Mistakes such as buying near market tops or selling near bottoms often occur when traders confuse strong price movement with a sustainable trend. The RSI Relative Strength Index is a powerful momentum tool created to mitigate this problem. Developed by J. Welles Wilder Jr., the RSI acts as a momentum gauge, effectively signaling when an asset’s price is entering an overbought or oversold state.

This comprehensive guide will provide everything needed to master the RSI, from its formula and advanced strategies to the key limitations and mistakes to avoid.

Key Takeaways

- RSI is a momentum tool that measures the speed and magnitude of a security’s price change on a 0-100 scale.

- The main signals are generated when RSI indicates an extreme market state.

- Trading with RSI divergence is one of the most powerful advanced techniques.

- The standard 14-period setting is the best for starting and mastering this indicator.

- RSI is a confirmation tool, not a standalone trading system, and is most effective when used with key price levels.

1. What is the RSI Relative Strength Index?

The RSI, short for Relative Strength Index, is a technical indicator designed to measure the velocity and change in price. In simple terms, this tool helps traders identify when an asset is potentially overextended to the upside or downside, making it a powerful part of any analytical framework.

The RSI was created by the brilliant engineer and analyst J. Welles Wilder Jr. and first detailed in his 1978 book, New Concepts in Technical Trading Systems (Wilder, 1978; Investopedia, 2025). In the decades since, it has grown to be one of the most popular technical tools globally, featured on every charting platform from TradingView to MT4 (Wikipedia, 2025; TradingView, n.d.).

The core purpose of the RSI is to gauge the internal strength of a trend. The indicator functions by contrasting the size of an asset’s recent positive price with the size of its recent negative ones, then charting the outcome on a 0-to-100 scale.

The price chart tells what is happening; the RSI indicator tells how much power is left in the tank. When the price climbs higher but the RSI fails to follow, it serves as a critical warning that the underlying trend is losing power and may soon reverse.

2. How to calculate the Relative Strength Index?

Traders absolutely do not need to calculate the RSI Relative Strength Index by hand, the charting software does it instantly. However, taking a moment to understand the logic behind its formula is what separates traders who use it blindly from those who truly understand what it’s telling them.

2.1. The formula

At its core, the RSI is built from two main parts. It first calculates a value called ‘Relative Strength‘ (RS), then plugs that value into the main RSI formula to normalize it on a 0-100 scale.

Here are the formulas:

| RS = Average Gain / Average Loss |

| RSI = 100 – [100 / (1 + RS)] |

The “Average Gain” and “Average Loss” are calculated over a specific number of periods, which is almost always set to 14 by default. Traders can also add tools like VWAP and volume analytics to get a more complete picture of price behavior.

2.2. The calculation process in simple steps

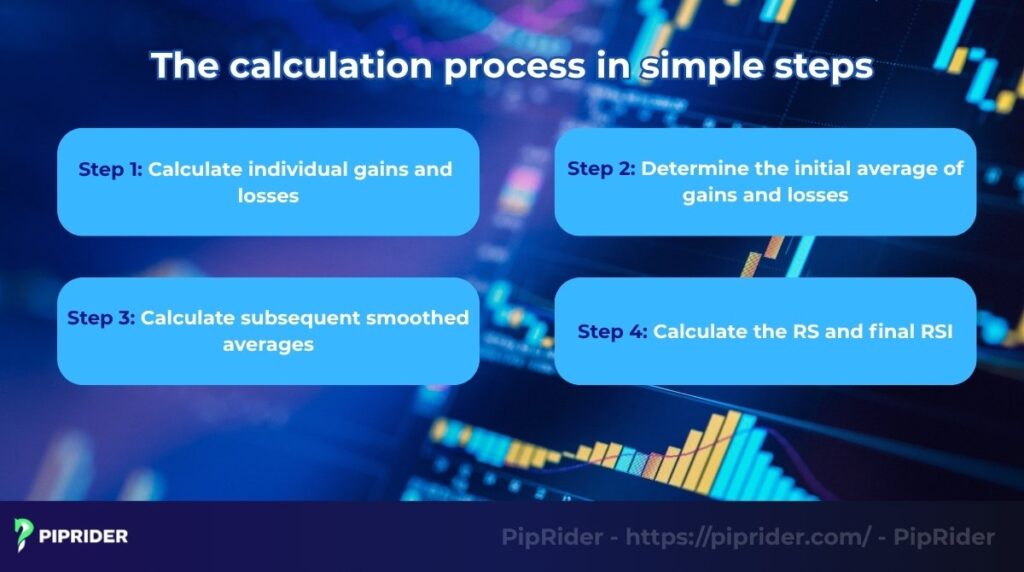

Let’s break down how your computer thinks when it calculates the RSI Relative Strength Index. Understanding this process helps you appreciate why it’s such a robust tool.

