For day traders, identifying precise levels for reversals and breakouts is a constant challenge. Enter the Camarilla Pivot Points, a powerful tool designed specifically for intraday trading. This guide provides a complete playbook for the Camarilla Pivot Points Strategy, breaking down its unique calculation and the core trading setups that can give traders an edge.

Key Takeaways

- Camarilla Pivot Points are a key tool for day traders, providing reliable support and resistance levels.

- The pivots are calculated from the previous day’s closing price to forecast potential intraday turning points.

- Core Camarilla pivot strategies involve range reversals at the S3/R3 levels and trend breakouts at the S4/R4 levels.

- The strategy’s reliability increases when combined with other indicators and disciplined risk control.

1. What Are Camarilla Pivot Points?

In technical analysis, Camarilla Pivot Points are a versatile tool used primarily by day traders to identify key intraday levels of support and resistance (BabyPips, n.d.). They consist of a central pivot point (PP) and eight corresponding levels above and below it: four resistance levels and four support levels.

According to BabyPips, the Camarilla Pivot Points concept was introduced in 1989 by Nick Scott, a successful bond trader. The key difference from conventional pivot points lies in its calculation; the Camarilla formula uses a special multiplier that keeps the support and resistance levels much closer to the current price. This makes it particularly effective for short-term and range-bound trading.

Their primary role is to provide traders with clear, objective levels for decision-making. These pivots are used to determine precise entry points, place logical stop-loss orders, and set profit targets. By providing a pre-calculated map of potential turning points, Camarilla Pivots are an essential tool for day trading risk management.

