Is the volume supporting the price trend? The Chaikin Money Flow indicator (CMF), developed by famed analyst Marc Chaikin, is a volume-weighted oscillator designed to answer this critical question. It measures the amount of money flowing into or out of an asset over a specific period and provides insight into the underlying buying and selling pressure.

This guide breaks down the CMF formula, its key signals, and practical chaikin algorithm trading strategies.

Key Takeaways

- An oscillator that measures buying and selling pressure by combining an asset’s closing price position with its volume.

- A positive CMF value (above the zero line) indicates buying pressure, while a negative value signals selling pressure.

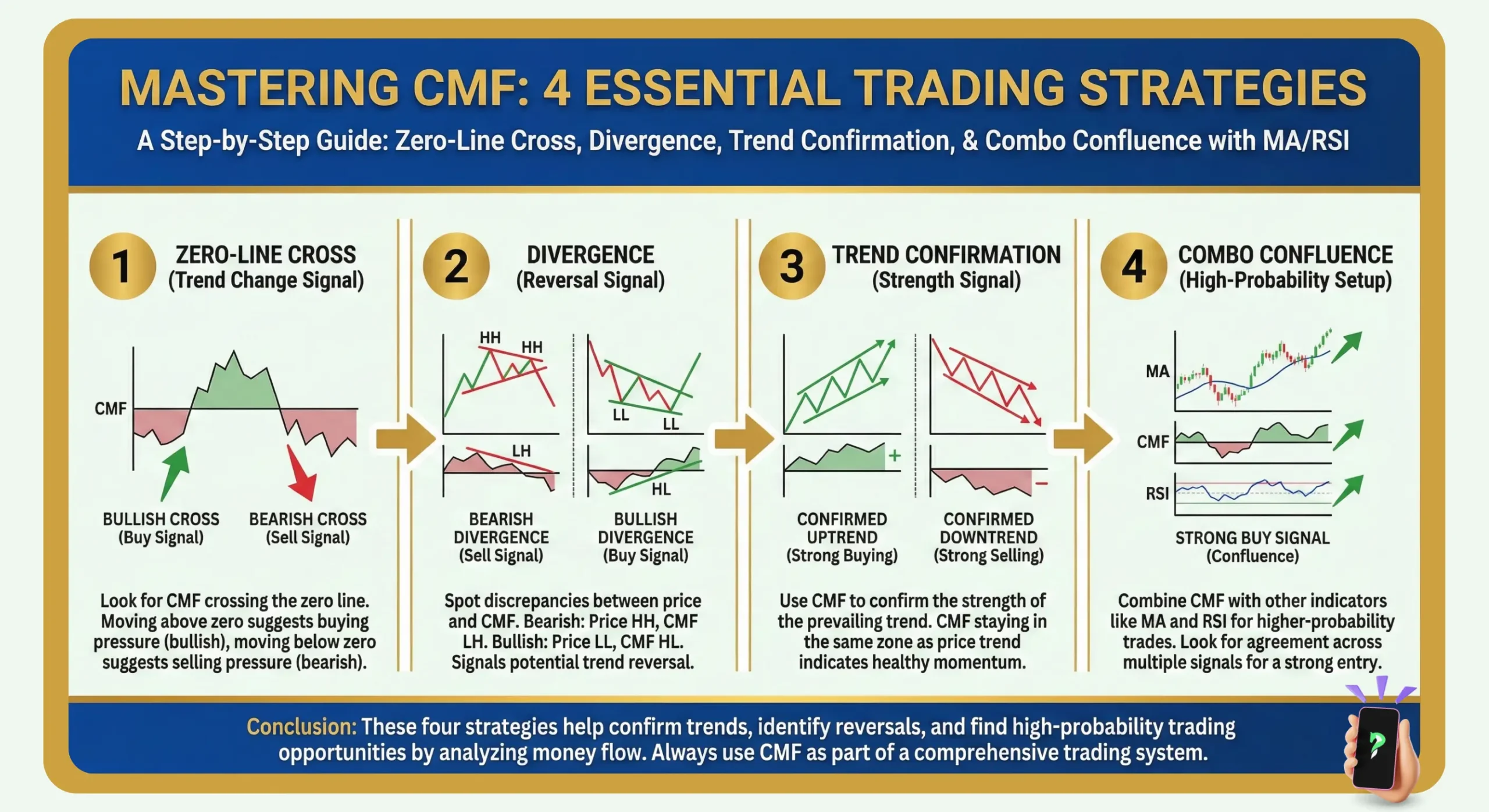

- Traders use zero-line crossovers for trend confirmation and divergences to spot potential reversals before they happen.

- The chaikin money flow oscillator can generate false signals (whipsaws) in choppy or non-trending markets.

- It works best when combined with other indicators like moving averages or the RSI for signal confirmation.

1. What Is Chaikin Money Flow Indicator (CMF)?

The Chaikin Money Flow (CMF) is a technical indicator created by Marc Chaikin that measures the flow of money into or out of a security over a specific period. It helps traders gauge the underlying buying and selling pressure that might not be obvious from price alone.

Here’s how it works:

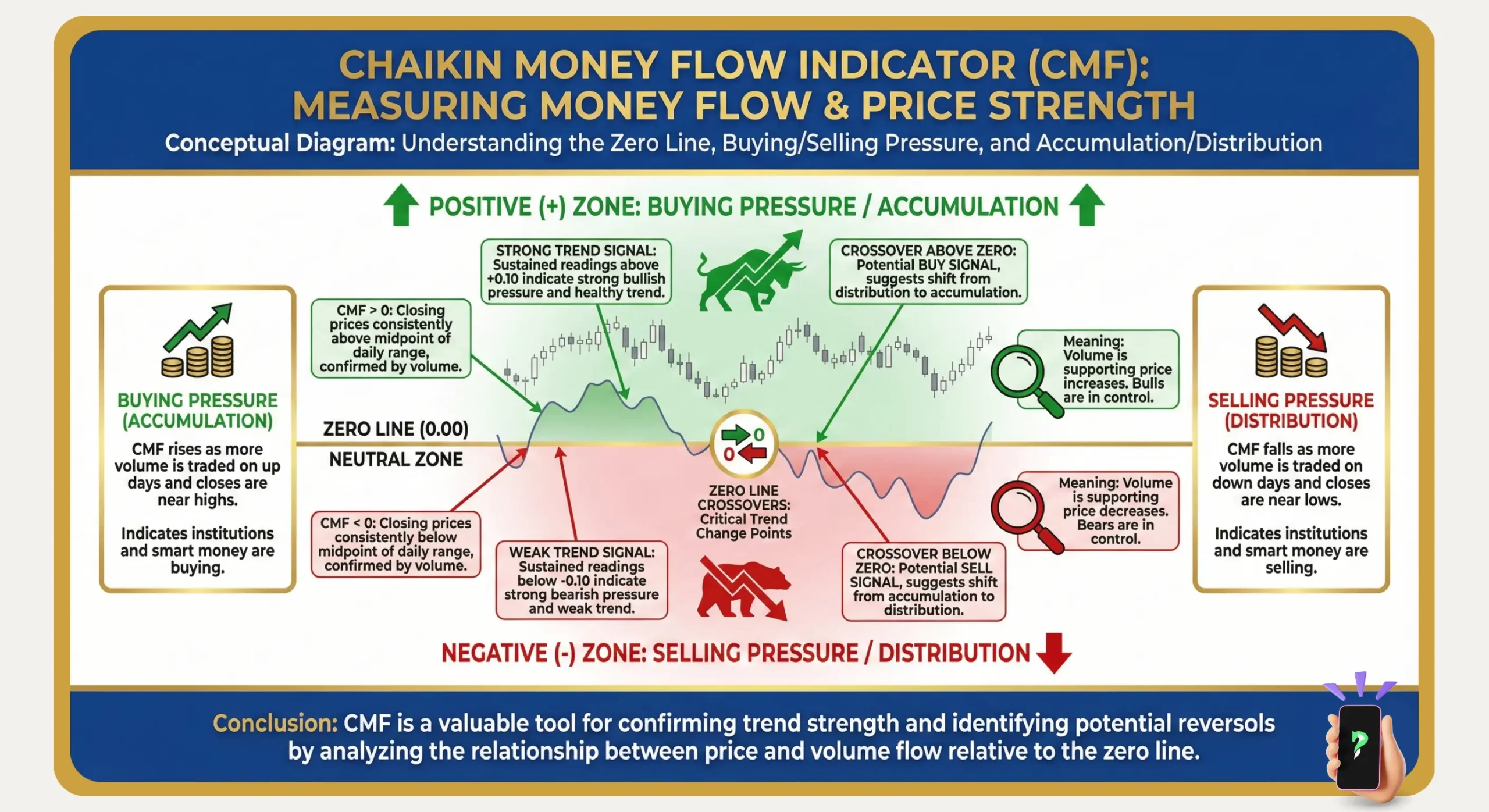

- Core principle: It operates on a simple but powerful idea. High-volume closes near the top of a period’s range signal accumulation (buying pressure), while high-volume closes near the bottom signal distribution (selling pressure).

- Visual representation: The indicator is an oscillator that moves between +1 and -1. A reading above the zero line indicates buying pressure is dominant, while a reading below zero shows selling pressure is in control.

- Main goal: Ultimately, the CMF’s purpose is to help traders answer a critical question: is the “smart money” confirming or contradicting the current price trend?

2. History and Basics of CMF

The Chaikin Money Flow indicator was developed in the late 1980s by Marc Chaikin, a renowned stock market analyst. It was designed as an evolution of his earlier work on the Accumulation-Distribution Line (A/D Line). While the accumulation-distribution Line is a cumulative indicator, Chaikin created the CMF as an oscillator to make money flow signals easier to quantify and interpret.

This innovation, a key part of modern technical analysis, laid the groundwork for other popular volume-based indicators, including the Chaikin Oscillator and, conceptually, the Money Flow Index (MFI). At its core, the CMF was designed to look past simple price movements and reveal the underlying market sentiment by analyzing how volume confirms or contradicts a trend.

3. The Chaikin Money Flow Formula