Step 1: Calculate individual gains and losses

The calculation begins by examining the price change over the past 14 periods (e.g., the last 14 days). It then separates these into two lists: one for periods that closed with a gain, and one for those that closed with a loss.

Step 2: Determine the initial average of gains and losses

For the initial calculation, it simply averages all entries from the two lists.

Step 3: Calculate subsequent smoothed averages

This is the clever part that J. Welles Wilder Jr. designed. For every new period after the first one, the indicator uses a smoothing formula. This approach places greater emphasis on the latest data points, giving it a character similar to an exponential moving average.

Step 4: Calculate the RS and final RSI

An average gain is divided by an average loss to yield the RS value, which is then plugged into the main formula for the final RSI number you see on the chart.

2.3. A practical example

Let’s make this real with some simple numbers. Imagine we are looking at the last 14 days for the EUR/USD pair.

- After the smoothing process, let’s say the indicator calculates that the average gain over the last 14 days was 20 pips.

- In that same period, the average loss was only 5 pips.

Now, we just plug those into the formula:

- First, we find the RS:

| RS = 20 pips (Average Gain) / 5 pips (Average Loss) = 4 |

An RS value of 4 is very strong. It tells us that, on average, the bullish moves have been four times stronger than the bearish moves recently.

- Then, we calculate the final RSI:

| RSI = 100 – [100 / (1 + 4)] = 80 |

An RSI reading of 80 is a clear signal of powerful overbought momentum.

3. Understanding RSI levels and market conditions

This is the primary function of the RSI Relative Strength Index and the first thing every new trader learns. The indicator’s 0-100 scale is divided into three key zones that help you quickly gauge the market’s state.

3.1. The classic 70/30 levels

The standard and most widely accepted levels were set by Wilder himself. Understanding the meaning of these levels is your first step to interpreting the indicator correctly.

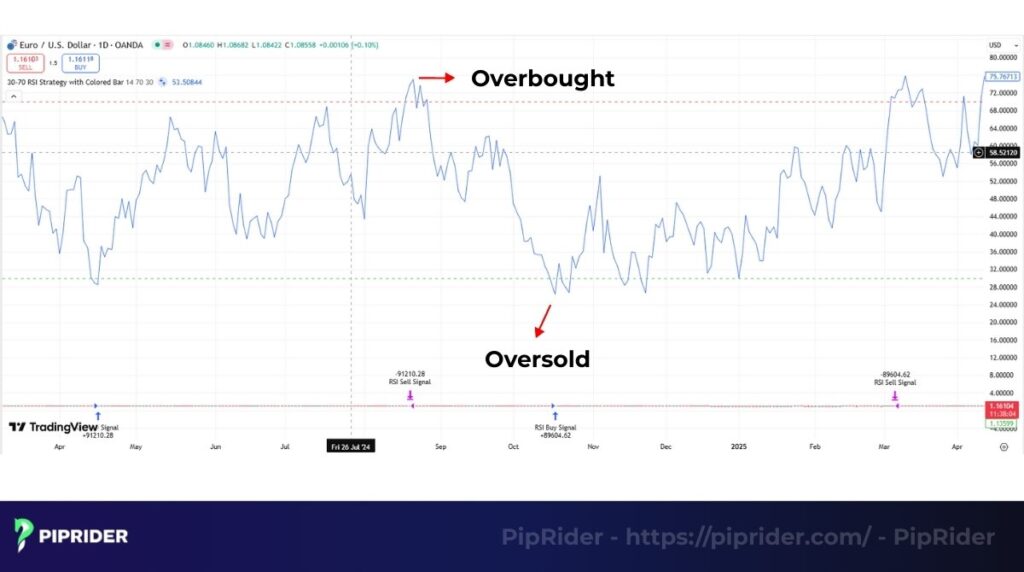

- The chart above shows that an RSI reading that climbs above the 70 mark indicates a state of extreme buying pressure. It’s crucial to understand that this is not a guarantee that the price will reverse right away. It’s better to think of this as a warning sign that the overbought momentum is reaching an extreme, and the trend may be overextended and vulnerable to a corrective pullback.

- Conversely, when the RSI falls below the 30 level, the market is deemed to be in an oversold state. This suggests that bearish pressure has been intense and that the move might be running out of steam. Again, this is a warning, not an automatic trading decision.

3.2. A critical mistake to avoid

One of the single biggest mistake new traders make is to immediately sell the moment the RSI crosses 70, or buy the moment it crosses 30. This is a recipe for disaster.

In a very strong, powerful bullish trend, the RSI can enter the extreme zone and stay there for a very long time as the price continues to grind higher. If you automatically sell every time the RSI shows a high reading in a strong uptrend, you risk being steamrolled by the prevailing trend.