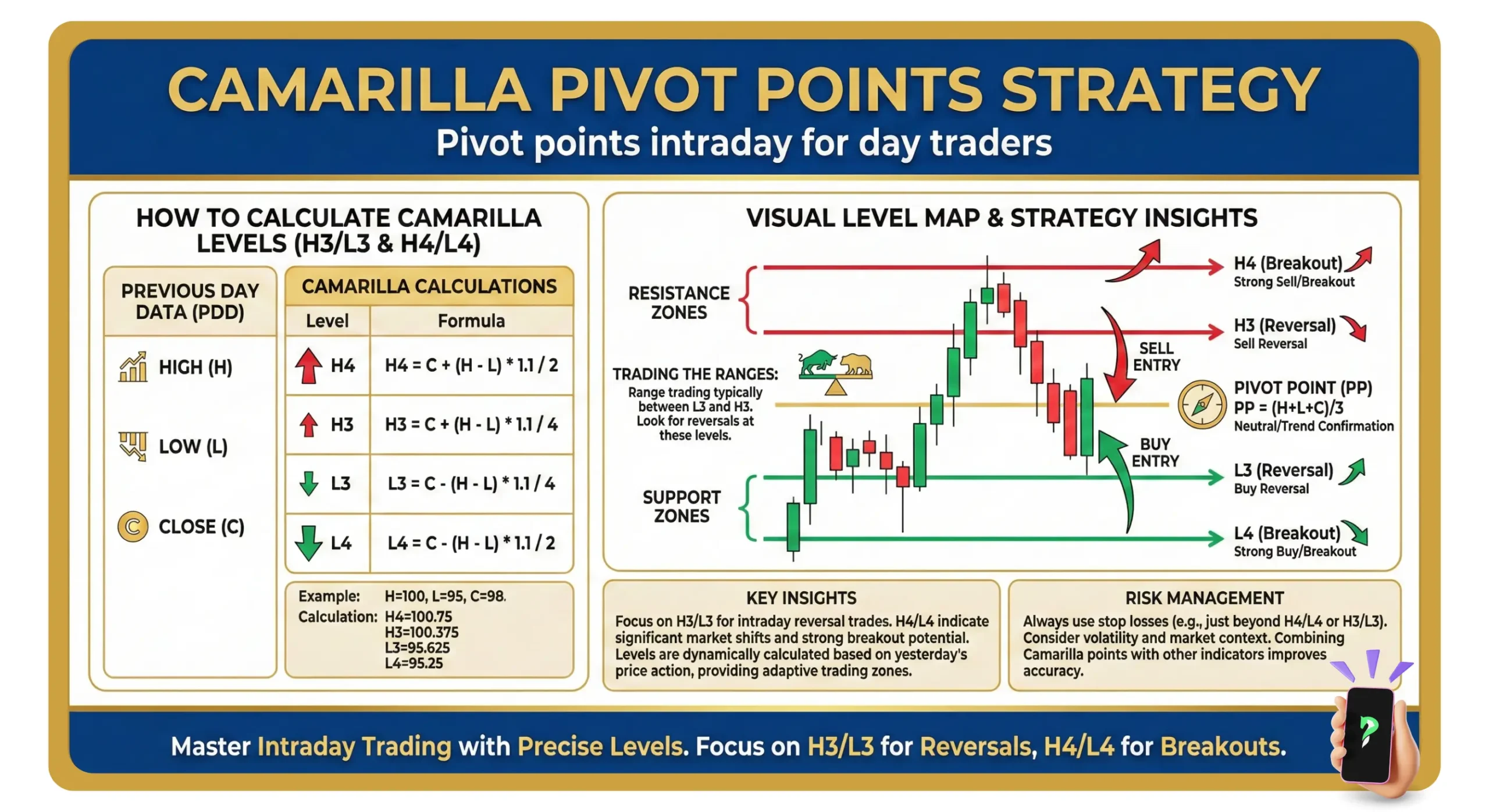

2. How To Calculate Camarilla Pivot Points?

The Camarilla Pivot Points are calculated using the previous day’s high (H), low (L), and close (C) prices. The formula generates a total of eight primary levels: four resistance levels (R1-R4) and four corresponding support levels (S1-S4).

2.1. The Camarilla Formula

To calculate the levels, the following variables from the previous trading day are used:

- H: The high price

- L: The low price

- C: The closing price

The levels are then calculated as follows:

Resistance Levels:

| R4 = C + ((H – L) * 1.1 / 2) R3 = C + ((H – L) * 1.1 / 4) R2 = C + ((H – L) * 1.1 / 6) R1 = C + ((H – L) * 1.1 / 12) |

Support Levels:

| S1 = C – ((H – L) * 1.1 / 12) S2 = C – ((H – L) * 1.1 / 6) S3 = C – ((H – L) * 1.1 / 4) S4 = C – ((H – L) * 1.1 / 2) |

2.2. Calculation Example

Let’s assume a stock had the following prices on the previous day:

- High (H): 150

- Low (L): 140

- Close (C): 148

The price range is 150 – 140 = 10. Using this, we can calculate the key R3 and S3 levels:

| R3 (Resistance) = 148 + ((10) * 1.1 / 4) = 150.75 |

| S3 (Support) = 148 – ((10) * 1.1 / 4) = 145.25 |

2.3. Comparison with Traditional Formulas

To understand what makes the Camarilla unique, this table compares how the first resistance level (R1) is calculated in different systems:

| Pivot System | R1 Calculation Formula |

| Camarilla | C + ((H – L) * 1.1 / 12) |

| Classic | (Pivot Point * 2) – L |

| Fibonacci | Pivot Point + ((H – L) * 0.382) |

| Woodie | (Pivot Point * 2) – L (PP is calculated differently) |

The Camarilla formula’s direct relationship to the previous day’s close and its unique multipliers create the distinct, tighter levels that day traders value.