The CMF’s formula is a three-step process that quantifies buying and selling pressure for each period and then averages it out to create a smooth oscillator line.

3.1. CMF Formula

The complete formula for the Chaikin Money Flow is:

CMF = ∑n Money Flow Volume / ∑n Volume

Where ‘n’ is the look-back period. The most common setting for this period, as recommended by Marc Chaikin, is 20 or 21 days.

3.2. Step-by-Step Calculation

Here’s a breakdown of how that final value is derived:

Step 1: Calculate the Money Flow Multiplier (MFM)

First, the formula determines where the closing price landed within the period’s high-low range. A close near the high results in a positive multiplier, while a close near the low results in a negative one.

MFM = [ (Close – Low) – (High – Close) ] / (High – Low)

Step 2: Calculate the Money Flow Volume (MFV)

Next, the multiplier is multiplied by the volume for that period to determine the amount of money flow.

MFV = MFM * Volume

Step 3: Calculate the Final CMF Value

Finally, the indicator sums up the Money Flow Volume for the chosen period (e.g., 20 days) and divides it by the sum of all volume over that same period. This gives you the final CMF oscillator value.

Read more:

Unlock Forex trends with the currency strength meter (CSM)

4. How the CMF Indicator Works

The Chaikin Money Flow works by linking two critical pieces of data: where an asset closes within its session range and the volume traded during that session. This combination provides a more insightful view of money flow than looking at price or volume alone.

