Maintaining discipline and avoiding costly errors are critical elements for sustainable success in trading. A trading checklist serves as an essential risk management and execution tool to achieve this consistency.

This article introduces a comprehensive, 10-step checklist of critical steps. Implementing this pre-trade checklist helps traders systematically verify all market conditions and strategic criteria, significantly improving trade execution quality and overall success rates.

Key Takeaways

- A trading checklist helps traders maintain discipline and minimize emotion-based trading.

- An effective checklist covers market analysis, trade setup, risk mitigation plan, and trading psychology.

- A trader can customize their checklist for forex, stocks, crypto, or any other market.

- Applying a checklist consistently improves performance and fosters disciplined execution through ongoing education.

- The simpler a checklist is, the easier it is to implement in real trading scenarios, requiring a healthy time investment.

1. What Is a Trading Checklist and Why Is It Essential?

A trading checklist is a trader’s personalized set of criteria that must be met before, during, and after executing a trade. Much like a pilot’s pre-flight checklist, its purpose is to ensure no critical steps are missed and that every action is deliberate and systematic.

Why Every Trader Needs a Checklist?

The benefits of implementing a trading checklist are fundamental to a trader’s success and mental well-being:

- Enforces discipline & consistency: It helps control emotion in trading, such as fear or greed, from the emotional decision-making process. This systematic approach prevents impulsive trades and ensures every position aligns with a well-defined strategy. It cultivates crucial emotional control.

- Boosts confidence: Trading based on a clear plan, rather than gut feeling, builds trust in one’s own decisions, enhancing motivation.

- Reduces errors: By verifying a set of objective rules, a trader avoids common mistakes like forgetting to set stop-loss orders or ignoring key market indicators.

The Professional’s Edge

Professional traders understand that long-term profitability comes from a repeatable process, not from sporadic wins. A trading checklist is the tool that codifies this process. For them, it’s a non-negotiable instrument for professional execution and a robust risk mitigation plan. It’s built upon solid market insight.

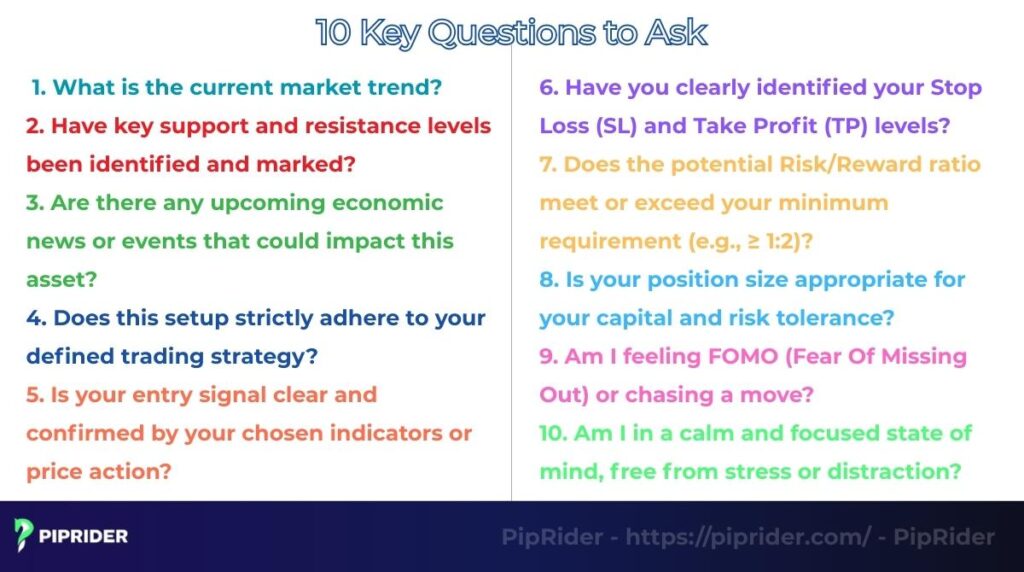

2. Pre-Trade Checklist: 10 Key Questions to Ask

Before a trader even considers placing an order, a thorough pre-trade analysis is crucial. This phase focuses on assessing the market environment and ensuring all fundamental and technical conditions align with a predefined strategy. Here are essential questions to integrate into your checklist:

2.1. Market Analysis

This section ensures a trader understands the broader market context and potential influences before committing to a trade.

What is the current market trend?