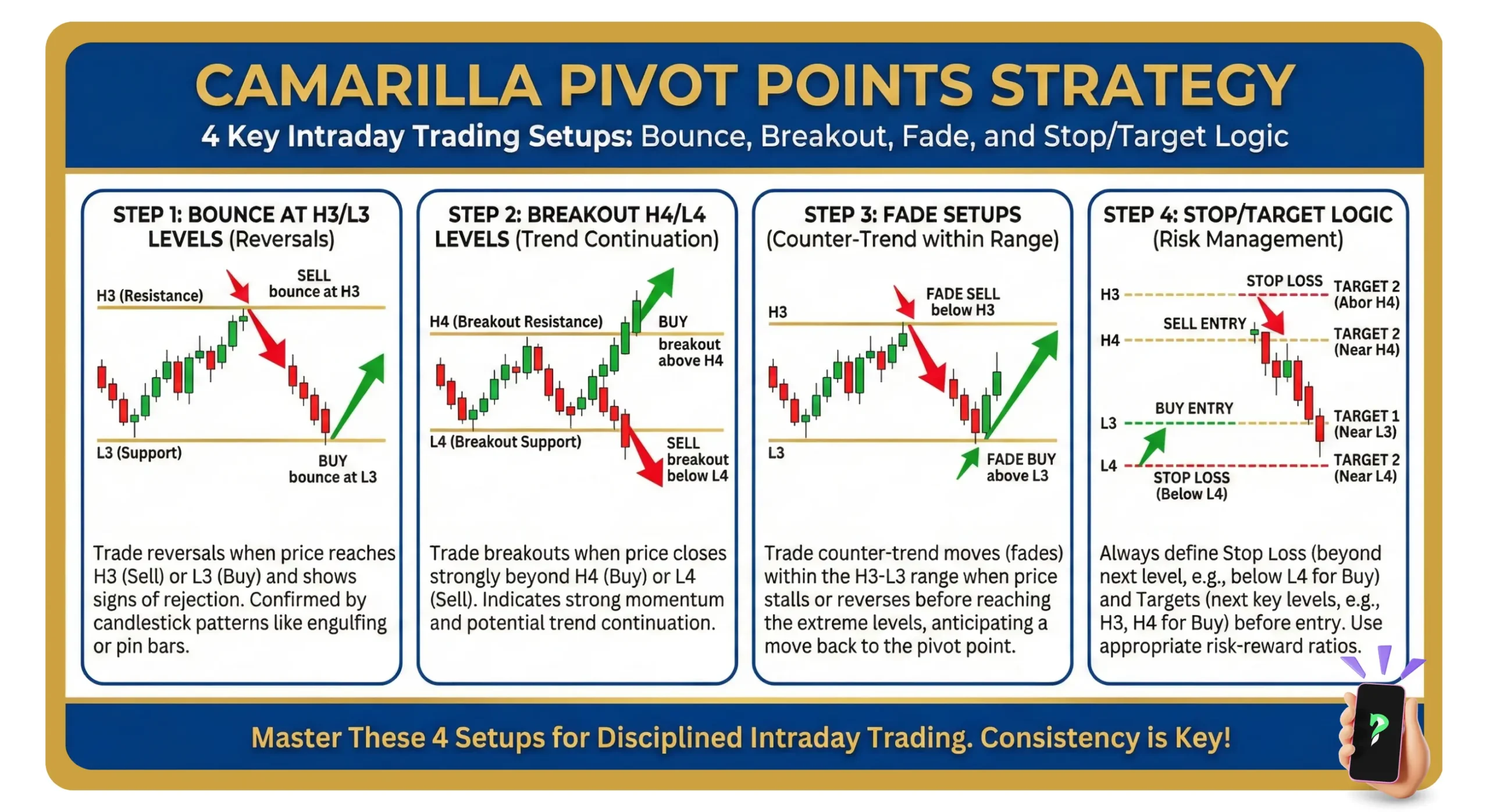

3. Camarilla Pivot Trading Strategies

The power of Camarilla Pivots lies in their versatility. They can be used to develop clear strategies for both trending and ranging market conditions. Here are the two core approaches.

