The megaphone pattern is a rare but powerful chart formation that warns traders of extreme market volatility and changing market dynamics. Understanding this “Broadening Formation” is the key to catching major breakouts while avoiding chaotic price swings. This guide explains exactly how to identify the pattern, the market psychology behind it, and the step-by-step strategies to trade it effectively.

Key Takeaways

- The megaphone pattern, or broadening formation, is defined by expanding higher highs and lower lows.

- It reflects increasing market volatility and a lack of consensus between buyers and sellers.

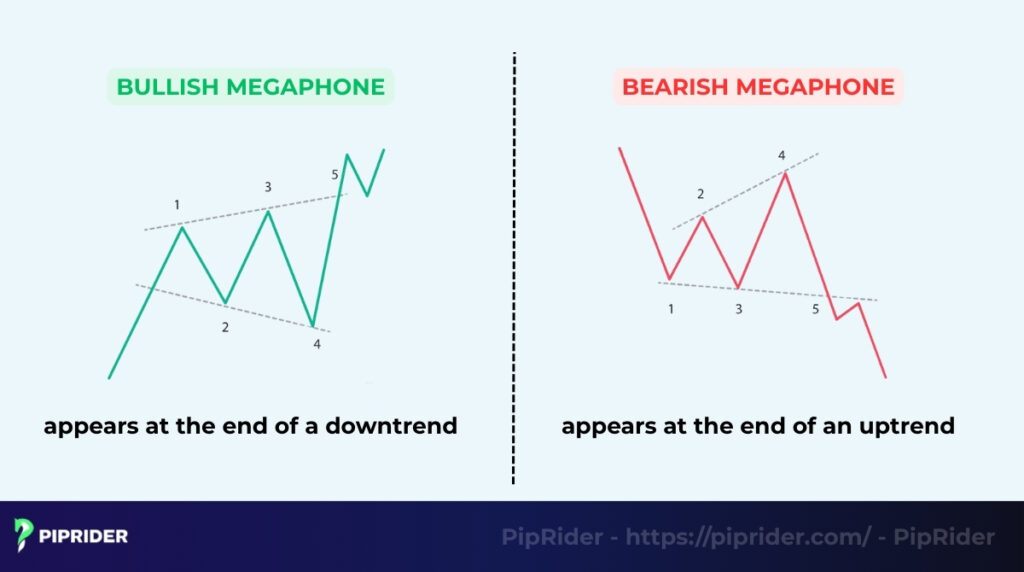

- The two main types are the megaphone top (bearish reversal) and megaphone bottom (bullish reversal).

- The strongest signal is a breakout beyond the upper or lower boundary, confirmed by high volume.

- For better accuracy, combine it with indicators like EMA, RSI, and volume profile.

