When answering the question who is David Tepper, three roles usually come to mind: a billionaire hedge fund manager, the legendary founder of Appaloosa Management, and the owner of the Carolina Panthers. Famous for his bold contrarian bets, especially on distressed debt during market panic, Tepper, a Pittsburgh native, has built one of the most successful investment records in history.

This article will explore his biography, tracing his journey from the University of Pittsburgh to his current status. It also examines the investment philosophy that made him billions and the key lessons traders can learn from him.

Key Takeaways

- An American investor and founder of the famed hedge fund Appaloosa Management.

- A master of distressed debt and contrarian investing, famous for buying when markets are in panic.

- Earned billions by buying bank stocks (like Bank of America) at deep crisis lows during 2008-2009.

- His net worth is estimated in the tens of billions, consistently placing him among the world’s richest fund managers.

- He is the owner of the Carolina Panthers (NFL) and Charlotte FC (MLS), answering what does David Tepper own.

- Success comes from deep fundamental analysis combined with the psychological courage to act against the crowd.

David Tepper: Quick Facts

| Category | Details |

| Full Name & Birth | David Alan Tepper (Born September 11, 1957) |

| Firm Founded | Appaloosa Management (1993) with ~$57 million initial capital |

| Investment Style | Distressed debt investing & Contrarian crisis bets |

| Sports Ownership | Carolina Panthers (NFL) – Acquired for ~$2.275 billion (2018) Charlotte FC (MLS) |

| Current Status | Transitioning Appaloosa toward a Family Office structure (Announced 2019) |

1. David Tepper’s Biography

David Tepper was born in Pittsburgh, Pennsylvania, in 1957. His early life in a working-class family defined his drive. His biography is a classic American success story, defined by intelligence and an ability to spot opportunities where others see only risk.

He earned his Bachelor of Arts in economics from the University of Pittsburgh before getting his MBA from Carnegie Mellon University. This formal education laid the foundation for his business career.

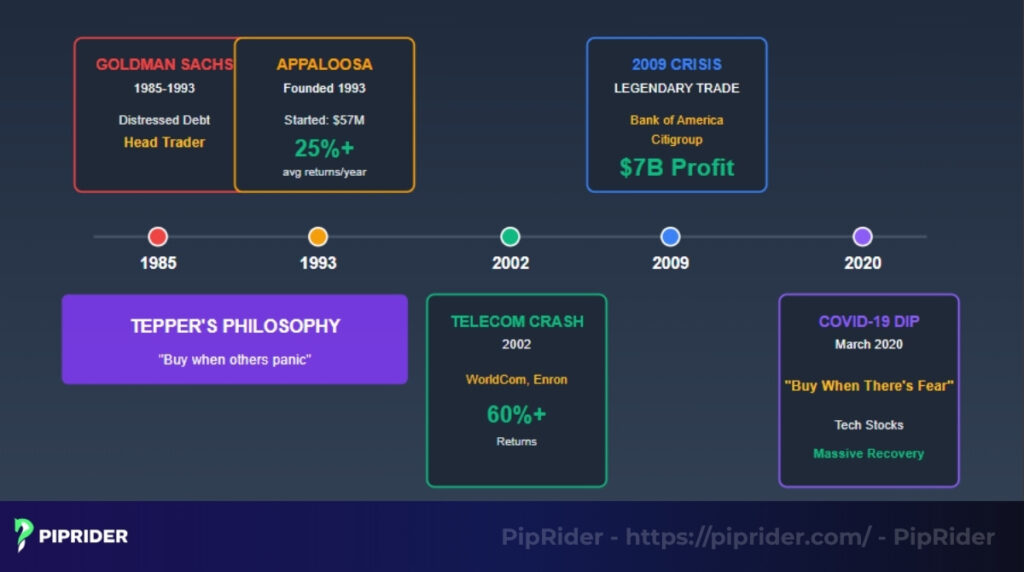

Tepper’s early career included roles at Republic Steel and Keystone Mutual Funds. His big break came in 1985 when he joined Goldman Sachs. There, he quickly became the head trader for the high-yield desk, specializing in distressed debt and bankruptcies. After being famously passed over for partnership, Tepper left Goldman.

