Pivot Point constitutes a fundamental yet powerful technical analysis tool designed to identify potential support and resistance levels in the market. By utilizing the high, low, and closing prices of the preceding trading session, Pivot Points furnish critical reference markers that help traders determine the trend bias and systematically plan their trades.

This comprehensive guide will show you how to master the formulas, choose the right variation for your style, and implement three high-probability strategies to set confident stop-loss and take-profit targets.

Key Takeaways

- Pivot points are calculated in advance to identify potential support and resistance areas in stock, and other markets.

- From day trading to swing trading, this tool remains a core element in many strategies.

- Popular variations include Classic, Woodie, Camarilla, and Fibonacci, each with unique calculation methods and market applications.

- The indicator for MT4 comes as a built-in or custom tool, making it easy to add to charts without manual calculations.

- In stock market trading, they help traders plan entries, exits, and stop-losses with greater precision.

1. What is the pivot point in trading?

A pivot point is a key technical analysis indicator that helps identify the overall market trend across various time frames (Investopedia, n.d.). It is calculated by averaging the previous session’s high, low, and close, then projecting these levels into the current session to highlight possible support and resistance areas.

1.1. How they started in trading

Pivot points originated on the trading floors of stock exchanges, where floor traders needed a quick way to identify price levels of interest without using complex charts. Over time, this method evolved into a reliable technical tool for futures, and stock markets.

1.2. Why traders use them today

Today, pivot points serve two main purposes:

- Market bias identification: A price above the main level typically indicates bullish sentiment, while a price below suggests bearish sentiment.

- Trade planning: They provide predefined levels for entries, exits, and stop-loss placement.

Market prices often show strong reactions near the R1 and S1 levels. However, reaching R1 (Resistance 1) is not a guaranteed reversal signal. Effective trading requires waiting for clear confirmation from price action, such as a bearish engulfing candle at R1—before taking a position. Combining Pivot Points with supporting price action patterns is crucial for a reliable technical approach.

2. Pivot Points calculation: Formula and Step-by-Step example

Knowing how pivot points are calculated is a key step before incorporating them into your trading strategy. The classic method is the most widely used and forms the basis for most pivot indicators.

2.1. Classic formula

The classic method is the most widely used because it is simple, quick to calculate, and works across different markets. The process begins with the main pivot (PP), serving as the central reference for the day trading. From this point, three resistance levels (R1, R2, R3) are calculated above it, and three support levels (S1, S2, S3) are calculated below for the current trading period.

| Pivot Point (PP) = (Close + Low + High) ÷ 3 |

This is the central guide for the day: Above the PP often suggests upward price action, while below it signals potential downward pressure.

| R1 = (2 × PP) − Low |

First resistance level. Often the first upside target in a bullish move or the first barrier to a higher high price.

| S1 = (2 × PP) − High |

First support level. Often the first downside target is a bearish move or the first floor to prevent a lower low price.

| R2 = PP + (High − Low) |

Second resistance level. This usually signals stronger bullish price action if price breaks above R1 and reaches here.

| S2 = PP − (High − Low) |

Second support level. Breaking below this may show that sellers are in stronger control.

| R3 = High + 2 × (PP − Low) |

Third resistance level. A rare target reached only on strong trending days.

| S3 = Low − 2 × (High − PP) |

Third support level. This is often hit during high volatility sell-offs.

Piprider’s tip: We rarely aim for R3 or S3 in intraday trading unless there’s strong news or market momentum. Most profitable trades for us happen between S1–R1 or S2–R2, as these levels get tested more often.

2.2. Step-by-step example for beginners

Let’s say last month’s market data for USD/CAD was:

- High = 1.37981

- Low = 1.35399

- Close = 1.36074

Step 1 – Main pivot:

| PP = (1.37981 + 1.35399 + 1.36074) ÷ 3 = 1.36485 |

Step 2 – First support and resistance:

| R1 = (2 × 1.36485) − 1.35399 = 1.37571 S1 = (2 × 1.36485) − 1.37981 = 1.34989 |

Step 3 – Second support and resistance:

| R2 = 1.36485 + (1.37981 − 1.35399) = 1.39067 S2 = 1.36485 − (1.37981 − 1.35399) = 1.33903 |

Step 4 – Third support and resistance:

| R3 = 1.37981 + 2 × (1.36485 − 1.35399) = 1.39153 S3 = 1.35399 − 2 × (1.37981 − 1.36485) = 1.32417 |

In this USD/CAD example, the PP (1.36485) defines the market’s monthly bias: price above PP is bullish, below is bearish. R1 (1.37571) and S1 (1.34989) are the primary reaction zones for trade planning (entry/stops/targets). R2/S2 and R3/S3 offer extended targets for stronger trending movements.