The underlying logic is straightforward:

- When an asset closes in the upper portion of its range, especially on high volume, the indicator assumes accumulators (buyers) are active. This generates a positive CMF value, reflecting bullish money flow.

- Conversely, when an asset closes in the lower portion of its range, it signals distributors (sellers) are in control. This produces a negative CMF value, reflecting bearish money flow.

The indicator’s value, which oscillates between +1 and -1, quantifies this pressure. A reading closer to +1 indicates very strong buying pressure, while a reading approaching -1 shows intense selling pressure. A value near zero suggests a balance between buying and selling forces.

5. What the Chaikin Money Flow Tells You

The interpretation of Chaikin Money Flow provides three distinct indication types that traders use to spot potential trading opportunities: the direction of money flow, divergences, and zero-line crossovers.

5.1. Positive vs. Negative Values

The indicator’s position relative to the central zero line is the most fundamental signal. It provides an immediate reading of the dominant pressure in the market.

- A positive CMF (above 0) indicates that buying pressure is in control, suggesting a bullish sentiment.

- A negative CMF (below 0) indicates that selling pressure is dominant, suggesting a bearish sentiment.

5.2. Divergences

Divergences are powerful warnings that occur when the CMF indicator disagrees with the price action. They often provide an early warning that a trend is losing its underlying momentum.

- A bearish divergence occurs when the price makes a new high, but the CMF fails to do so, making a lower high instead. This is a red flag that the uptrend is weakening and may soon reverse.

- A bullish divergence occurs when the price makes a new low, but the CMF forms a higher low. This suggests that selling pressure is easing, and a bullish reversal could be imminent.

5.3. Zero Line Crossovers

Crossovers of the zero line are used as direct confirmation signals for a shift in money flow, often providing potential entry and exit triggers.

- A bullish crossover happens when the CMF crosses from negative to positive territory. This is interpreted as a buy signal, confirming that money is now flowing into the asset.

- A bearish crossover happens when the CMF crosses from positive to negative. This is a sell signal, confirming that money is flowing out.

6. Example of Chaikin Money Flow in Action

Let’s analyze a real-world example on a chart to see how CMF signals work together. This chart illustrates a strong uptrend confirmed by the CMF, followed by a clear reversal warning.

- Trend confirmation: During the initial strong uptrend, notice how the CMF consistently stays above the zero line. This confirms that the rally is supported by significant buying pressure (accumulation), giving traders confidence to hold long positions. The price staying above a moving average or a bullish MACD crossover would provide additional confirmation.

- Reversal warning (Bearish Divergence): Later, as the trend matures, the price pushes to a new high. However, the CMF fails to follow and instead forms a lower high. This bearish divergence is a critical red flag. It signals that money is quietly flowing out of the asset (distribution) and the uptrend’s momentum is fading, providing an early warning of a potential reversal.

7. How to Use CMF in Trading

The Chaikin Money Flow indicator is a versatile tool that can be integrated into various trading styles. Its primary uses are trend confirmation, generating entry/exit signals, and validating breakouts.

7.1. Trend Confirmation

CMF is an excellent tool for gauging the health of an existing trend. A sustained reading on one side of the zero line indicates that “smart money” is consistently supporting the price move.

- A CMF that remains above the zero line for an extended period confirms a strong and sustainable uptrend.

- Conversely, a CMF that stays consistently below zero confirms a persistent downtrend.

7.2. Entry and Exit Signals

Zero-line crossovers can be used as direct trading signals, especially when combined with a simple trend filter like a moving average (MA).

- Buy signal: The CMF crosses above the zero line while the price is trading above its 20-period exponential moving average (EMA). This combination confirms that both money flow and price momentum are bullish.

- Sell signal: The CMF crosses below the zero line, preferably on a spike in volume. This indicates that significant distribution is occurring, providing a strong signal to sell.