1. What Is the Megaphone Pattern?

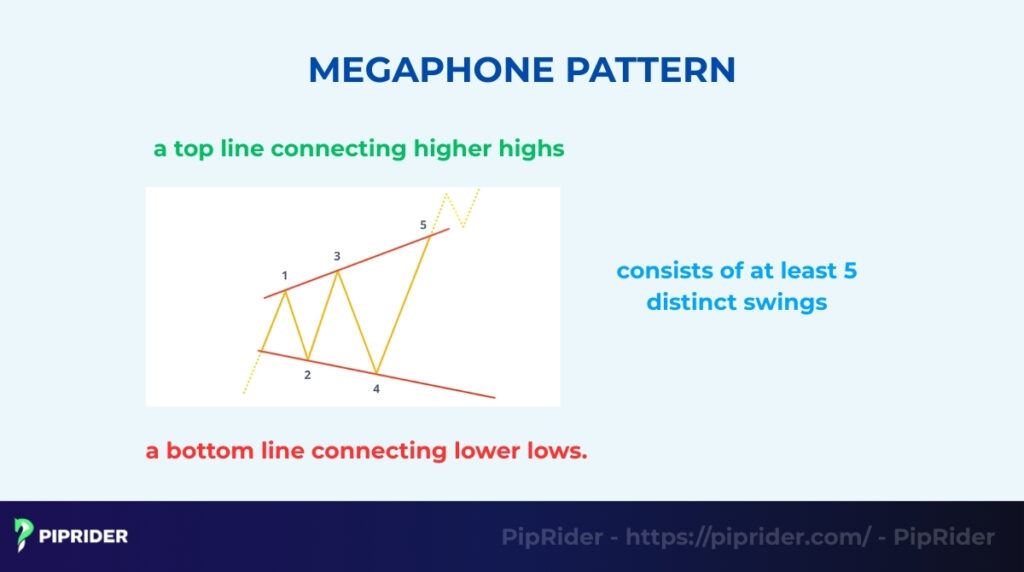

The megaphone pattern, also known as a broadening formation or broadening wedge, is a technical analysis chart formation characterized by increasing volatility (Scott, 2025). It consists of two diverging trend lines: a top line connecting higher highs and a bottom line connecting lower lows.

First identified by Richard Schabacker in 1932 (Murphy, 1999), the megaphone pattern typically consists of at least 5 distinct swings (or price movements), showing a chaotic battle between buyers and sellers.

It often appears at market tops or bottoms, signaling that the market has lost control and is highly emotional. Traders use it to spot potential reversals or explosive breakouts.

Megaphone vs. Symmetrical Triangle

To understand the Megaphone, compare it to a standard symmetrical triangle.

- Triangle (Contraction): The price range gets smaller as the market calms down.

- Megaphone (Expansion): The price range gets larger as the market becomes more unstable and uncertain.

2. What Are the Types of Megaphone Patterns?

While the expanding shape is consistent, the pattern’s meaning changes depending on where it forms in the market trend. There are three core variations you must recognize.

| Pattern Type | Market Context | Likely Outcome |

| Megaphone Top | Forms after an uptrend | Bearish reversal (Down) |

| Megaphone Bottom | Forms after a downtrend | Bullish reversal (Up) |

| Horizontal | Forms in sideways markets | Neutral / Volatility expansion |

2.1. Megaphone Top (Bearish Broadening Formation)

This pattern typically appears at the end of a strong uptrend, signifying that the bulls are losing control. Visually, the price makes higher highs but is also forced into deeper lower lows, showing instability.

It acts as a bearish pattern reversal signal. Traders watch for the price to break below the lower trendline to confirm the downtrend is starting.

2.2. Megaphone Bottom (Bullish Broadening Formation)

Conversely, this pattern forms at the end of a downtrend. It indicates that while sellers are pushing the price lower, buyers are aggressively fighting back to create higher peaks.

This setup serves as a bullish pattern reversal signal. The key trigger is a breakout above the upper trendline, suggesting buyers have won the battle.

2.3. Horizontal Megaphone Pattern (Right-Angled)

Sometimes, the pattern doesn’t tilt clearly up or down. It may look like a “reverse rectangle” where one trendline is flat while the other expands. This formation indicates pure volatility expansion without a clear directional bias yet. Traders should expect a massive breakout in either direction once the range is broken.

3. What Is the Market Psychology Behind the Megaphone Pattern?

The megaphone pattern is unique because it visualizes a market that is losing control. Unlike a symmetrical triangle where the price range tightens (showing agreement), a Megaphone shows a market tearing itself apart with disagreement. It represents a chaotic battle between fear and greed.

- Increasing volatility: This formation signals a total lack of consensus. Buyers are aggressive enough to push the price to new highs, but sellers are equally aggressive, smashing the price to new lows immediately after. This widening battlefield shows that neither side has control.

- Fear & uncertainty: During this phase, traders are reacting with emotion rather than logic. The new highs trigger FOMO (fear of missing out), sucking buyers in at the top. Moments later, the new lows trigger panic, forcing them to sell at the bottom.

- Liquidity sweeps: For “Smart Money” (institutions), this pattern is a tool to hunt liquidity. By pushing the price slightly higher than the previous peak, they trigger the stop-losses of short-sellers. By pushing it lower, they trigger the stop-losses of buyers. The market is effectively “cleaning out” both sides before the real trend begins.