3.1. Trend Trading Strategy Using Camarilla Levels

The S3 and R3 levels are excellent for trading breakouts in the direction of a prevailing trend. The strategy is to wait for a decisive price move beyond these key levels.

- In a strong uptrend, a confirmed close above the R3 level is a signal to enter a long (buy) trade, targeting the R4 level.

- In a strong downtrend, a confirmed close below the S3 level is a signal to enter a short (sell) trade, targeting the S4 level.

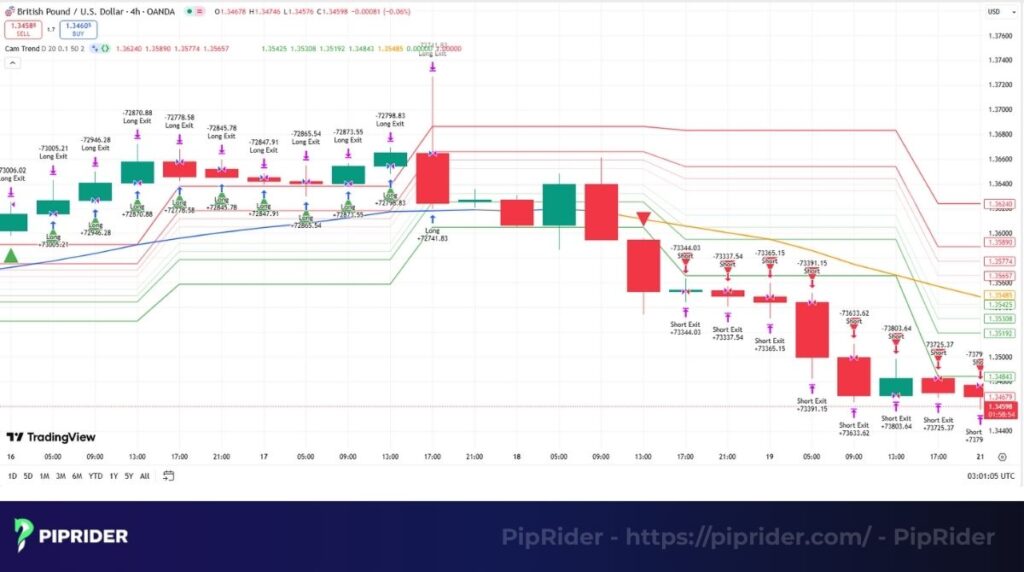

For example, on a EUR/USD chart in a clear uptrend, once the price breaks and closes above R3, a trader could enter a long position with a stop-loss just below R3, aiming for R4 as the profit target.

3.2. Range Trading Strategy Using Camarilla Points

This is the most popular Camarilla pivot strategy, designed for sideways or range-bound markets. The strategy uses the S3 and R3 levels as the boundaries of a potential trading range.

The rules are straightforward:

- Entry: A trader looks to sell when the price rejects the R3 resistance level and buy when the price rejects the S3 support level.

- Exit: A stop-loss is placed just outside the range (above R4 for a sell, below S4 for a buy). The take-profit orders target the opposite side of the range (target S3 for a sell, and R3 for a buy).

3.3. Intraday Trading with Camarilla Levels

The Camarilla formula is specifically designed for short-term day trading and scalping. Its levels are much closer to the current price than classic pivots, providing more frequent and relevant trading opportunities throughout a single trading session.