7.3. Breakout Confirmation

CMF is highly effective at distinguishing between legitimate breakouts and false ones (fakeouts). A true breakout should be accompanied by strong money flow.

- Reliable breakout: If the price breaks above a key resistance level and the CMF simultaneously crosses above the zero line, it confirms the breakout is backed by real buying pressure.

- False breakout warning: If the price breaks out, but the CMF is flat or falling, it’s a major red flag that the move lacks conviction and may be a trap.

8. Chaikin Money Flow vs. Chaikin Oscillator

Traders often confuse the Chaikin Money Flow with the Chaikin Oscillator. While both were created by Marc Chaikin, they measure different aspects of money flow and are used for different purposes.

- The CMF is a direct measure of buying and selling pressure.

- The Chaikin Oscillator is a “momentum of volume” indicator, measuring the rate of change of the Accumulation-Distribution Line.

Here is a direct comparison:

| Aspect | CMF | Chaikin Oscillator |

| Indicator Type | A volume-based oscillator. | A momentum indicator of the A/D Line. |

| Scale | Oscillates between +1 and -1. | Oscillates around a central zero line (unbounded). |

| Main Goal | To measure the overall direction of money flow. | To measure the momentum (rate of change) of money flow. |

| Primary Use | Trend confirmation. | Early reversal signals via divergences. |

In simple terms, the CMF tells you if money is flowing in or out of an asset. The Chaikin Oscillator tells you how fast that money flow is accelerating or decelerating, often providing earlier signals of a potential shift in momentum.