3. Types of Pivot Points: Which Works Best for Your Trading

Not all calculation methods are the same. Over time, traders have created various formulas to match different market conditions and trading approaches. While the classic version is the most popular, other versions such as Woodie, Camarilla, and Fibonacci offer distinct perspectives on price action (Babypips, n.d.; Forex Training Group, 2018).

Below, Piprider’ll explain each type in simple terms, with real-life style examples so you can quickly grasp how they work in practice.

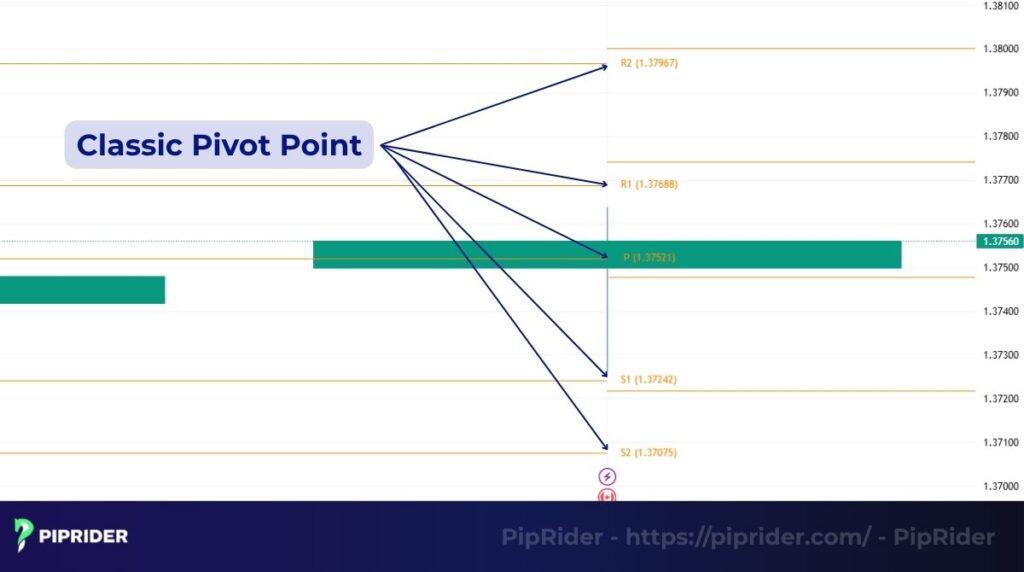

3.1. Classic (standard) pivot points

Originally developed by floor traders, this formula finds the main pivot (PP) by averaging the prior session’s high, low, and close, and uses the price range to establish support and resistance levels.

Formula:

| PP = (High + Low + Close) ÷ 3 R1 = (2 × PP) − LowS1 = (2 × PP) − High R2 = PP + (High − Low) S2 = PP − (High − Low) R3 = High + 2 × (PP − Low) S3 = Low − 2 × (High − PP) |

Example:

Yesterday’s USD/CAD: High (H) = 1.37800, Low (L) = 1.37354, Close (C) = 1.37409

| PP = (H + L + C) ÷ 3 = (1.37800 + 1.37354 + 1.37409) ÷ 3 = 1.37521 R1 = (2 × PP) − L = (2 × 1.37521) − 1.37354 = 1.37688 S1 = (2 × PP) − H = (2 × 1.37521) − 1.37800 = 1.37242 R2 = PP + (H − L) = 1.37521 + (1.37800 − 1.37354) = 1.37967 S2 = PP − (H − L) = 1.37521 − (1.37800 − 1.37354) = 1.37075 R3 = H + 2 × (PP − L) = 1.37800 + 2 × (1.37521 − 1.37354) = 1.38134 S3 = L − 2 × (H − PP) = 1.37354 − 2 × (1.37800 − 1.37521) = 1.36887 |

If today’s price opens above PP and heads towards R1 at 1.37688, you could look for a breakout trade toward R2 at 1.37967.