3.3. An advanced tip: Adjusting levels for the trend

This is a professional technique that can dramatically improve your RSI analysis. Instead of always using 70/30, you can adjust the levels based on the primary trend to get more relevant signals.

- In a strong bullish trend: The market will naturally have stronger momentum. In this case, adjust the levels to 80 and 40. The 80 level becomes the new, more reliable overbought signal, and the 40-50 zone often acts as a key area for the RSI during pullbacks.

- In a strong downtrend: The opposite is true. You should adjust the levels to 60 and 20. The 20 level becomes the new oversold signal, and the 50-60 zone often acts as a key area for the RSI during minor rallies.

By adapting your levels to the market’s current personality, you move from a rigid, one-size-fits-all approach to a more dynamic and intelligent form of analysis.

4. RSI trading strategies

Knowing the levels is one thing, but building a disciplined strategy around them is what truly matters in trading. Without a clear set of rules, an indicator is merely a meaningless line on your screen. This requires a robust risk management plan.

Let us walk you through two of the most powerful ways we personally use the RSI Relative Strength Index to find high-probability trade setups.

4.1. The trading strategy

This is the market giving you a subtle whisper that the current trend is getting tired and may be about to change course.

The chart shows that the RSI divergence strategies include: bullish divergence and bearish divergence

4.1.1. Bullish Divergence (high-quality buy signals)

A bullish pattern is identified as price on the chart forms a lower low, but the RSI indicator concurrently carves out a higher one.

This indicates a textbook signal that bearish selling momentum is becoming exhausted. Even though it fell to a new low, the momentum behind that final push was significantly weaker, suggesting sellers are exhausted.

The strategy:

- Spot the pattern: Identify a clear situation where price forms a new low while the RSI simultaneously registers a higher one.

- Wait for confirmation: This is a step most beginners skip and where they lose money. Do not commit to a trade yet. Wait for price action itself to confirm the reversal by a clear break of a descending trendline or the formation of a strong candle pattern.

- Entry: Enter the trade after the confirmation signal has occurred.

- Stop loss: Position your stop loss just underneath the absolute low point of the move.

- Take profit: A logical first target is the nearest significant support level.

4.1.2. Bearish Divergence (high-quality sell signals)

In this opposite scenario, price establishes a new higher high, but the RSI indicator does not follow, instead forming a lower one.

This is a major red flag indicating that buying momentum is fading. The final push to a new high was weak and not supported by the same force as before, signaling that buyers are running out of steam.

The strategy:

- Spot the pattern: Find the situation where price makes a higher high while the RSI forms a lower one.

- Wait for confirmation: Wait for price to break below a key short-term level or an ascending trendline. This confirms that the trend is actually turning.

- Entry: Enter a sell order after the price has confirmed the break in structure.

- Stop loss: Your stop loss should be placed just beyond the absolute peak of the move.

- Take profit: Target the nearest significant resistance level.

4.2. Using RSI for entry and exit signals

This is a practical and effective way to use the RSI for managing your trades. This approach focuses on using extreme levels within a specific market context.

Using RSI as an exit signal

- In the context of a confirmed, strong uptrend, if you are in a long (buy) position and see the RSI push above 70, this is a strong prompt to consider taking some profits.

- This signal does not mean the trend will reverse immediately, but it does indicate that the move is getting overextended and a pullback is becoming more likely.

Using RSI as an entry signal

- For this signal to work effectively, the most critical condition is that the market must be in a clear, defined trend.

- For example, in a strong uptrend, when price makes a temporary pullback, the RSI may quickly fall to the oversold zone (below 30).

The high-probability entry signal then appears when the RSI crosses back up above the 30 line, confirming that the temporary retreat is likely over and the main trend is resuming.

5. Best RSI settings for different trading styles

What is the setting for the RSI Relative Strength Index? The honest answer is that there is no single “best” setting, but there are smarter settings depending on your trading style and goals.

The only parameter you can change is the ‘period’, which is the lookback window for the calculation. The default of 14 periods was chosen by Wilder himself and has become the industry standard for a reason. For most traders, especially when you are starting out, you should master the 14-period RSI first.

With experience, however, you can modify the period to increase or decrease the indicator’s sensitivity. A shorter period makes it faster and more sensitive, while a longer period makes it slower and smoother.

