Learning how to trade indices means you are speculating on the performance of an entire group of stocks (like the S&P 500 or NASDAQ 100) in a single trade, rather than just one company. Most retail traders use CFDs (Contracts for Difference) to get exposure to these markets, often using leverage.

This guide provides a complete introduction to what indices are and the different ways you can trade them (CFDs, ETFs, Futures). Moreover, Piprider also covers the basic strategies and risk management rules you need to know to get started.

Key Takeaways

- An index (like the S&P 500 or NASDAQ 100) is a “basket” of stocks that measures a market sector’s or country’s overall performance.

- Traders use indices for diversification. It allows you to trade your view on the whole economy with one position.

- The most common way for beginners to trade indices is with CFDs (e.g., symbols like US100 for NASDAQ or US500 for S&P 500).

- Simple strategies and strong risk management are essential for beginners.

- The main risk is leverage. CFDs and futures use leverage, which can amplify both your potential profits and your potential losses.

1. What Are Indices and How Do They Work?

A stock index (or “market index”) is a financial tool that measures the collective performance of a group of stocks. Instead of tracking just one company, an index like the S&P 500 (US500) tracks 500 of the largest U.S. companies. This allows you to trade the entire market with a single position.

An index’s price is a “weighted” average. This weighting determines which companies have the biggest impact:

- Market-cap weighted: Most indices, like the S&P 500 and NASDAQ 100, give more power to companies with a larger market capitalization (e.g., Apple, Microsoft).

- Price-weighted: A few, like the Dow Jones (US30), give more power to stocks with higher share prices, regardless of the company’s actual size.

The main difference between trading an index and a single stock is diversification. A single stock (like Tesla) can collapse from one bad news report. An index (like the NASDAQ 100) holds 100 stocks, so the failure of one company is buffered by the other 99. This is why indices often have smoother price movements and represent the entire market’s sentiment, not just one company’s drama.

2. What Are the Most Popular Indices to Trade?

While there are hundreds of indices, most trading professionals focus on a few major national indices known for their high liquidity and clear personalities. Each index represents a different part of the global economy and is most active during its specific market session.

Here is a quick comparison of the most popular indices:

| Index Name | Common CFD Symbol | What It Represents | Trader Profile | Best Session to Trade |

| S&P 500 | US500, SPX500 | Top 500 US Companies (Broad Market) | All-rounders, Beginners | US Session (New York) |

| NASDAQ 100 | US100, NAS100 | Top 100 US Tech & Non-Financials | Volatility & Tech Traders | US Session (New York) |

| Dow Jones | US30, DJ30 | 30 US Blue-Chip Industrials | Stable Trend Traders | US Session (New York) |

| DAX 40 | DE40, GER40 | 40 Major German Companies | European Session Traders | European Session (Frankfurt) |

| FTSE 100 | UK100 | 100 Major UK Companies | UK-focused Traders | European Session (London) |

| Nikkei 225 | JP225, JPN225 | 225 Major Japanese Companies | Asian Session Traders | Asian Session (Tokyo) |

2.1. US30 (Dow Jones): The Blue-Chip Index

The US30 (Dow Jones) is a blue-chip index tracking 30 of the largest, most established industrial and financial companies in the United States (like Boeing and Goldman Sachs). Traders who prefer more stable, established trends often look for a detailed manual on how to trade the Dow index, as the US30’s highest volatility occurs during the US session, especially right at the New York open.

2.2. NAS100 (NASDAQ 100): The Tech Index

The NAS100 (NASDAQ 100) is the go-to index for technology. It tracks the 100 largest non-financial companies on the NASDAQ, meaning it’s packed with giants like Apple, Microsoft, and NVIDIA. This index is perfect for traders who want high volatility and follow the tech sector. It’s most active during the US session, particularly around tech earnings, making a specialized guide to trading NAS100 essential for mastering its unique price action.

2.3. S&P 500 (US500): The Market Benchmark

Often called the market benchmark, the S&P 500 (US500) is the most-watched index in the world. It tracks 500 of the largest US companies, offering the broadest snapshot of the entire US economy. As an excellent all-around index, it’s popular with both beginners and pros. It sees the most volume and volatility during the US session.