Best for: Beginners and day traders who want a simple and widely accepted approach.

Traders use classic pivots most often because they work well in both trending and ranging markets.

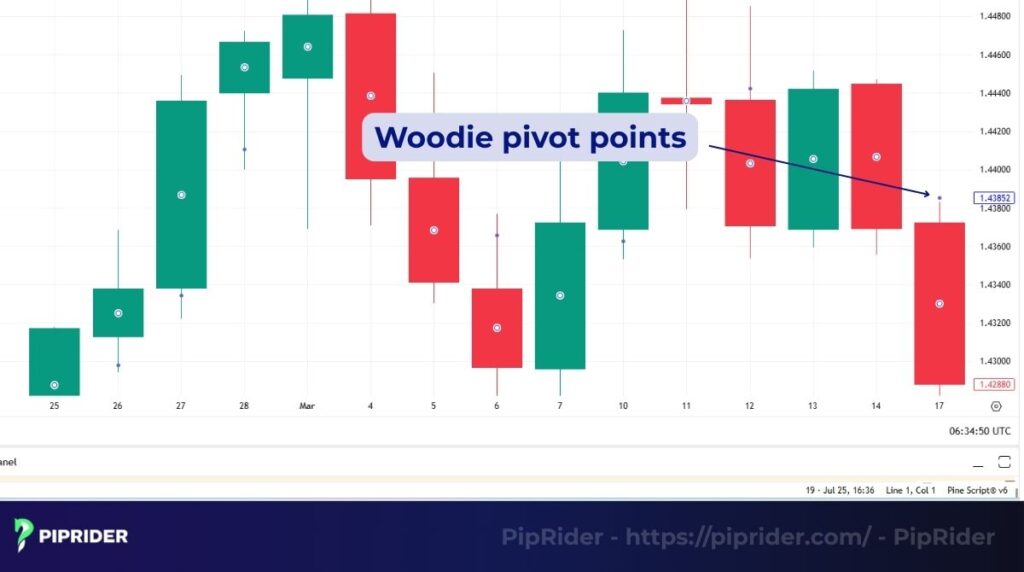

3.2. Woodie pivot points

Woodie pivots give greater emphasis to the closing price, making them more sensitive to recent price changes (StocksToTrade, n.d.). This is particularly useful when the close strongly mirrors the day’s market sentiment.

Formula:

| PP = (High + Low + 2 × Close) ÷ 4 R1 = (2 × PP) − Low S1 = (2 × PP) − High R2 = PP + (High − Low) S2 = PP − (High − Low) R3 = High + 2 × (PP − Low) S3 = Low − 2 × (High − PP |

Example:

USD/CAD closed yesterday at 1.43692, with a high of 1.44470 and a low of 1.43556:

| PP = (1.44470 + 1.43556 + 2 × 1.43692) ÷ 4 = 1.43852 R1 = (2 × 1.43852) − 1.43556 = 1.44149 S1 = (2 × 1.43852) − 1.44470 = 1.43235 R2 = 1.43852 + (1.44470 − 1.43556) = 1.44767 S2 = 1.43852 − (1.44470 − 1.43556) = 1.42938 R3 = 1.44470 + 2 × (1.43852 − 1.43556) = 1.45063 S3 = 1.43556 − 2 × (1.44470 − 1.43852) = 1.42321 |

Because the close was closer to the low than the high, the pivot levels and price barriers are slightly lower, hinting at mild bearish bias from the previous session.

Best for: Short-term traders who want pivots that adjust quickly to market sentiment.

Woodie pivots (Close-based) particularly useful when the prior day’s close sharply influences the next day’s momentum, especially in pairs that react to short-term news.