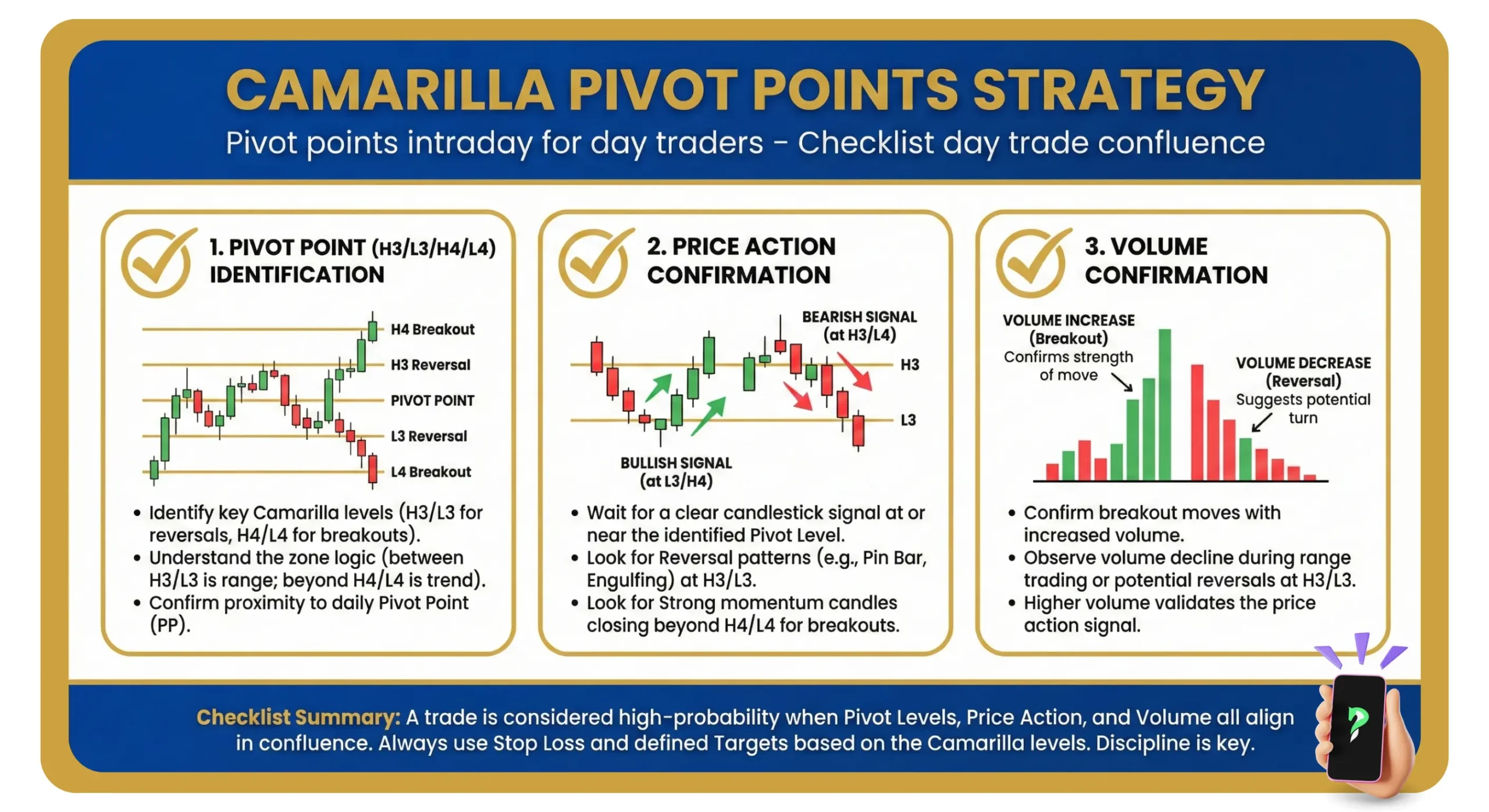

To improve the reliability of these fast-paced setups, traders should always look for confirmation signals.

- Volume confirmation: A breakout through the S4 or R4 level should be accompanied by a clear surge in volume. This indicates strong conviction behind the move and reduces the chance of a false breakout scenario.

- Momentum confirmation: Use a momentum oscillator like the RSI. For example, a breakout above R4 is a much stronger signal if the RSI is also showing strong upward momentum and is not yet in an extreme overbought condition.