Is the market in an uptrend, downtrend, or trading sideways? Are there signs of a potential breakout or reversal? Understanding the prevailing trend helps a trader to trade with the market’s momentum.

Have key support and resistance levels been identified and marked?

Knowing these critical price areas helps in anticipating potential reversals or breakouts and is fundamental for setting accurate stop-loss orders and take-profit targets.

Are there any upcoming economic news or events that could impact this asset?

Check the economic calendar for high-impact news releases (e.g., interest rate decisions, inflation reports, employment data, geopolitical events, corporate announcements). These events can cause significant market volatility and invalidate even the best technical setups.

2.2. Trade Setup

Once a trader has a grasp of the market context, the next step is to evaluate the specific conditions for their trade entry. This ensures their setup aligns with their predefined strategy.

Does this setup strictly adhere to your defined trading strategy?

Before entering, confirm that the current market conditions and price action precisely match the criteria outlined in personal trading plan. Avoid “forcing” a trade that doesn’t fully qualify. Consider chart trading patterns for confirmation.

Is your entry signal clear and confirmed by your chosen indicators or price action?

Are you seeing strong confirmation from your preferred tools (e.g., clear crossover on RSI or MACD, a definitive price action pattern like an engulfing bar or pin bar)? A weak or ambiguous signal should be a red flag. Using price notifications on your trading platform can help.

2.3. Risk Management

This is arguably the most critical part of a trader’s pre-trade checklist. Effective risk management protects capital and ensures the longevity of their trading career.

Have you clearly identified your Stop Loss (SL) and Take Profit (TP) levels?

Before entering, know exactly where you will exit the trade if it moves against you (maximum acceptable loss) and where you aim to secure your profits. These should be based on technical analysis and form a clear exit plan.

Does the potential Risk/Reward ratio meet or exceed your minimum requirement (e.g., ≥ 1:2)?

Calculate the potential profit versus potential loss for this specific trade. Ensuring a favorable risk-reward ratio helps ensure that even with a win rate below 50%, a trader can still be profitable.

Is your position size appropriate for your capital and risk tolerance?

Never risk more than a small percentage (e.g., 1-2%) of your total trading capital on a single trade. This involves calculating the correct trade sizes based on your stop-loss distance and account equity to manage potential drawdown effectively.

2.4. Psychology Check

Even with the best technical setup and risk management, emotions can derail a trade. This crucial step helps ensure a trader’s mental state is optimized for objective decision-making. Ask yourself 2 questions below:

Am I feeling FOMO (Fear Of Missing Out) or chasing a move?

If a trader feels an urgent need to jump into a trade because they’re afraid of missing out on potential profits, they should step back. FOMO often leads to impulsive entries at suboptimal prices, increasing the risk of loss and is a classic example of poor emotion-based trading.

Am I in a calm and focused state of mind, free from stress or distraction?

Never trade when you’re tired, stressed, angry, or overly excited. Emotional states impair judgment. Ensure you are well-rested, mentally clear, and have sufficient time commitment to focus solely on your analysis and execution. If not, it’s better to step away from the charts.

3. Sample Trading Checklist

To make it easier to apply these concepts, here is a practical, printable checklist template. You can use this as a starting point and customize it to fit your specific strategy and market. Remember, “If it’s not checked, it’s not a trade.”

| Checklist Item | Yes/No | Notes |

| Market Analysis | ||

| Trend direction confirmed | ☐ | (Uptrend/Downtrend/Sideways, considering sector performance) |

| Key support and resistance marked | ☐ | (Clear levels identified on the chart, confirmed by chart patterns) |

| Major economic news/events checked (upcoming within 2-4 hours) | ☐ | (No high-impact news against your trade direction) |

| Trade Setup | ||

| Setup matches trading plan | ☐ | (Specific criteria for entry met, based on market knowledge) |

| Entry signal clear (e.g., Price Action, RSI, MACD) | ☐ | (Strong confirmation of signal, potentially using price alerts) |

| Risk Management | ||

| Stop-loss orders placed | ☐ | (Clearly defined exit point for loss) |

| Take Profit placed (part of exit strategy) | ☐ | (Clearly defined target for profit) |

| Risk-reward ratio ≥ 1:2 | ☐ | (Potential gain at least twice potential loss) |

| Position sizes correct (e.g., max 1-2% risk of capital) | ☐ | (Calculated based on SL and account size, key for risk management strategy) |

| Psychology Check | ||

| No emotional decision-making (FOMO, revenge, overconfidence) | ☐ | (Calm, objective, following the plan, demonstrating emotional discipline) |

Feel free to print this table or copy it into a digital format to use before every single trade you execute. This will be a valuable input for your trading diary.