In 1993, he co-founded Appaloosa Management, his own David Tepper hedge fund. He started with $57 million in capital. Through a series of brilliant trades, he quickly built Appaloosa into one of the most successful hedge funds in history, cementing his status as a Wall Street legend (Investopedia, n.d.).

2. What Is David Tepper Known For?

David Tepper is famous in the financial world and beyond for four main reasons. He is widely recognized as the billionaire founder and Chief Investment Officer of Appaloosa Management L.P., one of the most successful hedge fund firms of his generation.

His investment reputation was built on a masterful contrarian strategy, specifically focusing on distressed debt. His philosophy is to buy when others are panicking, famously purchasing the bonds of struggling companies that others believed were worthless.

This strategy has been incredibly successful, leading to his enormous wealth. His net worth is consistently estimated in the tens of billions, placing him among the highest-earning hedge fund managers and wealthiest people in the world.

Finally, answering the common question what does David Tepper own, he is also known to the general public as a prominent sports owner. He is the owner of the NFL’s Carolina Panthers and the MLS soccer team Charlotte FC, which are based far from his native Pittsburgh.

3. Career Timeline and Major Achievements

David Tepper’s career is marked by a series of high-stakes, successful bets that built his reputation as a financial heavyweight.

3.1. Early Years at Goldman Sachs (1985–1993)

After joining Goldman Sachs in 1985, Tepper quickly specialized in distressed debt. This involves buying the bonds of companies that are struggling or near bankruptcy, betting on their potential recovery. He became the head trader for this desk and was highly successful, earning a reputation for his ability to find value where others saw only failure.

3.2. Founding Appaloosa Management (1993)

After being passed over for partnership at Goldman, Tepper left to build his own firm. In 1993, he co-founded Appaloosa Management with Jack Walton. According to Investopedia, the firm launched with roughly $57 million in capital.

Through his focused distressed-debt strategies, the fund achieved one of the most enviable track records in Wall Street history. Major financial outlets like Forbes have reported that Appaloosa generated average annual returns of approximately 25% (net) for its investors over nearly three decades, significantly outperforming the S&P 500.

3.3. Crisis Trades that Built His Reputation

David Tepper’s fame is defined by his massive, contrarian bets during moments of extreme market fear.

The 2009 Financial Crisis (The “Appaloosa Trade”): This was his masterpiece. In early 2009, while the financial system appeared to be collapsing, Tepper aggressively bought the distressed preferred shares and bonds of major banks like Bank of America and Citigroup.

- The Thesis: He correctly reasoned that the US government would not allow these institutions to fail and that the market was pricing them for a liquidation that wouldn’t happen.

- The Result: As the banks stabilized, the trade generated a massive windfall. According to The Guardian (2009), Appaloosa profited by approximately $7 billion that year, with Tepper personally earning an estimated $2.5 billion, cementing his status as a legendary fund manager.

Other Notable Wins

2020 COVID Dip: During the pandemic panic of March 2020, he once again bought heavily into technology stocks, capitalizing on the subsequent V-shaped recovery.

2002 Telecom Debt: Following the dot-com bust, he bought distressed bonds of companies like WorldCom and Marconi, earning triple-digit returns as they restructured.

4. David Tepper’s Investment Philosophy

David Tepper’s investment philosophy is not one-dimensional. It’s a powerful blend of value investing (finding bargains), global macro awareness (understanding the big picture), and strong contrarian conviction. He is famous for taking bold, calculated risks when others are paralyzed by fear.

4.1. Buy When There’s Blood in the Streets

This is Tepper’s most famous principle, inspired by the 19th-century Rothschild quote. He excels at investing during market panics. While most investors are selling in fear, Tepper is analyzing the chaos for opportunities. This strategy requires immense emotional control and deep confidence in one’s own research, which enables him to act on his belief that “the best time to buy is when things look the worst”.

4.2. Master of Distressed Debt and Turnarounds

This is his core specialty. Tepper is an expert at analyzing companies in deep financial trouble, often sifting through bankruptcies and complex debt restructuring. He finds opportunities by buying a company’s bonds or stock for “cents on the dollar” when the market assumes the company will fail. His analysis focuses on whether the company has a viable path to recovery, allowing him to profit massively if and when it turns around.