2.4. DAX40 (Germany 40): The German Powerhouse

For traders active in the European session, the DAX40 (Germany 40) is the most popular choice. It tracks the 40 largest German companies, with a heavy focus on industrial and automotive brands (like Volkswagen and Siemens). Its volatility peaks at the Frankfurt and London session open.

2.5. FTSE100 (UK 100): The UK Benchmark

The FTSE100 (UK 100) represents the 100 largest companies on the London Stock Exchange, giving a good view of the UK economy. It’s heavily weighted toward banking, energy, and mining sectors. This index is a good choice for traders focusing on UK news, and its main activity is during the London session open.

2.6. Nikkei 225 (Japan 225): The Asian Leader

Finally, Nikkei 225 (Japan 225) is the main stock index for Japan, tracking 225 top companies from the Tokyo Stock Exchange. Its price is often influenced by the value of the Japanese Yen (JPY). Nikkei 225 is the primary choice for traders who are active during Asian trading hours, especially at the Tokyo open.

3. What Are the Different Ways to Trade Indices?

You cannot buy an index directly. Instead, you get market exposure by trading its value using different financial products. The most common methods are CFDs, futures, ETFs, options, and spread betting. Each product works differently and is designed for a specific type of trader.

Here is a simple comparison:

| Method | Best For | Leverage | Complexity |

| CFDs | Day Traders / Beginners | Yes | Low-Medium |

| ETFs | Long-Term Investors | No | Low |

| Futures | Pro / High-Volume Traders | Yes | High |

| Options | Advanced Strategists | Yes | Very High |

| Spread Betting | UK Traders | Yes | Low-Medium |

3.1. CFDs (Contract for Difference)

CFDs are the most popular method for retail day traders. A CFD is a contract with a broker where you agree to exchange the difference in an index’s price from when you open the trade to when you close it.

The main feature is leverage. Leverage allows you to control a large position (e.g., $5,000 worth of the NAS100) with a small amount of capital (called margin) from your account (e.g., $250). Leverage can magnify your potential profits, but it also magnifies your potential losses just as quickly.

3.2. Futures

Index Futures are large, standardized contracts traded on an official exchange (like the CME). They have set expiration dates and are often used by professional, high-volume traders (e.g., “E-mini” contracts). Futures contracts involve different commission structures and margin requirements and are generally more complex than CFD trading.

3.3. ETFs (Exchange-Traded Funds)

ETFs are funds that you buy and sell just like a regular stock. An index ETF (like the SPY for the S&P 500) actually holds the stocks in that index. This method uses no leverage and is best suited for long-term investors and swing traders using ETFs to gain index exposure for weeks, months, or even years.

3.4. Options on Indices

Index Options are complex contracts that give you the right (but not the obligation) to buy or sell an index at a specific price before a set date. Options are advanced tools used for a variety of investment strategies, such as hedging (protecting an existing portfolio) or making specific directional plays.

3.5. Spread Betting

Spread Betting is a popular, tax-efficient (in some regions) method, especially for traders in the UK. CFDs vs spread betting work similarly, where you are not buying the asset but are betting a certain amount of money per “point” of the index’s movement (either up or down).

4. What Moves Index Prices?

Index prices are moved by “big picture” economic events, company performance, and overall investor sentiment, which is key for index trading.

- Economic news: The most powerful short-term movements are caused by major economic data releases, especially CPI (inflation), NFP (jobs), FOMC (interest rate decisions), and GDP reports.

- Earnings seasons: Indices are made of stocks. Strong or weak company financial results (earnings) from major “heavyweight” companies (like Apple or Microsoft) can cause the entire NAS100 or S&P 500 to move significantly.

- Interest rates & Fed policy: The single most important driver is interest rate policy. Higher rates are generally bad for indices, while lower rates are good. All markets react strongly to FOMC announcements (Investopedia, n.d.).

- Market sentiment (Risk-On/Risk-Off): Investor feeling is a key driver. When investors are fearful (“Risk-Off”), they often sell indices (taking a short position) and buy “safe” assets like the US Dollar. A rising USD often signals a falling stock market. Understanding these forex and index correlations to monitor is vital for anticipating how currency fluctuations might impact your index positions.

- Global events: Large-scale events can cause major trading volatility, including geopolitical conflicts, an oil crisis, or unexpected waves of inflation.