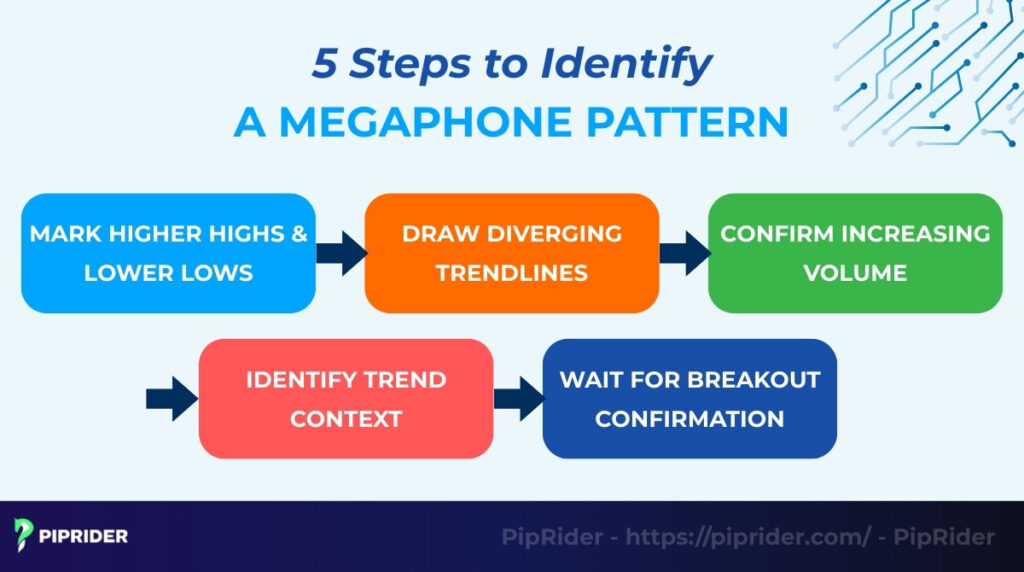

4. How to Identify a Megaphone Pattern (Step-by-Step)

Identifying this pattern requires a keen eye for technical analysis and market structure where price swings get wider over time, defying normal trend rules. To be considered a valid formation, you should look for at least five distinct swings before drawing your lines. Follow these steps to spot it correctly.

4.1. Step 1: Mark Higher Highs & Lower Lows

Start by scanning the chart for pivot lines or points where the price seems “out of control.” You need to identify at least two higher highs and two lower lows. This expanding pivot structure is the first clue that the market is losing stability.

4.2. Step 2: Draw Diverging Trendlines

Once the pivots are marked, connect the highs with a top trendline and the lows with a bottom trendline. Unlike a standard triangle where lines converge (meet), these lines must diverge (move apart). The result should look like a megaphone or a reverse cone opening up to the right.

4.3. Step 3: Confirm Increasing Volume

Check the volume indicator. In a standard triangle, volume usually drops as the price coils. In a megaphone pattern, volume often increases or remains high and irregular. This confirms that participation is high and the battle between buyers and sellers is intensifying.

4.4. Step 4: Identify Trend Context

Zoom out to see the bigger picture. Is this pattern forming after a long rally (suggesting a megaphone top) or after a steep decline (suggesting a megaphone bottom)? Knowing the prior trend helps you anticipate which way the eventual breakout is likely to go.

4.5. Step 5: Wait for Breakout Confirmation

Identifying the shape is not a trade signal. You must wait for the price to close decisively outside one of the trendlines. Trading inside the widening range is dangerous; the real opportunity comes when the market finally chooses a direction and breaks out.

5. How to Trade the Megaphone Pattern

Trading this pattern requires patience because the expanding range can easily trap impatient traders. You can choose to trade the final breakout or capitalize on the volatility within the pattern using these three specific strategies for high-quality trading opportunities.

5.1. Strategy 1: Breakout Strategy

Trading the breakout is generally considered the safest approach. Instead of guessing the direction inside the chaos, you wait for the market to pick a winner.

Monitor the upper and lower trendlines. Enter a trade only when a candle closes decisively outside the trendline, making it one of the safest breakout trades. For example, in a Megaphone Bottom, look for a breakout above resistance. Always ensure there is a spike in volume on the breakout candle to confirm the move is real.