4.3. Macro-Awareness Is Essential

Tepper doesn’t just buy cheap assets in a vacuum; he connects every trade to the “big picture.” He closely monitors macroeconomic factors like Federal Reserve policy, interest rate shifts, and global capital flows. His 2009 bank trade wasn’t just a bet on cheap stocks; it was a bet that the government’s bailout and stimulus policies would create the necessary environment for those banks to survive and thrive.

4.4. Flexibility and Active Risk Management

Tepper is not dogmatically attached to a single style. He is highly flexible and opportunistic, adapting his strategy to fit the current market. He is willing to hold large amounts of cash, go long on stocks, or bet on bonds, depending on where he sees the best opportunity. He is not a “perma-bull” or “perma-bear,” famously stating that traders must “adapt to the market, not the other way around.” This flexibility is a key component of his risk management.

5. David Tepper’s Net Worth and Charitable Contributions

David Tepper’s Net Worth

As a result of his long-term success at Appaloosa Management, David Tepper has become one of the wealthiest investors in the world. Answering the common question of how much is David Tepper worth, his net worth fluctuates alongside market conditions and the performance of his investments. Publicly available data from the Bloomberg Billionaires Index and Investopedia consistently places his fortune in the top tier of global fund managers, with recent valuations frequently exceeding $20 billion.

Major Philanthropic Contributions

Tepper is also one of the most prominent philanthropists in the financial industry, often donating through his charitable foundation with a focus on education and basic needs.

- Carnegie Mellon University (The Tepper School): His most famous relationship is with his alma mater. In 2004, he donated $55 million (Carnegie Mellon University, 2004), a gift that led to the renaming of the graduate school to the Tepper School of Business. Later, in 2013, he donated an additional $67 million to sponsor the Tepper Quadrangle, a major new hub for campus collaboration (Carnegie Mellon University, 2013).

- Other Causes: He has also given millions to the University of Pittsburgh, Rutgers University, and various organizations focused on food pantries and community relief, particularly during the COVID-19 pandemic.

6. Investment Lessons from David Tepper

David Tepper’s career offers a masterclass for modern investors and traders. His philosophy provides a practical roadmap for navigating volatile markets.

6.1. Stay Rational When Markets Panic

Tepper’s greatest successes came from his ability to remain rational and analytical during widespread panic. While other investors are emotionally selling, he focuses on fundamentals and valuation. The lesson is to trust deep research over the noise of the crowd. He understands that maximum fear creates maximum mispricing, which is the source of the greatest opportunities.

6.2. Study the Macro Environment

He demonstrated the critical importance of understanding the “big picture.” Traders should not just analyze single stocks; they must monitor monetary policy, credit conditions, and inflation, as these macroeconomic factors are what create the major, long-term trends. His ability to anticipate the effects of Federal Reserve actions, for example, is a key part of his success.

6.3. Be Flexible and Opportunistic

Tepper’s success isn’t tied to a rigid “bull” or “bear” label. The lesson is to be flexible and opportunistic, acting on the available data rather than a fixed bias. This flexibility means he is comfortable holding large amounts of cash when no opportunities exist or quickly shifting from long to short positions as the facts of the market change.

6.4. Embrace Risk, But Manage It Intelligently

Tepper is not afraid to take on significant, concentrated risk, but it is always calculated, not blind. He embraces risk when his analysis shows the odds are overwhelmingly in his favor. This teaches the importance of intelligent risk management, which includes using diversification when appropriate but also having the conviction to make large, non-diversified bets when a truly unique opportunity arises.

7. How to Apply David Tepper’s Strategy to Forex Trading

7. How to Apply David Tepper’s Strategy to Forex

While David Tepper is primarily known for equities, his “Global Macro” success is built on understanding liquidity, interest rates, and market psychology—the exact same forces that drive currency pairs.

For Piprider traders, here is the executive checklist before entering a trade:

- Fed Policy: Determine the USD trend bias (Hawkish = Bullish).