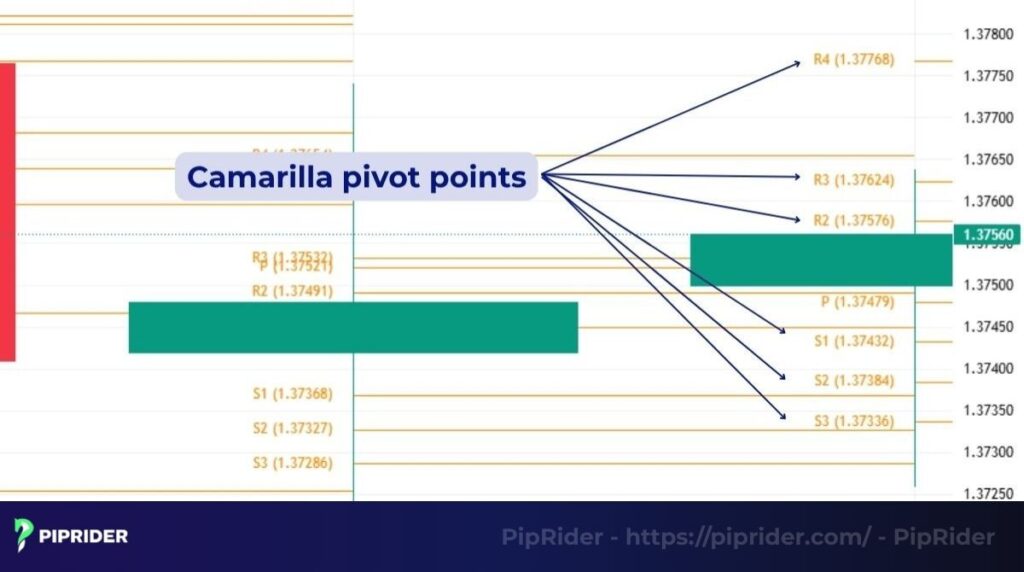

3.3. Camarilla pivot points

Camarilla pivots create support and resistance zones closer to the current price than other versions, making them particularly effective for intraday reversals.

In the traditional method, Camarilla does not use a central PP. Instead, it takes the previous day’s closing price as the reference, then adds or subtracts a fixed multiplier of the previous day’s range (Range = High − Low) to determine support and resistance levels.

Note: The 1.1 multiplier in the formulas below is a common variant, but some sources and platforms use different values (e.g., 1.0833), which will produce slightly different levels. Also, some trading platforms add a central PP to the Camarilla set for reference, even though it is not part of the original method.

Formula (1.1 multiplier variant):

Let Range = High − Low

| R1 = Close + (Range × 1.1 ÷ 12) R2 = Close + (Range × 1.1 ÷ 6) R3 = Close + (Range × 1.1 ÷ 4) R4 = Close + (Range × 1.1 ÷ 2) S1 = Close − (Range × 1.1 ÷ 12) S2 = Close − (Range × 1.1 ÷ 6) S3 = Close − (Range × 1.1 ÷ 4) S4 = Close − (Range × 1.1 ÷ 2) |

Example:

If USD/CAD had a high of 1.37740, a low of 1.37217, and a close of 1.37480:

| Range = 1.37740 − 1.37217 = 0.00523 (523 pips) R1 = 1.37480 + (0.00523 × 1.1 ÷ 12) = 1.37528 R2 = 1.37480 + (0.00523 × 1.1 ÷ 6) = 1.37577 R3 = 1.37480 + (0.00523 × 1.1 ÷ 4) = 1.37624 R4 = 1.37480 + (0.00523 × 1.1 ÷ 2) = 1.37768 S1 = 1.37480 − (0.00523 × 1.1 ÷ 12) = 1.37432 S2 = 1.37480 − (0.00523 × 1.1 ÷ 6) = 1.37383 S3 = 1.37480 − (0.00523 × 1.1 ÷ 4) = 1.37336 S4 = 1.37480 − (0.00523 × 1.1 ÷ 2) = 1.37192 |

In this USD/CAD example, the Camarilla R1 and R2 levels are less than 5 pips apart, indicating a tight range. If price touches R2 but fails to break higher, it could be a shorting opportunity with a target at S1.

Best for: Scalpers and intraday traders looking for quick bounce setups.