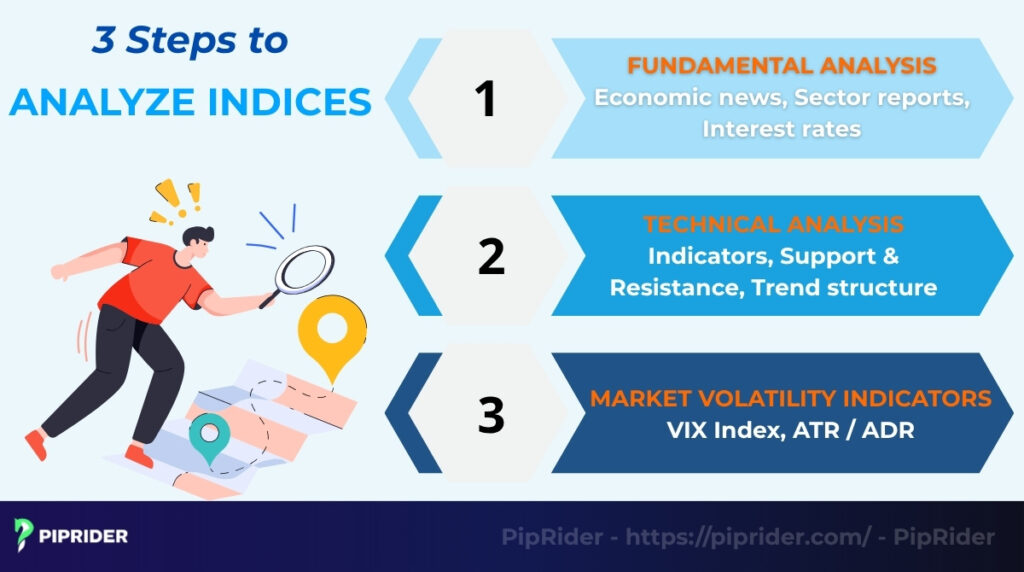

5. How Do You Analyze Indices Before Trading?

A successful trade is based on a plan, not a guess. Before trading, professionals analyze the market using three main types of analysis: fundamental, technical, and volatility.

5.1. Fundamental Analysis

Fundamental analysis looks at “big picture” economic health to determine the long-term direction. This includes:

- Economic news: Is the economic data (like CPI or NFP) better or worse than expected?

- Sector reports: How is the overall industry doing? (e.g., are tech companies growing or shrinking?)

- Interest rates: Are interest rates rising (which is bad for indices) or falling (which is good for indices)?

5.2. Technical Analysis

Technical analysis involves reading the chart to find patterns and clear entry/exit points. This includes:

- Indicators: Using tools like EMAs (EMA20/50) to define the market trends and RSI or MACD to measure momentum.

- Support & Resistance: Finding key price “floors” (support) and “ceilings” (resistance) where the price is likely to react.

- Trend structure: Looking at the “higher highs and higher lows” (an uptrend) or “lower lows and lower highs” (a downtrend).

5.3. Market Volatility Indicators

Volatility analysis helps you understand how much the market is likely to move, which is critical for setting your stop-loss.

- VIX Index: The VIX Index (one of the key volatility indices). A high VIX means investors are scared, and high volatility is expected (common in market crashes).

- ATR / ADR: The Average True Range (ATR indicator) or Average Daily Range (ADR) tells you the average number of points the index moves in a single day. This helps you set a realistic stop-loss that won’t get hit by normal market “noise.”

6. How to Trade Indices: A Step-by-Step Guide

A successful trade follows a clear 5-step process. This framework helps you move from analysis to trading execution while managing your risk.

6.1. Step 1: Choose Your Index & Session

First, choose an index that matches your trading schedule. Trade an index when its home market is open and volatility is high.

- The NAS100 (US Tech) is most volatile during the US session.

- The DAX40 (Germany) is most volatile during the London/Frankfurt session.

6.2. Step 2: Identify the Trend

Second, never trade “blind.” You must identify the main trend. A simple way is to use the 50-period EMA (Exponential Moving Average) on a 1-hour or 4-hour chart.

- If the price is above the EMA50, the trend is up (look for buys).

- If the price is below the EMA50, the trend is down (look for sells).

- You should also check the market structure (is the price making higher highs or lower lows?). Mastering these techniques to identify stock market trends will help you filter out noise and focus on high-probability setups.