5.2. Strategy 2: Reversal Strategy (The “Fakeout”)

Smart Money often uses the widening range to “hunt liquidity” just beyond the trendlines. This strategy profits from those traps, offering excellent swing trades.

Watch for the price to break a trendline (e.g., a new high) but fail to hold the level. If the price immediately reverses back inside the pattern, enter a trade in the opposite direction (e.g., Sell). This confirms that the reversal signals were valid and the breakout was just a liquidity sweep (fakeout).

5.3. Strategy 3: Trend Continuation Strategy

Megaphones are not always reversal patterns; they can also act as a pause in a major trend.

First, identify the main trend before the pattern formed (e.g., a strong uptrend). If the price eventually breaks out in the same direction as the prior trend (e.g., an upward breakout in an uptrend), treat the move as one of the strong continuation signals. This provides the trigger to enter a trend-following trade.

5.4. Stop Loss Placement

Due to the high volatility of this pattern, precise stop-loss placement is critical for risk management to avoid being stopped out by noise.

- For breakouts: Place your stop-loss just inside the pattern, below the breakout candle’s low (for buys) or above its high (for sells).

- Using ATR: Alternatively, use the Average True Range – ATR indicator to calculate a buffer (e.g., 1.5x ATR). This accounts for the expanded volatility and gives the trade room to breathe.

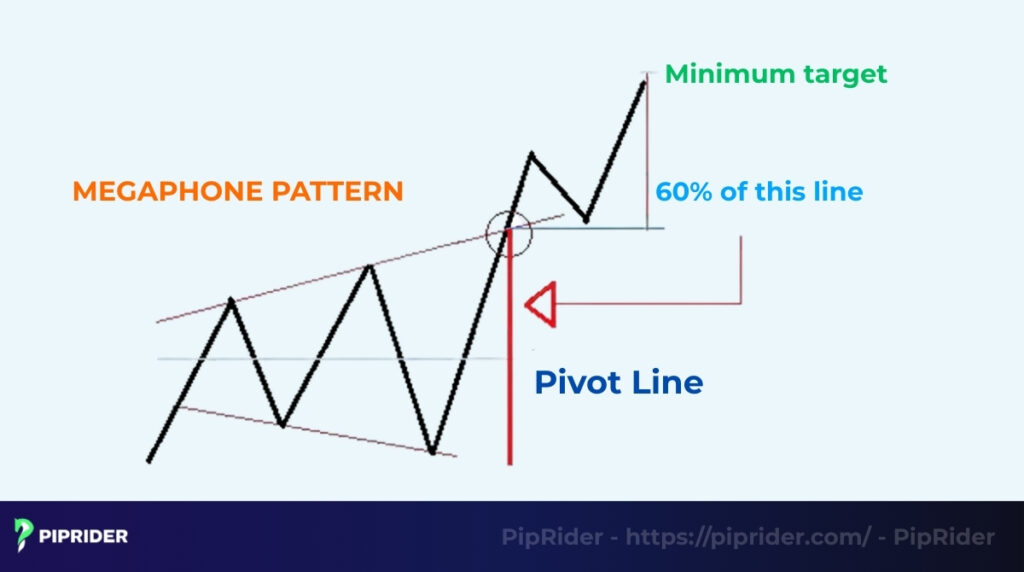

5.5. Take Profit Targets

You need clear price targets and exit points to lock in profits before the volatility shifts again.

- Swing zones: Target the next major swing high swing low on the chart.

- Measured move: Measure the vertical height of the widest part of the megaphone. Project that distance from the breakout point, or use Fibonacci levels to find your mathematical target.

6. Which Indicators Best Confirm the Megaphone Pattern?

Because the Megaphone pattern is defined by instability, trading it based on price action alone can be risky. Combining the pattern with volume indicators and other technical tools adds a necessary layer of “confluence” to filter out false moves.

6.1. Volume Spike & Volatility Expansion

Volume is the primary “lie detector” for this pattern. Unlike standard triangles where volume dries up, volume in a megaphone often increases as the range widens.

You must see a significant volume spike on the breakout candle. If the price breaks the trendline on low volume, it is highly likely to be a trap.

6.2. RSI Divergence

Oscillators like the RSI Relative Strength Index are perfect for trading the “reversal strategy” at the top or bottom of the megaphone.