Traders often use Camarilla pivots as a secondary confirmation when expecting fast intraday reversals.

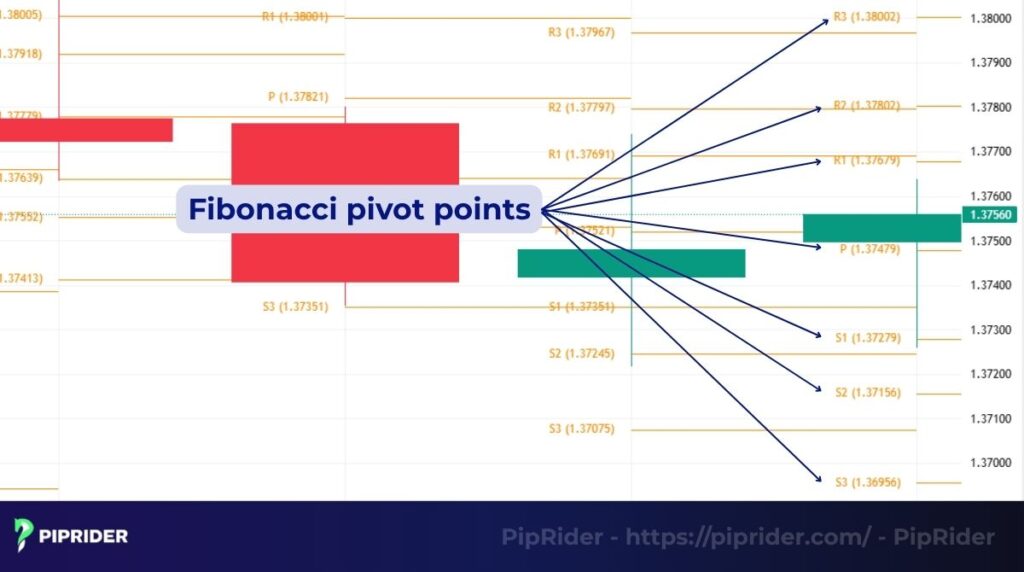

3.4. Fibonacci pivot points

This method combines the classic formula with Fibonacci ratios to find potential support and resistance. It starts by calculating the main pivot (PP) for the current trading period in the same way as the classic method, then applies Fibonacci percentages (38.2%, 61.8%, 100%) to the previous session’s price range.

Formula:

| PP = (High + Low + Close) ÷ 3 Range = High − Low R1 = PP + (Range × 0.382) R2 = PP + (Range × 0.618) R3 = PP + (Range × 1.000) S1 = PP − (Range × 0.382) S2 = PP − (Range × 0.618) S3 = PP − (Range × 1.000) |

Example:

If USD/CAD high was 1.37740, low was 1.37217, and close was 1.37480:

| PP = (1.37740 + 1.37217 + 1.37480) ÷ 3 = 1.37479 Range = 1.37740 − 1.37217 = 0.00523 R1 = 1.37479 + (0.00523 × 0.382) = 1.37679 R2 = 1.37479 + (0.00523 × 0.618) = 1.37802 R3 = 1.37479 + (0.00523 × 1.000) = 1.38002 S1 = 1.37479 − (0.00523 × 0.382) = 1.37279 S2 = 1.37479 − (0.00523 × 0.618) = 1.37156 S3 = 1.37479 − (0.00523 × 1.000) = 1.36956 |

If price stalls at R1, it often aligns with a 38.2% Fibonacci retracement zone, increasing the chance of a reversal.

Best for: Traders who already use Fibonacci tools. It is especially powerful when a Fibonacci level aligns with a standard pivot, creating a strong confluence zone that can improve trading accuracy.