4. How to Customize Your Trading Checklist

A trading checklist is not a one-size-fits-all solution; it’s a dynamic tool that should evolve with a trader’s experience and adapt to their specific trading environment. Customization is key to making it truly effective for their strategy.

4.1. Adapt to Your Market: Forex vs Stocks vs Crypto

The specifics of a market will influence certain checklist items, particularly in the “Market Analysis” section.

- Forex trading: A trader might emphasize checking for central bank announcements, interest rate decisions, and intermarket forex pair correlations.

- Stocks: Focus on earnings reports, company news, industry trends, and overall stock market indices (e.g., S&P 500), considering industry trends.

- Crypto: Pay attention to blockchain news, regulatory updates, project developments, and social sentiment, as price fluctuations can be extreme. Requires strong market insight.

4.2. Tailor to Your Trading Style: Scalping vs Swing Trading

A trader’s chosen timeframe and holding period will also dictate which aspects of the checklist are most crucial.

- Scalping: For ultra-short-term trades, a checklist might focus heavily on micro price action on very low timeframes (e.g., 1-minute scaping strategy), tight spreads, and immediate volume confirmation. Emotional checks are even more vital due to the fast pace and intense time investment.

- Swing Trading: This style, involving holding trades for days or weeks, requires more emphasis on daily/weekly trends, larger support/resistance zones, and potentially more in-depth fundamental analysis for sustained moves.

- Position Trading: For long-term trades (weeks to months), a checklist will lean heavily on macroeconomic factors, fundamental strength, and significant long-term technical levels, with less focus on intraday noise.

4.3. Adjust Your Checklist to Your Personal Style & Experience

A trader’s checklist is a reflection of their trading journey.

- Start simple: As a beginner, keep it concise (5-7 items) to avoid overwhelming oneself. Focus on the absolute essentials like risk mitigation plan and trend identification. This builds emotional control.

- Add complexity gradually: As a trader gains experience and thrives on continuous learning, they can add more nuanced items, such as specific indicator confluence, advanced technical analysis patterns, or refined exit plan criteria.

- Learn from your trading journal: Regularly review your trading journal. If recurring mistakes are noticed (e.g., forgetting to check news, entering against a major trend), add a specific item to your checklist to address that weakness. A checklist should be a living document that constantly improves decision-making, fueled by drive.

5. Common Mistakes Traders Make Without a Checklist

Without a structured process, traders are highly susceptible to a series of costly, unforced errors. A checklist is specifically designed to prevent these common mistakes:

- Overtrading: A checklist forces a trader to wait for high-quality setups that meet all predefined criteria. Without it, the temptation to trade out of boredom or to chase small, insignificant moves can lead to taking too many low-probability trades.

- Forgetting to set stop-loss orders: In the excitement of seeing a setup, it is easy to forget the most critical risk mitigation plan step. A checklist makes setting stop loss orders a mandatory part of the process, ensuring no trade is ever entered without a defined safety net.

- Making emotional decisions: A checklist replaces subjective feelings (“I think the price will go up”) with objective facts (“Does the setup meet my 5 specific rules?”). It acts as a logical barrier against impulsive decisions driven by FOMO or a desire to “win back” a previous loss.

- Ignoring high-impact news: A perfect technical setup can be instantly invalidated by a major economic data release. A checklist item requiring a quick look at the calendar can prevent a trader from unknowingly entering a position just moments before extreme price fluctuations. This requires solid market insight.

6. Frequently Asked Questions (FAQs)

7. Summary: Elevate Your Trading with a Personal Checklist

A trading checklist is far more than just a list of items to tick off; it’s a powerful instrument for instilling emotional control, safeguarding capital through a robust risk mitigation plan, and optimizing returns.

By consistently applying a checklist before every trade, traders can ensure strict adherence to their defined strategy, effectively mitigate risk, and significantly improve their long-term trading performance and disciplined execution. It transforms reactive, emotion-based trading into proactive, strategic actions, supported by ongoing education.

To further enhance your trading knowledge and explore more advanced strategies and insights, we invite you to visit the Trading Strategies category on Piprider.