Here is a simple table to guide your adjustments based on your trading style.

| Trading style | Common RSI period | Logic and purpose |

| Scalping | 2 to 6 | Needs to be extremely sensitive to very small, immediate price changes. The goal is to catch tiny momentum shifts. |

| Day trading | 7 to 11 | A slightly faster setting than the default to capture momentum shifts within a single trading day. |

| Swing trading | 14 (Standard) | This is the traditional and most widely used setting. It’s the perfect balance for analyzing trends that last several days to weeks. |

| Position trading | 21 to 30 | Needs to be very slow and smooth to filter out all short-term market noise and focus only on the major, primary trend. |

Key takeaway: Don’t endlessly search for a “magic” setting. A shorter setting will always give more signals, but most will be false. A longer setting will give fewer signals, but they will generally be more reliable. Choose the setting that best fits the timeframe you are trading.

6. RSI advantages and limitations

Like any tool in a trader’s toolbox, the RSI is incredibly useful for certain jobs but completely wrong for others. Understanding its strengths and, more importantly, its weaknesses is critical for using it effectively and avoiding costly mistakes.

6.1. The advantages of the RSI

When used correctly, the RSI offers some clear and powerful benefits that have made it a favorite among traders for decades.

- Clarity in defining market extremes: The 0-100 scale with classic 70/30 thresholds provides an easy-to-read, objective gauge of overbought and oversold conditions, helping prevent you from chasing an overextended move.

- Reliability of signals: This is one of the most reliable early warning signals that a trend is losing momentum. Catching this pattern at a key price level is a true A+ trading setup.

- Extreme versatility: The RSI can be effectively applied to any financial market, including forex, stocks, and crypto, and it functions on all timeframes.

6.2. The limitations of the RSI

Now for the reality check. Believing the RSI Relative Strength Index is a foolproof, standalone system is a dangerous mindset. Here are its most significant weaknesses.

- Susceptibility to false signals: As a “leading” indicator that tries to predict reversals, it will inevitably be wrong at times. In a strong trend, it often gives a premature signal that gets ignored by the market, which is why it must be confirmed with other tools.

- The persistence of extreme conditions: This is the most important limitation to understand. In a powerful, runaway bullish trend, the RSI can remain in the overbought zone for a long time as the price continues to climb. Selling simply because the RSI is “high” is a classic beginner’s mistake.

- Subjective signal interpretation: While the 70/30 levels are fixed, interpreting a pattern can be subjective. What one trader sees as a clear signal, another might see as just a minor wiggle, which is why having a clear, rule-based definition for the signals you trade is so important.

7. RSI vs. MACD vs. Stochastic: Which indicator is better?

Debating which indicator is “best” (RSI, MACD, or Stochastic) is unproductive, as they are specialized tools designed for different jobs. Effective analysis depends on understanding the unique strengths of each tool. Using an indicator outside of its intended purpose leads to errors.

Traders should supplement these core tools with other analyses, like VWAP or Pivot Points, to add depth and confirmation, especially in ranging markets.

Here is a simple breakdown to help you quickly understand the role of each indicator.

| Feature | RSI (Relative Strength Index) | MACD (Moving Average Convergence Divergence) | Stochastic Oscillator |

| Classification | Momentum Tool | Trend-Following momentum indicator | Oscillator Tool |

| What it measures | The speed and magnitude of recent price changes. | Illustrates the relationship between two moving averages to show trend and momentum. | Compares the current price to its recent high-low range. |

| Measurement scale | Fixed Range (0 to 100) | No Fixed Range | Fixed Range (0 to 100) |

| Primary signals | overbought (70) / oversold (30) levels, signals. | Signal Line Crossovers, Zero Line Crossovers. | overbought (80) / oversold (20) levels, Crossovers. |

| Responsiveness | Balanced speed. | The slowest and most smooth of the three. | The fastest and most sensitive of the three. |

| Best used for | Identifying overbought/oversold conditions and spotting major bullish or bearish signals. It’s a great all-rounder. | Validating the power and trend direction of a new or ongoing trend. | The preferred tool for finding potential short-term turning points when there is no clear market trend. |

| Recommendations | A go-to tool for a general read on market health and for spotting major bearish or bullish signals before a reversal. | The primary tool for confirming that a trend has enough momentum to be worth trading. | The preferred tool for finding potential short-term turning points when there is no clear market trend. |

The key takeaway is this: you don’t need to choose just one. A powerful trading system often involves using two of these indicators together. For example, you might use the MACD to confirm the primary trend and then use the Stochastic to time your entry on a pullback.

8. Frequently asked questions (FAQs)

Here are some quick, no-nonsense answers to the questions I hear most frequently about the RSI.

9. Conclusion

The RSI Relative Strength Index is a timeless and essential tool for technical traders, providing a clear window into market momentum and health. Its primary value lies not as a standalone system, but as a confirmation tool.

The most reliable signals, whether from overbought/oversold levels or divergence patterns, are those that confirm existing price action at key market levels. Mastering the RSI is key to moving from reacting to price to confidently anticipating potential market turning points.

To continue your journey, explore more advanced trading stratrgies guides in our Learn Forex category right here on Piprider.