3.5. Comparison table

Now that you understand each type and how it works, here’s a side-by-side comparison to help you quickly decide which method fits your trading style. This table sums up their main focus, best use cases, and a simple real-market example for easy reference.

| Type | Main Focus | Best for | Example in practice |

| Classic | Equal weight on H, L, C | All markets, all timeframes | EUR/USD breakout from PP to R1 aiming for R2 |

| Woodie | Heavier weight on Close | Intraday, volatile markets | GBP/JPY bullish bias after strong close |

| Camarilla | Tight reversal/breakout zones | Scalping, sideways trading | USD/CAD reversal from R3 back to S1 |

| Fibonacci | Fibonacci ratios + pivot formula | Fibonacci traders, swing setups using Fibonacci retracements | Gold stalling at R1 near 38.2% retracement |

The Classic Pivot provides a general market overview. A strong strategy is to layer Classic with Fibonacci Pivots. When a Classic level (e.g., R1) aligns with a Fibonacci ratio, it forms a confluence zone. This zone signals a high probability of reversal or reaction, making it an ideal point for entry planning.

4. How to use pivot points in trading

Pivot points are more than just numbers on a chart; they are a pre-planned roadmap that helps form objective trading decisions.

In simple terms:

- If the price is above the main pivot (PP), market sentiment is generally bullish.

- When the price trades below the PP, it’s generally viewed as bearish.

- Support levels (S1, S2, S3) often highlight areas where traders may look for buying opportunities.

- Resistance levels (R1, R2, R3) often indicate zones where selling opportunities could arise.

To trade with pivot points effectively, follow a simple daily routine. Here is a step-by-step process for using them that work on MT4, TradingView, or any charting platform.

- Identify the main pivot (PP) before the trading session begins.

- Mark the support (S1–S3) and resistance (R1–R3) levels on your chart.

- Check the opening price relative to the PP for bullish or bearish bias.

- Watch for price action patterns forming near pivot levels before making your entry.

- Set your stop-loss and take-profit using the next levels as guides.

When trading EUR/USD on MT4, start by checking the daily pivots before the London session. When a pair starts the session above the PP and drives up toward R1 with solid price action, wait for a minor retracement before going long. Place the stop-loss just below the PP, with the first target at R2. This structured approach helps avoid impulsive trades by ensuring there is a clear plan before the session starts.

5. Pivot point trading strategies

Once you know how to plot pivot points, you can turn them into a powerful decision-making tool. Below are three strategies we’ve used in stock markets.

5.1. Bounce strategy

This method is most effective in range-bound markets, where price frequently bounces between support and resistance. The goal is to buy near lower levels (S1, S2) and sell near upper levels (R1, R2).

Trading Steps:

- Identify a key level: Spot S1 or R1 on your chart before the session begins.

- Wait for price to approach the level: Be patient and allow the market to get close to your chosen level.

- Confirm with a reversal signal: For instance, a bullish engulfing candle at S1 or a bearish crossover on the stochastic oscillator at R1.

- Enter in the opposite direction of the bounce: Go long from support or short from resistance.

- Set your stop-loss: Place it just beyond the next level to manage risk.

- Define your profit target: Aim for the main pivot or the opposite level, depending on trade direction.

Example: On EUR/USD, if the price falls to S1 and prints a strong bullish engulfing candle, you should buy with a stop loss just below S2 and aim for the main pivot as your target.

Note: It is important to note that the Bounce strategy is only truly effective when the market is moving sideways (ranging). If you try to sell at R1 on a strong uptrend day, you can easily get stopped out by whipsaws. Always identify the overall market trend before applying any strategy.

5.2. Breakout strategy

Instead of betting on a reversal, this method aims to catch breakouts when the price breaks decisively through a pivot level. This is common after news releases or during sessions with high volume, such as the London open.

Trading steps:

- Locate a key level such as R1, R2, S1, or S2.

- Wait for a strong candle to close beyond that level.

- Confirm the move using volume indicators or a trend indicator like ADX.

- Enter in the direction of the breakout.

- Place your stop-loss just inside the broken level.

- Target the next level in the breakout direction.

Example: If GBP/USD closes above R1 on strong volume during the London session, you can enter a buy with a target at R2 and a stop loss just under R1.

5.3. Trend-following strategy

In strong trending markets, pivot points can act as natural “pullback zones” for entering in the direction of the trend (AfterPullback, 2024). The main pivot or first support/resistance levels often serves as an ideal entry area.

Trading steps:

- Spot the overall trend with the help of moving averages or by studying price structure.

- In an uptrend, look for buying opportunities when price pulls back to the main pivot or S1.