- Rate Differentials: Identify the Carry Currency (High Yield) vs. Funding Currency.

- Liquidity Regime: Rotate between Safe Havens (JPY/CHF) and Risk Currencies (AUD) based on panic levels.

- Catalyst: Wait for forced selling or a clear macro trigger.

- Risk Plan: Position size based on volatility.

Here is how to execute these concepts in detail:

7.1. Trade Central Bank Divergence (“Don’t Fight the Fed”)

Tepper’s golden rule has always been to respect the power of central bank liquidity. He never bets against a market that is being supported by the Federal Reserve. In Forex, we apply this by looking for Policy Divergence.

- The Concept: Currency moves are driven by the difference in monetary policy between two nations. You want to buy the currency of the tightening bank and sell the currency of the loosening bank.

- The Forex Setup: Compare the central banks. If the Fed is raising rates (Hawkish) while the Bank of Japan keeps rates negative (Dovish), the fundamental bias for USD/JPY is strongly UP. In this scenario, technical resistance levels are likely to break.

7.2. Master Risk Sentiment (Risk-On vs. Risk-Off)

Tepper is famous for keeping a cool head and “buying when there is blood in the streets.” For a currency trader, this skill translates to mastering Risk Sentiment flows.

- The Concept: Markets oscillate between Fear and Greed (Risk-Off and Risk-On). Tepper waits for extreme fear to buy high-quality assets at a discount.

- The Forex Setup:

- During Panic (Risk-Off): When headlines are terrifying, capital flees to safe havens. This is the time to look for strength in USD, JPY, or CHF.

- The Recovery (Risk-On): When the panic subsides but prices are still suppressed, capital rotates back into growth. This is the “Tepper Moment” to go Long on “Risk Currencies” like AUD, NZD, or CAD.

7.3. Spot Crowded Trades (COT Report)

One of Tepper’s greatest strengths is his contrarian nature; he bets against the herd when the consensus view becomes mathematically unsustainable. Forex traders can visualize this “herd mentality” using the Commitment of Traders (COT) report.

- The Concept: If everyone is already on one side of the boat, there is no one left to keep buying, and the market is prone to a violent reversal.

- The Forex Setup: Check the “Non-Commercial” positioning every week. If speculative positioning is extreme (e.g., 90% Long EUR/USD) but the price fails to break a key resistance level, the trade is “crowded.” A contrarian Short trade here offers the best Risk-Reward ratio.

7.4. Watch for “Macro Circuit Breakers”

Tepper made billions in 2009 by betting that the US government would not let major banks fail. In the Forex market, this “government backstop” appears in the form of Central Bank Intervention.

- The Concept: Betting on institutional defense lines. Central banks will often step in to prevent their currency from becoming too strong or too weak if it hurts the economy.

- The Forex Setup: Watch for extreme valuation levels. For instance, if the Japanese Yen strengthens too much, the BoJ may intervene to sell Yen. Buying USD/JPY near these “intervention zones” aligns your trade with the most powerful player in the room.

8. David Tepper’s Influence in Modern Finance

David Tepper’s impact on the investment world extends far beyond his own fund’s returns. He is widely regarded as one of the most successful distressed-debt investors of his generation, recognized for his unparalleled expertise in finding value in seemingly failed enterprises.

- A Model for Modern Hedge Funds: His contrarian and deeply analytical approach has influenced a wave of prominent fund managers who have adopted similar principles of opportunistic and deep-value investing.

- Macro Flexibility: Furthermore, Tepper’s ability to blend deep, fundamental analysis with a broad macro overview set a new standard. Unlike rigid value investors, his willingness to adapt to Federal Reserve policies and global shifts has become a blueprint for modern macro trading.

9. Frequently asked questions about David Tepper

10. The Bottom Line

In answering who is David Tepper, it’s clear he is more than just a billionaire. He serves as a model investor, effectively combining financial intelligence, a capacity for calculated risk, and significant philanthropy. His core investment philosophy, being a data-driven contrarian, remains timelessly relevant.

With his ability to read the macro market and his unwavering conviction, Tepper continues to be an icon of independent investment thought. To stay updated with more useful information and analysis, be sure to explore Piprider now!