Look for divergence. For example, as price makes a higher high at the upper trendline, check if the RSI is making a lower high. This disagreement signals that the buying momentum is exhausted, confirming a high-probability short entry.

6.3. EMA Trend Confirmation

Moving averages help you keep the bigger picture in mind so you don’t get lost in the pattern’s noise.

Use the 200-period EMA to determine the dominant trend. If the megaphone forms above the 200 EMA, you should bias your trades toward a bullish breakout (megaphone bottom). If it forms below, look for bearish continuations.

6.4. ATR for Stop Loss Calculation

Since this pattern represents extreme volatility, using a fixed stop-loss (like “20 pips”) is dangerous and will likely get you stopped out prematurely.

Use the Average True Range (ATR) to calculate a dynamic stop-loss. Placing your stop at 1.5x or 2x the current ATR value ensures your trade has enough room to withstand the wild swings typical of a Broadening Formation.

7. What Do Real Megaphone Pattern Examples Look Like?

Seeing the pattern in theory is one thing, but spotting it in a live, messy market is another. Here are three real-world examples of how this pattern appears across different asset classes.

7.1. Megaphone Top on S&P 500

The S&P 500 often forms this pattern at the end of a multi-year bull run. After a long rally, the index begins to make higher highs but simultaneously suffers sharp, deep corrections (lower lows). This expanding volatility indicates that investors are nervous. Eventually, the price breaks decisively below the lower trendline, triggering a major correction or bear market.

7.2. Megaphone Bottom on Bitcoin

Crypto markets are highly emotional, making them perfect for Megaphone Bottoms. During a crypto winter, Bitcoin price action often becomes erratic. It crashes to new lows but then rallies aggressively to higher peaks within the downtrend. A final breakout above the upper trendline often signals that the “accumulation” phase is over and a new bull run is beginning.

7.3. Megaphone in Forex Pairs (EUR/USD)

In Forex trading, megaphone pattern often appears on intraday charts (like the 1-hour) during weeks with heavy news flow. Ahead of a major central bank announcement, the EUR/USD pair tends to whipsaw, expanding its range as traders speculate on the outcome. Intraday traders use this expanding range to “fade” the moves, selling the highs and buying the lows, until the news is released and a breakout occurs.

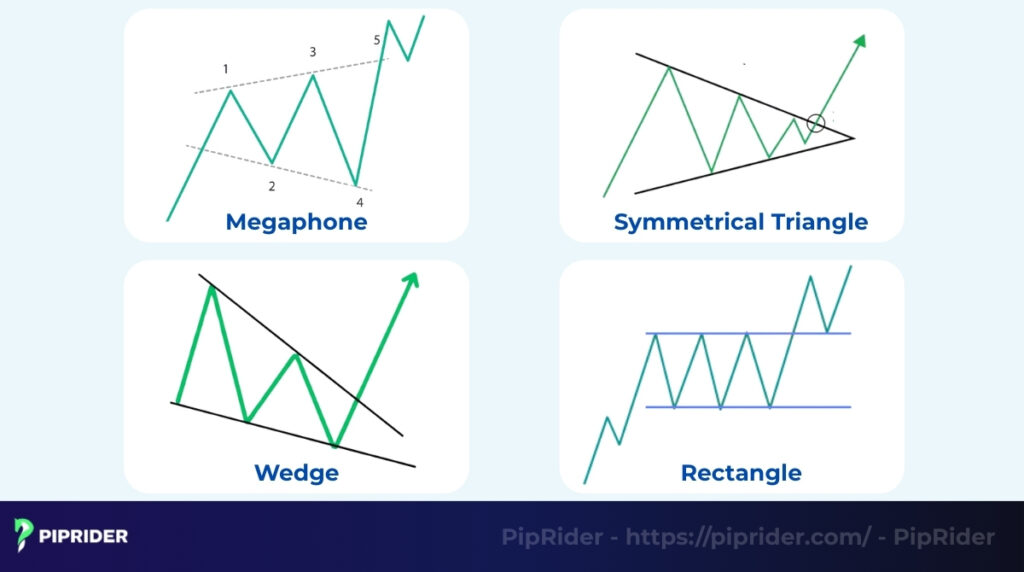

8. Megaphone Pattern vs. Other Chart Patterns

It is easy to confuse the Megaphone with other consolidation patterns. However, recognizing the difference is critical because they signal opposite market psychologies.

