizards (1992), his analysis suggested that the NZD was fundamentally overvalued by as much as 20% relative to the new “risk-off” global reality. He concluded that the currency had not yet corrected simply because no one had tested its liquidity.

3.3. The Execution: Leverage via Options

Krieger acted on this conviction with massive force. He used currency options to construct a short position with significant effective leverage.

- The “Money Supply” Legend: Market lore and financial chronicles often suggest that his position’s notional value briefly exceeded the entire money supply of New Zealand.

- The Leverage: Cited by Mallaby (2010) as reaching effective levels of 400:1, this figure refers to the effective exposure gained through the options pricing rather than simple margin.

- The Impact: The concentrated selling pressure overwhelmed the market. The NZD reportedly collapsed by roughly 5% in a matter of hours, fluctuating wildly as the central bank struggled to respond.

3.4. The Aftermath

The trade was a financial triumph but a political storm.

- The Departure: Krieger left Bankers Trust shortly after. While rumors often cite a dispute over his bonus (relative to the massive $300M profit), the exact reasons likely involved a mix of compensation and the opportunity to move to the buy-side.

- The Profit: Bankers Trust reportedly booked profits estimated at $300 million from the trade.

- The Fallout: The New Zealand government was outraged, publicly criticizing the bank for destabilizing their economy.

4. Prominent Achievements of Andrew Krieger

Andrew Krieger’s 1987 trade cemented his status as one of the most successful currency traders in history. His achievements are still widely discussed in trading circles.

- Massive profitability: He executed one of the single most profitable Forex trades on record. The $300 million gain from the NZD short remains legendary.

- Joining Soros Fund Management: Following his departure from Bankers Trust, Krieger’s talent was sought by other legends. He accepted an offer to work for George Soros, further validating his expertise as a top-tier macro trader.

- Featured in “The New Market Wizards”: Krieger’s story and mindset were later documented by Jack Schwager in the famous book, “The New Market Wizards.” Being featured in this collection placed him in the pantheon of trading greats, and his interview is still studied by traders today.