3.4. Camarilla Pivots Reversal Setups

The S4 and R4 levels are also powerful for reversal setups. This setup occurs when the price attempts to break out beyond these extreme levels but fails and aggressively reverses back into the main range.

- Sell Setup: Look for the price to hit R4, fail to continue, and then close back below it. This failed breakout is a high-probability sell signal, with the S3 level as the primary target.

- Buy Setup: Conversely, look for the price to hit S4, fail to continue, and then close back above it. This is a strong buy signal, with the R3 level as the primary target.

The stop-loss for these trades is placed just outside the extreme high or low of the failed breakout candle.

3.5. Combining Camarilla Pivots with Other Indicators

The reliability of Camarilla Pivots increases when combined with other indicators. This “confluence” of signals is what professional traders seek.

- Moving Averages: Use them to confirm the primary trend. A buy signal at an S3 support level is much stronger if the price is also trading above a key moving average.

- RSI/MACD: Look for momentum confirmation. A sell signal at an R3 resistance level is more reliable if the RSI is also “overbought” or showing bearish divergence.

- Price Action: Always wait for a confirmation candle. A bullish pin bar or an inside bar breakout at a Camarilla support level provides a clear entry trigger.

4. Pros and Cons of Camarilla Pivot Points Strategy

The primary advantage of Camarilla Pivot Points is their simplicity and suitability for day traders. Because the levels are calculated automatically and remain close to the current price, they provide clear and objective trading signals for potential entries, stop-losses, and targets, making them easy to apply as part of a rule-based plan.

However, their main disadvantage is that they can be prone to “noise” and generate false signals in highly volatile markets. For this reason, they are not a standalone system. Their reliability increases significantly when they are combined with other trading indicators, such as momentum oscillators or price action signals, to filter out lower-probability setups.

5. Camarilla Pivots vs. Other Pivot Point Systems

While all pivot points aim to identify key levels, their formulas and applications differ. Here’s how Camarilla Pivots compare to other popular systems:

- Camarilla Pivots vs. Classic Pivots: The main difference is proximity to price. Classic Pivots create wider, more spread-out levels. Camarilla levels are much tighter and closer to the current price, making them more suited for intraday action.

- Camarilla Pivots vs. Fibonacci Pivots: The difference is the mathematical calculations. Fibonacci Pivots use Fibonacci ratios (like 0.382 and 0.618). Camarilla Pivots use a fixed, non-Fibonacci mathematical formula.

When to choose Camarilla: The strategy is the preferred choice for day traders and scalpers due to its focus on short-term price movements. Swing or position traders often find Classic or Fibonacci pivots more suitable.

6. Advanced Tips for Using Camarilla Pivots

To take your strategy to the next level, consider these advanced tips that professional traders use to filter signals and improve their win rate.

- Use multi-timeframe analysis: Don’t trade the pivots in a vacuum. Check the higher timeframe trend (e.g., the 4-hour or daily chart). A buy signal at an S3 support level is much stronger if the overall directional bias is in a clear uptrend.

- Combine with trading sessions: Camarilla Pivots are most effective during high-volatility periods. Pay close attention to signals that form during the overlap of the London and New York trading sessions, as this is when the most significant moves often occur.

- Avoid ‘false breakout traps’: A common trap is a “false breakout,” where the price breaks the S4 or R4 level only to quickly reverse. To avoid this, always wait for strong candlestick patterns to close outside the level as confirmation before entering a trade.

7. Frequently Asked Questions (FAQs)

8. Conclusion

In conclusion, Camarilla Pivots are a powerful and effective tool for day traders, providing a clear framework for identifying intraday reversal setups and breakouts. However, their reliability increases significantly when combined with confirming indicators and a strict capital management plan. As with any Camarilla Pivot Points strategy, we strongly recommend that you test this approach thoroughly on a demo account before risking real capital.

To continue building your trading system, explore more in-depth guides in our Trading Strategies & Risk Management category on Piprider.