6.3. Step 3: Find an Entry Setup

Third, once you know the trend, find your entry setup. Do not just buy or sell randomly. Wait for a clear signal that matches your strategy:

- Breakout: The price breaks above a key resistance level (to take a long position in an uptrend).

- Pullback: The price pulls back to a support level (like the EMA50) within an uptrend.

- Reversal: The price hits a major support or resistance zone and shows a strong reversal signal (to take a short position).

6.4. Step 4: Place Stop Loss and Take Profit

Fourth, before you enter, you must define your exits.

- Stop Loss (SL): Set your SL based on volatility (like 1x the ATR) or just below the last swing low (for a buy).

- Take Profit (TP): Set your TP (often as a limit order) at a level that gives you a Risk/Reward (R:R) ratio of at least 1:2. A good target is the next major supply or demand zone.

6.5. Step 5: Monitor News

Finally, always check the economic calendar. If you are an experienced trader, you might trade the news. If you are a beginner, do not hold a trade right before a major news event like FOMC or NFP. The volatility can be extreme and unpredictable.

7. What Are the Best Strategies for Index Trading?

Professional traders often use simple, repeatable systems. They focus on clear, proven trading strategies rather than complex indicators. Here are five popular strategies you can use for trading indices.

7.1. The Trend-Following Strategy

A trend-following strategy is the most reliable approach for beginners. The goal is to “trade with the trend.”

- Tools: Use the EMA 20 and EMA 50 (Exponential Moving Averages) to see the trend direction.

- Setup: In an uptrend, wait for the price to pull back (dip) to the EMA, which often acts as a dynamic support level.

- Entry: Enter a “Buy” trade (a long position) when the price touches the EMA and shows a sign of bouncing up.

7.2. The Breakout Strategy

A breakout strategy involves waiting for the price to “break out” of a clear consolidation range.

- Setup: Identify a tight trading range, like the “US Open Range” (the high/low of the first 30-60 minutes), or the previous day’s high or low.

- Entry: Enter a trade in the direction of the breakout (e.g., Buy when the price breaks the high).

- Confirmation: The strongest breakouts are always confirmed by a large increase in volume.

7.3. The Mean Reversion (Countertrend) Strategy

Mean reversion is an advanced strategy that assumes the price has moved too far, too fast, and will “revert” (snap back) to its average.

- Setup: The price looks “overextended.” For example, the NAS100 has already moved more than its Average Daily Range (ADR).

- Entry: Look for RSI divergence (when the price makes a new high, but the RSI indicator makes a lower high) as a signal that the move is weak and may reverse.

7.4. The Supply and Demand Zones Strategy

A supply and demand strategy focuses on finding key zones where large institutional orders are likely waiting.

- Setup: Identify a fresh “Demand” zone (support) or “Supply” zone (resistance) on a higher timeframe (like H1 or H4).

- Entry: Wait for the price to return to that zone and look for a reaction (like a pin bar or engulfing candle) before entering. This works very well on the US30 and DAX40.

7.5. The Scalping Index Strategy (M1–M5)

Scalping is a very advanced, high-speed strategy used on the M1 or M5 charts to catch many small, fast moves.

- Setup: Scalpers use momentum tools like the VWAP indicator (Volume-Weighted Average Price) or Forex Order Blocks (OB) to find entries.

- Warning: This strategy is very difficult and requires a broker with extremely low spreads to be profitable.

8. What Is Position Sizing and Risk Management for Indices?

Position sizing and risk management are the most important rules when learning how to trade indices. Because indices move a lot, you must have a plan to protect your money and limit your market exposure. This plan involves choosing the right position size for the index’s volatility and never risking too much on one trade.

8.1. Volatility Consideration

Not all indices are equal. You must adjust your risk based on the index’s personality. The NASDAQ 100 (NAS100) is famously volatile and can move very fast, making it high-risk. The S&P 500 (US500) is less volatile, and the Dow Jones (US30) is often the slowest of the three. You should use a smaller position size for the NAS100 than for the US30.

8.2. Lot Size / Contract Size Calculation

Position sizing is the formula you use to decide how much (your “lot size”) to trade. The goal is to make sure that if your trade hits its stop-loss, you only lose a small, pre-planned amount of your account. You should never “guess” your lot size forex.