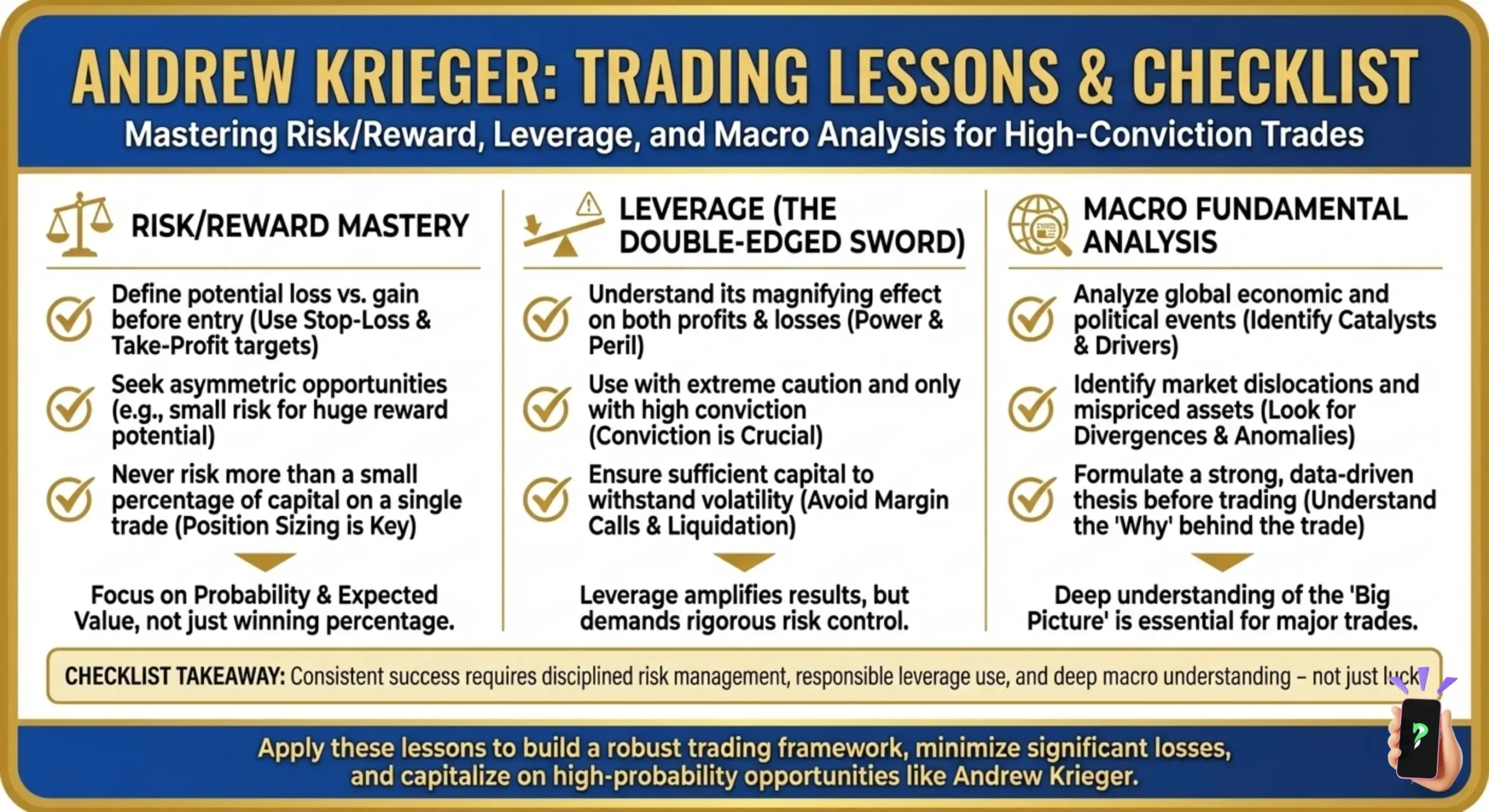

5. Krieger’s Trading Strategy Explained

Andrew Krieger‘s legendary NZD trade was not a random gamble; it was the result of a specific trading style and mindset. His approach combined deep fundamental analysis with bold execution.

5.1. Macro-Fundamental Focus

Krieger was a global macro trader. He didn’t focus on small, short-term chart patterns. Instead, he analyzed the “big picture,” looking at factors like global capital flows, interest rate differentials, and relative currency strength to find major economic imbalances suitable for large speculative positions.

5.2. Strategic Use of Leverage

The 400:1 leverage is a key part of his story. However, Krieger didn’t use it recklessly. His philosophy was to use high leverage only when his analysis provided extreme conviction and the probability of success was overwhelmingly high. It was not “gambling leverage” but rather a calculated, aggressive exposure designed to maximize the profit from a rare, high-certainty event.

5.3. A Contrarian Mindset

Krieger demonstrated a classic contrarian mindset. He was willing to bet against the prevailing market trend when he believed the market was being irrational. While others saw the NZD as stable due to high interest rates, he saw it as a vulnerable outlier in a post-crash world. He confidently took the opposite side of the majority, shorting the currency when many still saw it as strong.

5.4. Psychological Discipline

Executing such a massive trade required immense psychological discipline and control over market psychology. Krieger had to trust his data and analysis completely, even when initiating a position of that size. He was known for being calm and analytical, relying on his models and data-driven insights rather than succumbing to the widespread market fear and panic that defined the 1987 crash.

6. Key Insights from Krieger’s Philosophy

Andrew Krieger is notoriously private and rarely gives interviews. However, his chapter in Jack Schwager’s The New Market Wizards reveals the mindset behind his success. Instead of isolated quotes, here are the three core pillars of his trading philosophy:

6.1. Conviction Dictates Size

Most traders struggle with sizing. Krieger’s philosophy is that when the analysis reveals a massive discrepancy (like the NZD valuation), small trades are a waste of opportunity. He teaches that aggressive sizing should not be random, but strictly reserved for moments of overwhelming analytical conviction.