- During a downtrend, watch for sell setups as the price retraces to the main pivot or R1.

- Confirm your trade entry using a trend-strength measure such as ADX for a strong trend confirmation.

- Place your stop-loss beyond the next level opposite your trade.

- Look to reach the next level following the prevailing trend.

Example: On USD/JPY, if the market is in a clear uptrend and price retraces to the main pivot with ADX showing strong trend strength, traders should buy with a target at R1 or R2.

6. Pros and cons of pivot points

Like any trading tool, pivot points calculated levels have strengths and weaknesses. Knowing both helps you use them effectively and avoid common traps.

6.1. Pros

Pivot points offer several advantages, especially for traders who like structure and pre-planned levels:

- Clear market framework: You start each day with a predefined map of support and resistance levels, helping you analyze market trends and reduce guesswork.

- Works across markets: Useful in stocks, commodities, and indices.

- Fast decision-making: Simple to calculate and easy to interpret on the chart.

- Helps with trade planning: Levels make it easy to set entry, stop-loss, and target prices.

- Combines well with other tools: Can be used with oscillators like the relative strength index (RSI) for extra confirmation.

6.2. Cons

There are also limitations you need to be aware of:

- Not predictive on their own: They mark potential zones, but you still need confirmation from price action or other indicators.

- Less effective in low market volatility: Price may hover around levels without reacting clearly.

- Different types can cause confusion: Classic, Woodie, Camarilla, and Fibonacci can give slightly different levels.

- Short-term relevance: Daily pivots are most useful for intraday trading; they lose accuracy over longer timeframes.

Remember never rely on pivot points alone in your technical analysis. Combining them with trend analysis and volatility filters has saved you from many false signals.

7. Real-World Example and how to use Pivot Points to spot buy/sell opportunities

The chart below is a USD/JPY daily candlestick chart from TradingView, using the traditional indicator, which was captured on 08/08/2025.

On the chart, the orange horizontal lines are the levels automatically plotted by the tool:

- P (Pivot) – The main reference point for the current trading period.

- R1, R2, R3… – Resistance levels above the pivot.

- S1, S2, S3… – Support levels below the pivot.

7.1. What happened on the chart

Here’s what price action showed during this period:

- Earlier, USD/JPY broke above the old R1 (147.24) → showing the trend was gaining strength.

- After the breakout, the price pulled back to the 147.2–147.3 area to retest it. This old resistance now acted as new support.

- From this support zone, the price bounced higher and moved toward the new Pivot P (148.09).

7.2. How to apply pivot points in this situation

You can apply them by 4 steps:

- Identify the trend: Price is above the main level and has just broken past an old R1 → short-term bias is bullish.

- Look for a buy entry: The 147.2–147.3 zone (old R1) is an attractive area to watch for buy signals because it aligns with a key level and acts as fresh support.

- Place your stop-loss: Below the recent swing low or under 146.70 to protect against false breakouts.

- Plan your targets: First target would be the Pivot Point (148.09). If price pushes above it with strong price action, aim for the next R1 (153.51).

7.3. Why this is useful for beginners

Using this pivot-based plan offers clear benefits for new traders:

- Structured market view: Pivot Points provide a clear market map by defining key support and resistance levels before the session begins, eliminating guesswork.

- Simplified planning: The predefined levels (PP, R1, S1, v.v.) make setting entry, stop-loss, and target prices straightforward and mechanical.

- Emotional discipline: This methodology encourages traders to wait patiently for the price to reach predetermined levels, thereby reducing impulsive trading and promoting emotional control.

8. FAQ on Pivot Point

Before you start trading with pivot points, here are quick answers to the most common beginner questions.

9. Summary

Pivot point remains one of the most practical tools for traders who want a clear structure in their decision-making. Whether you trade stocks, or commodities, they provide predefined support and resistance levels that can guide entries, exits, and stop-loss placement.

If you’re ready to deepen your skills with this type of trading, explore further guides on combining them with indicators like ATR, Bollinger Bands, or ADX to refine your strategy.

To take your learning further, join us at Piprider and browse our best technical indicators category for in-depth resources, trading strategies, and real-world examples to elevate your trading performance.