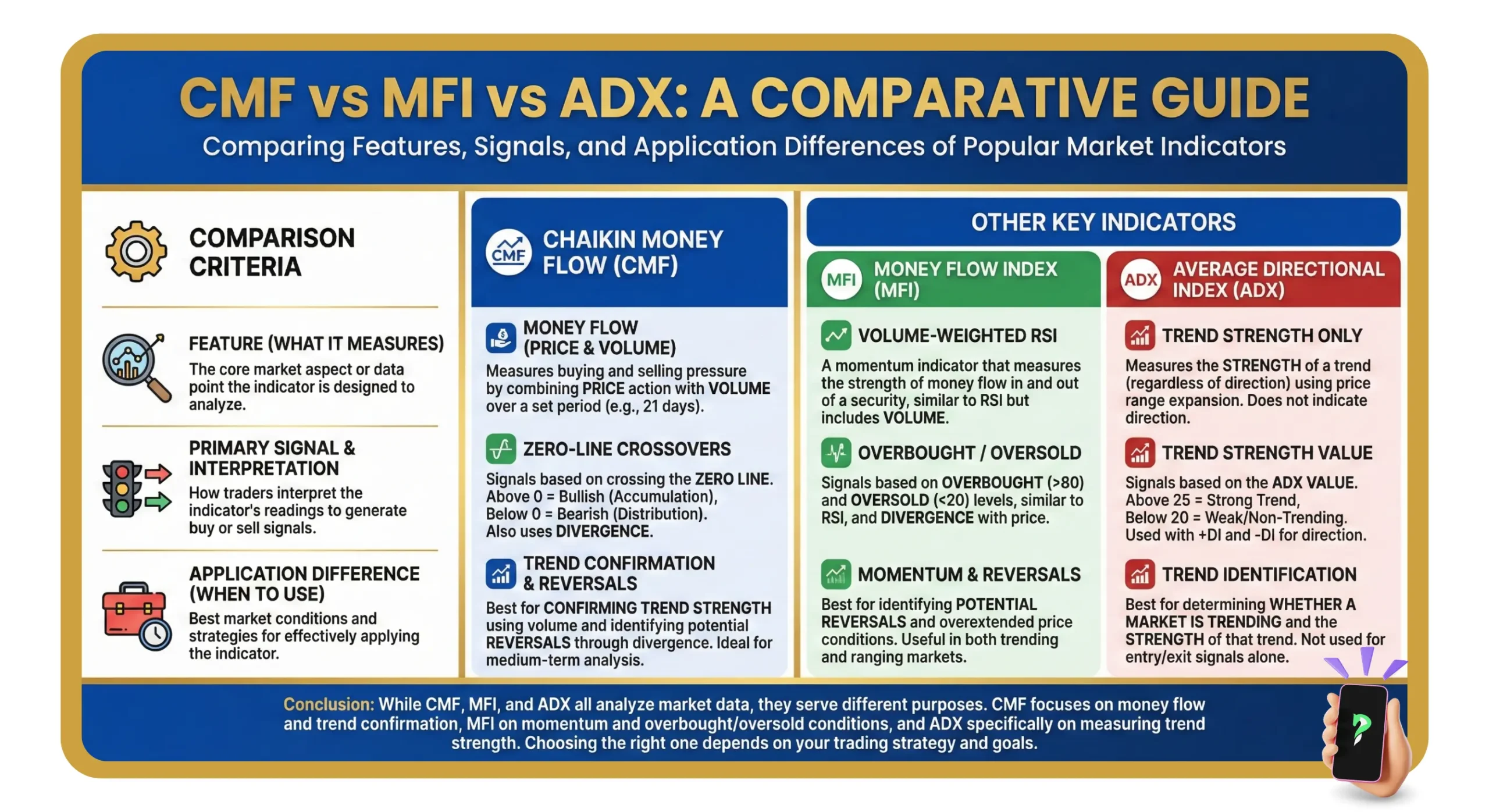

9. Chaikin Money Flow vs. Money Flow Index (MFI)

Both the CMF and the MFI indicator are popular volume-weighted oscillators, but they are designed to measure different aspects of money flow and serve different trading purposes.

Here is a direct comparison of their key differences:

| Aspect | CMF | MFI |

| Calculation Basis | Based on the closing price position within the high-low range. | Based on Typical Price (High + Low + Close) / 3. |

| Indicator Nature | A continuous oscillator that moves between +1 and -1. | A bounded oscillator, scaled from 0 to 100 like the RSI. |

| Primary Use | Best for trend confirmation and identifying money flow direction. | Best for identifying overbought and oversold conditions. |

In essence, the CMF is a trend-confirming tool that tells you if volume is supporting the current price direction. In contrast, the MFI is a reversal-spotting tool, similar to the RSI but with volume included, that signals when a move may be overextended and due for a pullback.

10. Limitations of CMF

While the Chaikin Money Flow is a powerful tool, it’s not a standalone solution. Understanding its limitations is crucial for avoiding common trading traps.

- Vulnerable to whipsaws: The indicator’s biggest weakness is its tendency to produce misleading indications in choppy, sideways markets. When there’s no clear trend, the CMF line will frequently cross the zero line back and forth, creating noise and unreliable signals.

- Inherent lag: Because it’s calculated over a 20 or 21-day period, the CMF is a lagging indicator. It confirms a change in money flow after it has already started, which can sometimes lead to delayed entry and exit signals.

- Requires confirmation: Relying solely on CMF signals is not recommended. Its accuracy is significantly improved when its signals are confirmed by other indicators that measure trend strength (like the ADX) or momentum (like the RSI or MACD).

11. Frequently asked questions about Chaikin Money Flow Indicator

12. The Bottom Line

The Chaikin Money Flow indicator (CMF) is a powerful tool for determining whether volume is confirming or contradicting the current price trend. By measuring the underlying buying and selling pressure, it gives traders a valuable look “under the hood” of the market.

When combined with momentum oscillators like the RSI or a simple Moving Average, the CMF becomes an effective filter for noise, helping to pinpoint genuine shifts in money flow. However, to achieve the best results, it should always be used for confirmation alongside other volume or momentum indicators.

To discover more essential tools for your trading arsenal, explore our in-depth guides on other Forex Indicators in the Analysis section at Piprider.