6.2. Identifying “Market Malfunctions”

Krieger didn’t just look for trends; he looked for broken markets. In 1987, the world had crashed, but the Kiwi was still priced as if everything was normal. His insight: Look for assets that are ignoring reality. These “market malfunctions” offer the most explosive risk-to-reward ratios because reality eventually forces a violent correction.

6.3. The Role of Leverage

To Krieger, leverage was a tool to amplify a correct thesis, not a gambling chip. He demonstrated that leverage is only dangerous without an edge. Because he had “done the homework” and hedged with options, he could wield 400:1 leverage to turn a 5% currency move into a 300 million dollar profit.

7. Risk Management Lessons from Krieger

While Andrew Krieger is famous for a highly leveraged trade, his success was not built on blind gambling. His methods provide key lessons in risk management, particularly in how to handle high-conviction setups.

- Use structural stop-losses: Even in his massive NZD short, the position was reportedly protected by options. This acted as a defined stop-loss. For modern traders, this reinforces the need to always use a stop-loss and practice sound money management, no matter how confident the trade seems.

- Have a contingency plan: Krieger’s analysis was so deep that he was prepared for different market reactions. A professional trader doesn’t just plan for the trade to work; they have a contingency plan for what to do if it goes wrong or if the market reacts unexpectedly.

- Link position sizing to conviction: The Krieger story is a masterclass on position sizing. He didn’t use 400:1 leverage on every trade. He reserved that level of exposure for a rare, “once-in-a-generation” setup where his analysis provided maximum conviction. The lesson is to scale your trade size relative to the quality and certainty of the setup.

8. The Legacy of the Trade

The 1987 NZD short is more than just a profitable trade; it remains a significant case study in financial history regarding market structure and risk management.

8.1. Exposing Liquidity Risk

Krieger’s trade demonstrated a frightening reality: even a sovereign currency is not immune if the market is illiquid.

- The Lesson: Before this, currencies of developed nations were often viewed as too large to manipulate. Krieger proved that in a smaller market like New Zealand, a massive order book (backed by high leverage) could overwhelm the central bank’s ability to absorb the selling pressure.

8.2. The Evolution of Internal Risk Controls

While the trade generated massive profits, it also highlighted a flaw in how banks managed personnel risk in the 1980s.

The Shift: The fact that a single trader could hold a position notionaly exceeding a nation’s money supply forced institutions to re-evaluate. In the years that followed, investment banks began implementing stricter Concentration Limits. These rules ensure that no single individual or position holds enough exposure to threaten the institution’s stability, regardless of how profitable the trader might be.

9. Useful Insights for Modern Forex Traders

The career of Andrew Krieger provides several timeless lessons for today’s Forex traders, even those not managing billions of dollars.

- Pick your battles: Krieger’s fame rests on one or two massive trades, not thousands of small ones. The lesson is to avoid constant trading (over-trading) and instead patiently wait for a high-probability setup where the odds are overwhelmingly in your favor.

- Analyze the big picture: Modern traders can apply his macro approach by thoroughly analyzing capital flows, interest rate differentials, and overall market sentiment (risk-on/risk-off). This fundamental analysis helps identify major, long-term currency mispricings.

- Embrace calculated risk: Krieger’s story teaches traders to have a “calculated risk” mindset. This means not being afraid to take a position (even a large or contrarian one) once in-depth analysis provides strong conviction. It is the opposite of a reckless gamble; it is courage based on data.

10. Frequently asked questions about Andrew Krieger

11. The Bottom Line

Andrew Krieger‘s career is a powerful testament that deep market knowledge and psychological discipline can be stronger than crowd sentiment.

His legendary 1987 NZD short remains a timeless case study in global macro analysis, calculated risk management, and the courage to act on high-conviction analysis.

More than just a story, his legacy continues to inspire traders who dare to “think differently” and “trade smarter”. To continue learning from the market’s most fascinating figures and trading strategies, keep following PipRider for more expert insights and trading knowledge.