Here is a quick cheat sheet:

| Pattern | Shape | Volatility | Meaning |

| Megaphone | Expanding (<) | Increasing | Chaos / Confusion |

| Symmetrical Triangle | Contracting (>) | Decreasing | Coiling / Pausing |

| Wedge | Converging (Sloped) | Decreasing | Trend Exhaustion |

| Rectangle | Parallel (=) | Stable | Indecision / Waiting |

8.1. Megaphone vs. Symmetrical Triangle

These two patterns are exact opposites.

A symmetrical triangle represents a market that is calming down. Price coils into a tighter and tighter range (lower highs + higher lows). In contrast, a megaphone represents a market losing control, with the range exploding outward.

8.2. Megaphone vs. Wedge (Rising/Falling)

Wedges and megaphones both signal potential reversals, but their shapes tell a different story.

A wedge has two trendlines that slope in the same direction (e.g., both sloping up in a Rising Wedge) and converge. A megaphone has trendlines that slope in opposite directions and diverge.

8.3. Broadening Formation vs. Rectangle

Rectangles are much safer and easier to identify than broadening formations.

A rectangle features clear, horizontal support and resistance lines. It shows stability. A broadening formation tilts and expands, showing that neither support nor resistance is holding firm.

9. What Are Common Mistakes When Trading Megaphone Pattern?

The megaphone pattern is dangerous for inexperienced traders because its volatility invites bad habits. Most losses occur not because the pattern failed, but because the trader entered too early or ignored the warning signs.

- Trading inside the range: The middle of a Megaphone pattern is a “high volatility zone” with no clear trend. Entering trades here often leads to being stopped out by sharp, random price spikes. It is safer to trade near the boundaries or wait for a breakout.

- Not waiting for confirmation: Impatience is costly. Traders often anticipate a breakout and buy before the candle closes. If the price reverses at the last second, they are trapped in a false breakout. Always wait for a daily or 4-hour candle to close outside the trendline.

- Confusing the pattern: Beginners sometimes mistake a simple trendline channel for a Megaphone. Remember, the key identifier is that the trendlines must diverge (open up). If they are parallel, it is a channel, not a Megaphone.

- Ignoring volume: A breakout without volume is often a trap. If the price breaks the upper trendline but volume is low or decreasing, it suggests the “Smart Money” is not supporting the move, and a reversal is likely.

10. Which Scanners and Tools Can Spot Megaphone Patterns?

Spotting these patterns manually takes practice. Fortunately, modern trading platforms offer automated tools to detect them for you.

- TradingView (auto-pattern detection): TradingView features a built-in indicator library called “Chart Patterns.” You can simply search for and add the “Broadening Formation” indicator, which will automatically highlight valid Megaphone patterns on your chart in real-time.

- TrendSpider (AI scanner): This platform is built for automation. Its AI-powered “Market Scanner” allows you to search through thousands of stocks instantly for specific chart geometries, including the “Broadening Wedge,” eliminating hours of manual work.

- MT4/MT5 (custom indicators): While MetaTrader doesn’t include this tool by default, its community is vast. You can download custom “Broadening Pattern Indicators” from the MQL5 marketplace and install them to receive alerts whenever the pattern forms on your chosen pairs.

11. Frequently asked questions about Megaphone Pattern

Traders often ask about the pattern’s directional bias, its reliability compared to other charts, and the best timeframes to trade it. Here are the answers to the most common questions.

12. Conclusion

The megaphone pattern is a powerful warning signal that market volatility is about to explode. While it can be chaotic, waiting for a decisive breakout confirmed by high volume transforms this instability into a high-probability trading opportunity.

To maximize your success, always combine this pattern with other indicators like RSI, EMA, and Volume Profile for confluence to make better trading decisions. Before risking real capital, make sure to test these strategies on a demo account. Ready to master more trading patterns? Explore the comprehensive trading guides available at Piprider.