8.3. Risk Per Trade

A professional trader always follows the 1-2% rule. This means you should never risk more than 1% or 2% of your total account balance on a single trade. For example, on a $1,000 account, a 1% risk is only $10. Following this rule makes it impossible to blow up your account on one or two bad trades.

8.4. Avoid Overleveraging

Leverage is a tool that lets you control a big position with small capital, but it is very dangerous. When trading indices, it is easy to get “stop hunted” or “stopped out” by a fast move, especially when spreads widen during news or at the market open. Using too much leverage is the #1 mistake beginners make.

9. What Tools and Indicators Are Best for Index Trading?

Successful index traders use specific tools to analyze the market. The most popular indicators help measure volatility, track institutional volume, and monitor market-moving news.

- ADR/ATR (Volatility): The Average Daily Range (ADR) and Average True Range (ATR) are critical for risk management. They tell you the average number of points an index moves per day, which helps you set a stop-loss that is outside the normal “market noise.”

- Volume & market profile (Volume): Volume shows how much trading is happening. Market profile is an advanced tool that shows at what price the most volume traded, helping you find strong support/resistance zones based on actual activity.

- VWAP (Volume-Weighted Average Price): A very popular indicator, especially during the US session. Many traders use it as a “line in the sand”: if the price is above VWAP, sentiment is bullish; if below, it is bearish.

- Economic calendar (News/Risk): This is a crucial risk tool. You must check it every morning to know when high-volatility news events (like FOMC or NFP) are scheduled, which helps you avoid or trade the spikes.

- Index heatmaps (Sentiment): A heatmap (e.g., for the S&P 500) uses red and green boxes to visually show which individual stocks or sectors (like Tech) are moving the entire index.

- VIX (Sentiment): The VIX (Volatility Index) is often called the “Fear Index.” High VIX signals high fear and volatility (common in market crashes). Low VIX signals low fear or complacency.

10. What Does a NAS100 Day Trade Example Look Like?

Here is a practical example that puts all the concepts together for a day trade on the NAS100 (NASDAQ 100) index.

| Component | Setup Detail |

| Session | US Open (High volatility) |

| Trend | Bullish (Price is trading above the H1 50-period EMA) |

| Strategy | Pullback to EMA20 (for a long position) |

| Entry | A “Buy” trade is taken after the price pulls back to and finds support at the 20-period EMA. |

| Stop Loss (SL) | Placed just below the most recent swing low. |

| Take Profit (TP) | Placed at the previous high. |

| R:R Target | The setup must offer at least a 1:2 Risk/Reward ratio. |

This trade is a high-probability setup because it aligns the session (US open volatility), the main trend (bullish), and a clear entry rule (pullback to EMA20) with good risk management.

11. What Are the Most Common Mistakes When Trading Indices?

Most beginners make the same few trading traps. Knowing these traps is the first step to avoiding them.

- Trading during major news: Entering a trade 10 seconds before a big news event (like FOMC or NFP) is gambling, not trading. The volatility is extreme, spreads widen, and you can be stopped out instantly.

- Ignoring volatility (Tight stop-loss): Using a 20-point stop-loss on the NAS100 (which can move 20 points in seconds) is a common mistake. Your stop-loss must respect the index’s volatility (e.g., be based on the ATR); otherwise, it is too tight and will be hit by normal “noise.”

- Fighting the main trend: Trying to “short” (sell) a strong uptrend on the H4 or Daily chart is one of the hardest and most expensive ways to trade. It is much easier to trade with the Higher Timeframe (HTF) trend.

- Overtrading: Taking too many trades because you are bored, angry (revenge trading), or trying to “catch” every small move. A professional trader waits patiently for their one or two “A+” setups per day.

- Using a lot size that is too large: This is the #1 account killer. Using a large lot size (overleveraging) means a single trade that goes against you can wipe out a huge part of your account.

12. Frequently asked questions about Trading Indices

13. Conclusion

How to trade indices successfully requires a clear strategy, a deep understanding of the market, and disciplined risk management.

Indices are an excellent choice for traders who want to trade markets with high liquidity, low spreads, and predictable volatility. To be successful, you must follow the main trend, trade during the correct high-volume session, and never overleverage your account.

To learn more expert trading strategies and improve your analysis, explore the free guides at Piprider.com.